Picture supply: Getty Photos

When in search of new dividend shares I all the time verify three elements: the yield, worth efficiency, and years of consecutive progress. Shares with excessive yields that lack a robust historical past of progress are likely to fall as rapidly as they rose.

I don’t thoughts a decrease yield if it guarantees constant progress for the indefinite future. And naturally, I additionally make sure that the inventory worth isn’t happening the bathroom.

With that in thoughts, these two FTSE 250 funding trusts have caught my consideration currently. So I calculated the potential returns they may web me in 10 years.

Metropolis of London Funding Belief

Managed by Henderson Funds, the Metropolis of London Funding Belief (LSE: CTY) invests primarily in UK-based public fairness markets. The 164-year-old belief focuses on dividend-paying progress shares throughout a diversified vary of sectors.

I consider it’s a protected and steady choice for constant progress and funds. However its worth efficiency leaves a lot to be desired. It’s up solely 130% up to now 20 years, offering moderately weak annualised returns of 4.3%.

However its dividend progress’s been sturdy, tripling from 7.18p in 2000 to virtually 21p at this time.

That equates to a 15-year compound annual progress fee (CAGR) of three.5%. With these numbers, if I purchased 3,000 shares for £12,630, I might virtually triple my funding to £33,315 in simply 10 years. Assuming that the present dividend and worth progress charges held and I reinvested the dividends.

I do have one concern although — the belief’s share worth could also be considerably overvalued. It’s elevated lately to 16.4 instances earnings and is calculated to be overvalued by 123%, based mostly on future money circulation estimates.

Whereas the price-to-earnings (P/E) ratio is on-par with the business, it might stifle future progress if earnings don’t enhance. Nonetheless, whereas it might have an effect on the general return, that is unlikely to have an effect on dividend funds.

Murray Worldwide Belief

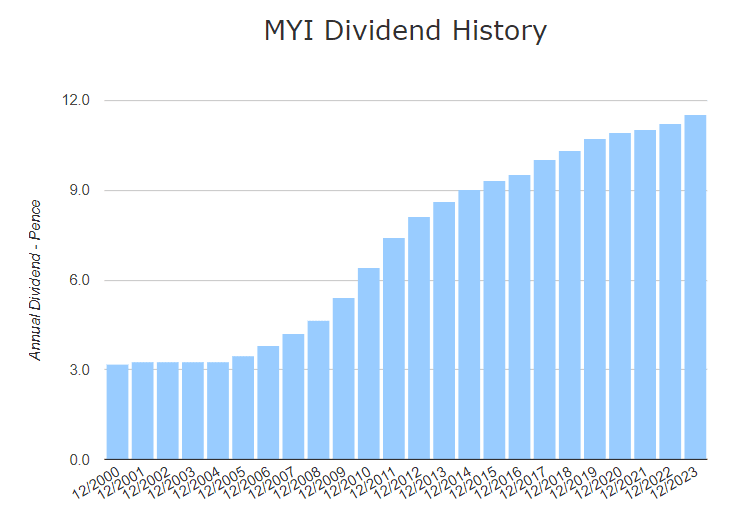

Murray Worldwide Belief (LSE: MYI) is a closed-end mutual fund that invests in a diversified mixture of public fairness markets globally. It’s been round for over 100 years and is managed by Aberdeen Fund Managers.

It at the moment sports activities an honest 4.6% yield. Over the previous 20 years the yield has fluctuated between 3% and seven% however has been steadily rising general. This might make it a dependable selection for a sluggish however regular stream of passive revenue.

Prior to now 20 years the worth is up a modest 239%, equating to annualised returns of 6.3%. Admittedly, latest efficiency has been disappointing. It’s down 7% over the previous yr, considerably under the GB Capital Markets progress of 9.4%.

However what I actually like is its dividend progress monitor report. Since 2004, it’s steadily elevated from 3.26p per share to 11.5p at this time.

That equates to a 15-year compound annual progress fee (CAGR) of 6.06%. If that fee remained constant and I purchased 4,000 shares at this time for £9,960, I might greater than triple my funding to £33,792 in simply 10 years. Assuming I additionally reinvested the dividend funds to compound the returns.

To be sincere, a majority of these investments are usually not super-exciting. However with regular progress and a stable stability sheet, they’re the sort that traders might merely ‘set and forget’. I believe that makes them a profitable combo for a dividend portfolio.