- Bitcoin millionaires surged by 111% in 2024, pushed by new ETFs and Bitcoin highs

- Prime crypto hubs like Singapore and Hong Kong benefited from favorable tax insurance policies

Regardless of the current dip within the cryptocurrency market, a dip accelerated by Bitcoin [BTC] falling beneath $60k on 28 August, there stays a silver lining. This, because of Bitcoin’s stellar efficiency for many of 2024.

Crypto wealth report analyzed

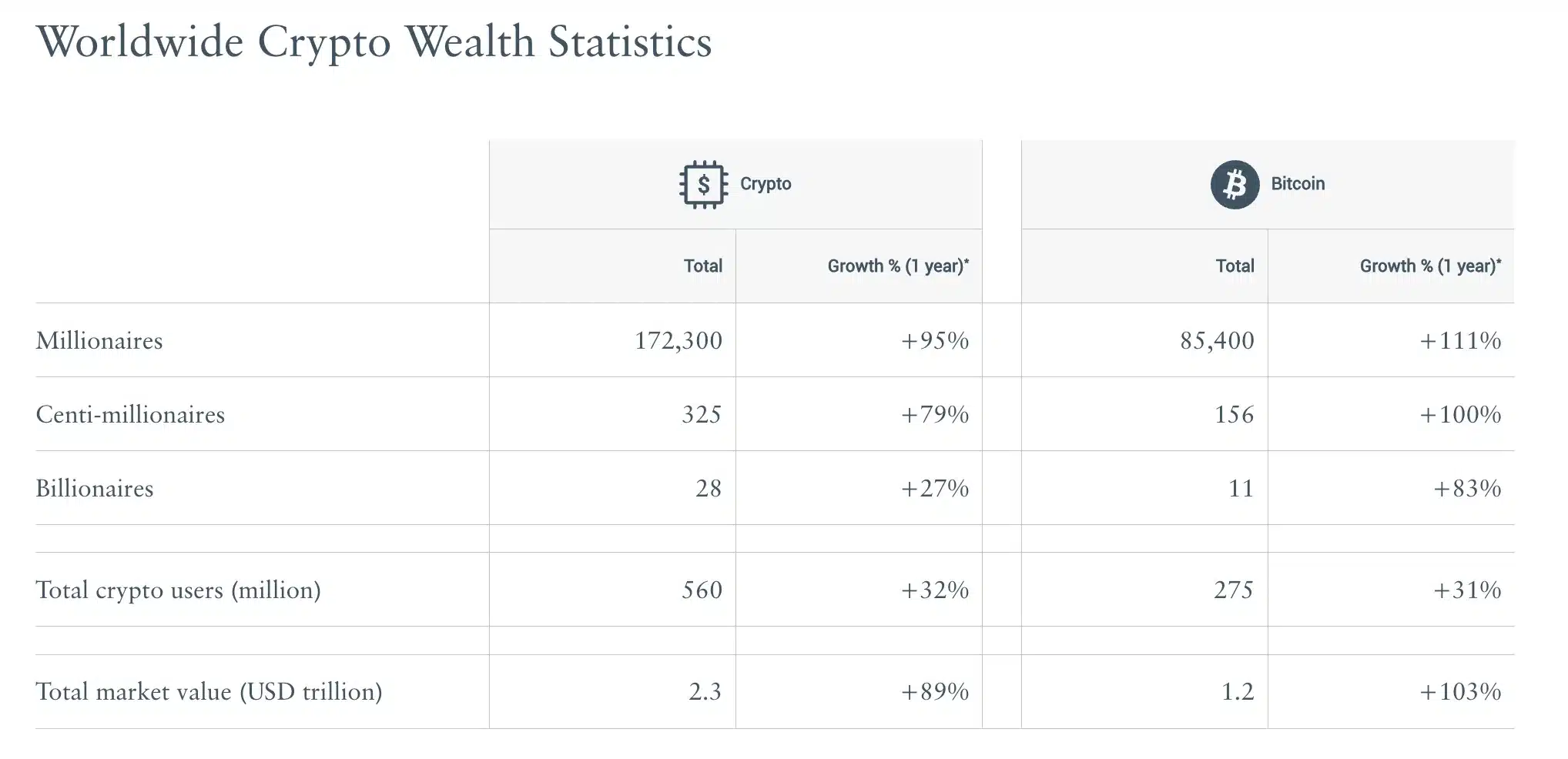

In line with “The Crypto Wealth Report 2024” by New World Wealth and Henley & Companions, the variety of BTC millionaires climbed by 111% over the previous yr. The truth is, figures for a similar at the moment are as excessive as 85,400.

In tandem, the general variety of crypto millionaires has additionally seen a big uptick, climbing to 172,300, up from 88,200 final yr.

The hike in crypto millionaires will be attributed to the introduction of newly authorised spot ETFs within the U.S., which propelled Bitcoin to new heights in 2024.

After reaching an all-time excessive of over $73,000 in March, Bitcoin quickly settled round $64,000 – Marking a forty five% improve regardless of some retracement. Later nonetheless, BTC would fall even additional on the charts.

Over the previous 12 months, BTC’s worth has soared by 138%. The launch of those ETFs has been significantly impactful, amassing over $50 billion in belongings since January, following a prolonged battle for approval from the Securities and Change Fee.

Execs weigh in…

Remarking on the identical, Dominic Volek, Group Head of Non-public Shoppers at Henley & Companions stated,

“The cryptocurrency landscape of 2024 bears little resemblance to its predecessors. Bitcoin’s rise to over USD 73,000 in March set a new all-time high, while the long-awaited approval of spot Bitcoin and Ethereum ETFs in the USA unleashed a torrent of institutional capital. Anticipation now builds for potential Solana ETFs joining the Wall Street party.”

He added,

“These milestones have seeded a new era of crypto adoption, one where digital assets increasingly cross-pollinate with traditional finance and global mobility.”

António Henriques, CEO of Bison Financial institution and Chairman of Bison Digital Belongings, additionally identified,

“In the rapidly evolving world of finance, cryptocurrencies are challenging the dominance of traditional fiat currencies. As these two financial realms intersect, we are witnessing the dawn of a new era in global finance, where the innovative potential of digital assets meets the stability of traditional money.”

What this implies is that regardless of short-term fluctuations, many nonetheless strongly consider within the potential of Bitcoin and different crypto belongings.

As Michael Saylor, former CEO of MicroStrategy, aptly put it,

“#Bitcoin is Rules Without Rulers.”

Nation-states step up their crypto recreation

Lastly, the report additionally revealed that Singapore tops the worldwide cryptocurrency hub index with a rating of 45.7 out of 60, adopted by Hong Kong and the UAE.

All three excel because of their favorable tax insurance policies, notably their exemption from capital features tax. This advantages crypto traders and high-net-worth people.

That’s not all although. Only recently, El Salvador’s Bitcoin reserves grew to five,851 BTC, price about $356.4 million.

In the meantime, Russia has shared plans that it’ll start trials for crypto exchanges and cross-border transactions from 1st September 2024.

This can be a signal of the persistent perception in Bitcoin’s potential, regardless of short-term market fluctuations.