Picture supply: Getty Photographs

Investing in penny shares is a high-risk however doubtlessly high-reward technique. And share pickers can scale back the hazards related to these small-cap shares by investing in low cost corporations.

The margin of security that low earnings multiples present can restrict losses and scale back the size of any worth volatility. And over the long term, traders can take pleasure in substantial returns if the market corrects itself and share costs take off.

So I’m looking for high penny shares which might be at present buying and selling at cut price costs. My focus is on corporations that appear undervalued primarily based on a number of of those key indicators:

Based mostly on this standards, listed here are two of my favorite penny shares.

Serabi Gold

Gold shares are naturally delicate to cost actions of the yellow steel. Even one of the best run miner like Serabi Gold (LSE:SRB) can see earnings collapse if bullion values recede.

However then the other can be the case. And with gold costs on the cost, now could possibly be a superb time to contemplate investing in it. It’s soared since mid-2023 according to the booming steel worth, because the chart beneath reveals.

I like this miner on account of its all-round cheapness. The Brazil-focused firm trades on a forward-looking P/E ratio of three instances. That is constructed on Metropolis predictions that earnings will soar 300%-plus in 2024.

As a consequence, Serabi shares additionally commerce on a PEG ratio of beneath 0.1. A sub-1 studying suggests {that a} inventory is undervalued.

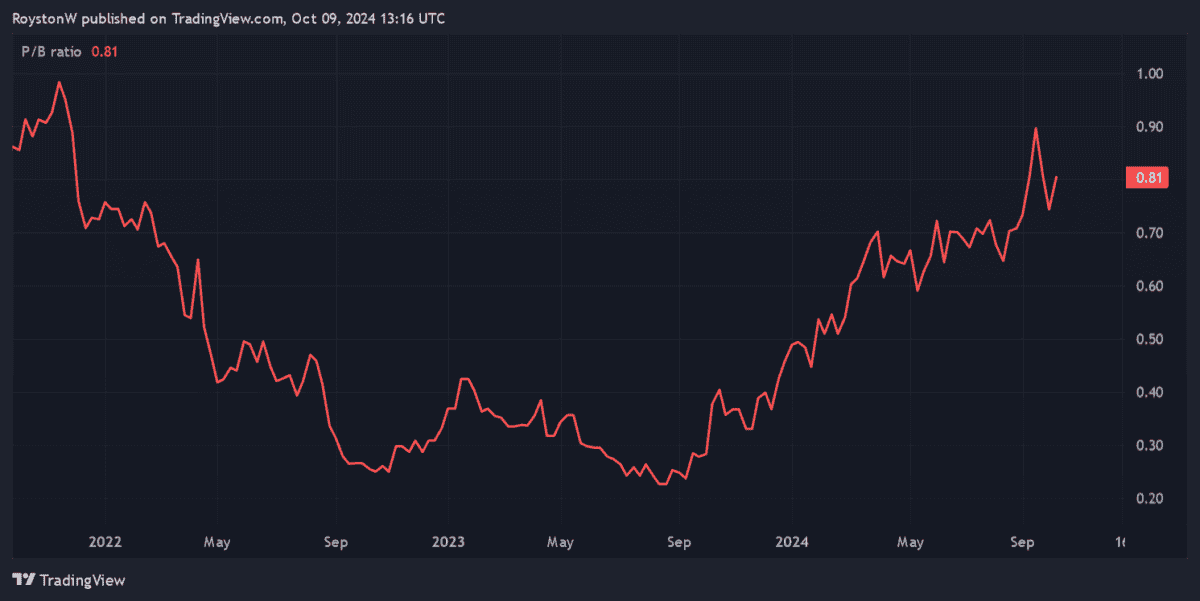

Lastly, the corporate’s P/B ratio additionally sits beneath the cut price watermark of 1, because the chart right here signifies. This reveals that Serabi trades at a reduction to the worth of its belongings.

Earnings can even be boosted by plans to extend manufacturing by way of to 2026. Its exploration tasks in Brazil’s gold-rich Tapajós province might ship spectacular development effectively past this era too.

Topps Tiles

Dwelling enchancment corporations like Topps Tiles (LSE:TPT) face uncertainty within the close to time period as Britain’s economic system splutters. However might this be baked into this penny inventory’s present valuation?

I believe the reply could also be sure. It trades on a ahead P/E ratio of 10.9 instances, whereas its PEG ratio for this 12 months sits at simply 0.1. These figures replicate expectations that earnings will bounce 82% 12 months on 12 months.

The Topps Tiles share worth has struggled for momentum in 2024. Information that like-for-like revenues dipped 8.2% within the 12 months to August hasn’t carried out it any favours on this time both.

However with Britain’s housing market steadily bettering, I believe it could possibly be on the cusp of a pointy rebound. Certainly, authorities plans to construct 300,000 new properties a 12 months by way of to 2029 may ship a sustained restoration.

I’m additionally anticipating Topps Tiles to take pleasure in robust demand from the restore, upkeep and enchancment (RMI) sector, given the superior age of Britain’s housing inventory.

With Topps Tiles additionally carrying a 6.6% dividend yield, I believe it’s a high worth inventory to contemplate.