Tesco (LSE: TSCO) shares haven’t actually set the world on hearth over the previous couple of many years. The group’s bold worldwide enlargement plans didn’t pan out as hoped whereas an accounting scandal in 2014 led to a dividend suspension and rocked investor confidence.

Extra not too long ago although, there appears to have been a reassessment of the funding case. The FTSE 100 inventory is up 81% from a low in October 2022.

Certainly, the share worth is up 26.2% since just the start of 2024. This implies anybody who invested £15,000 within the UK’s main grocery store again then would now be sitting on £18,925. And so they’d even have acquired round £635 in dividends, taking the whole return to roughly £19,500.

That’s a really stable end in a comparatively brief area of time.

Nonetheless dominant

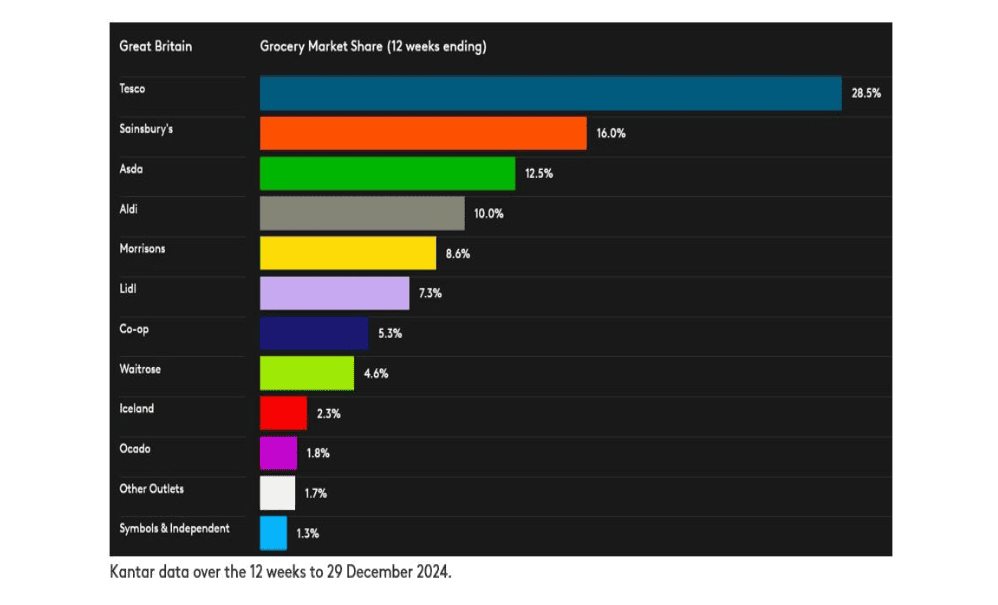

Each month, trade insights and developments are launched from information supplier Kantar. We bought these earlier in January, simply earlier than Tesco launched a Christmas buying and selling replace.

Collectively, they painted the identical image, which is that Tesco is performing very properly. Over the 12 weeks to 29 December, it loved 5% progress in gross sales throughout its comfort, superstore and on-line channels.

This noticed its market share enhance by 0.8%, the most important acquire of any grocery store, taking its maintain to twenty-eight.5%. That’s Tesco’s highest market share since 2016!

CEO Ken Murphy commented: “We delivered our biggest-ever Christmas, with continued market share growth and switching gains.”

On-line alternative and problem

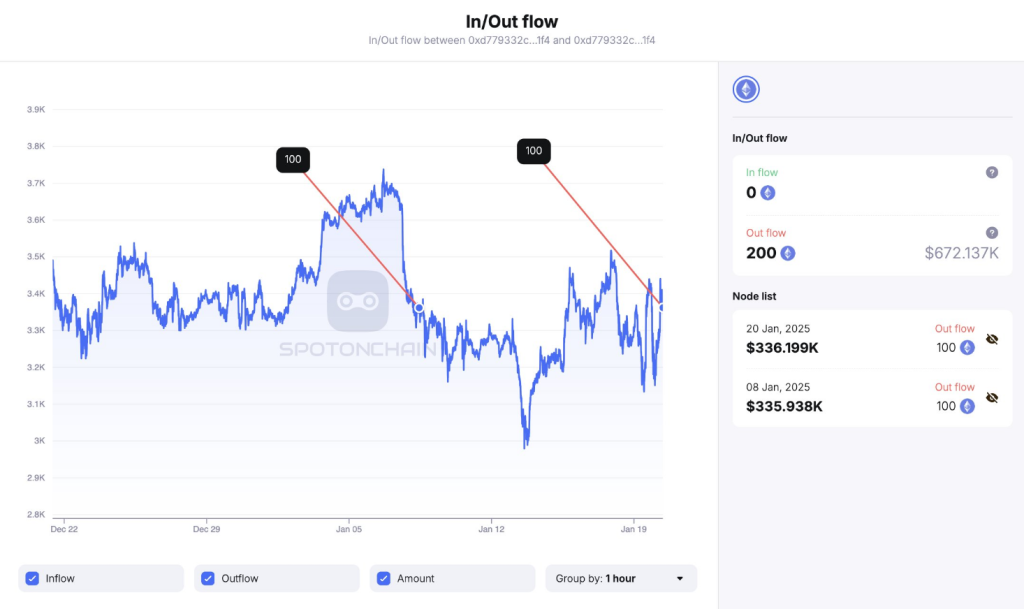

One potential threat for Tesco is on-line, the place spending for December reached a report £1.6bn. In keeping with Kantar, Ocado boosted its gross sales by 9.6% over the 12 weeks to 29 December, taking its total market share to 1.8%.

After all, Tesco has its personal on-line enterprise. This channel noticed 10.8% progress in UK gross sales over the Christmas interval, together with over 1.2m orders positioned by way of Tesco Whoosh, its speedy supply service.

In the meantime, the corporate leverages its intensive retailer community for click-and-collect providers, which pureplay on-line grocers don’t provide.

In contrast to online-only Ocado although, Tesco should stability this chance with sustaining its bodily operations. True, its huge scale offers it benefits relating to negotiating costs with suppliers. However Ocado makes use of robots to choose and pack orders effectively, lowering prices and enhancing order accuracy.

The long-term purpose is to translate these operational efficiencies into extra aggressive pricing for patrons to be able to take market share and (probably) enhance revenue margins. If that occurs, Tesco may in the future really feel compelled to speculate closely in automation applied sciences to stay aggressive. And that would weigh on margins and investor sentiment for the inventory.

Will I make investments?

The forward-looking dividend yield is 4%, with the payout anticipated to be lined two occasions by forecast earnings. Whereas no dividend is assured, this reassuring protection suggests to me that the payout needs to be met. Wanting forward, I do just like the dividend progress prospects right here.

Nonetheless, a extra quick concern for me is the rise in prices associated to the current Price range. Because of Tesco’s huge workforce, it will add an additional £250m to its prices annually, in response to administration. Passing this on to prospects by way of increased costs may end in decrease total basket sizes.

Subsequently, I’ve no plans to spend money on the inventory proper now.