It’s nearly surreal that Amazon (NASDAQ: AMZN) shares misplaced 54% of their worth between mid-2021 and late 2022. Or maybe recency bias makes me suppose it surreal as they’ve since bounced again in fashion, surging 180% to take the corporate’s market cap to a document $2.48trn.

Certainly, the inventory is up by a market-thrashing 25.4% in simply the previous three months! Which means an investor who was courageous sufficient to plonk down £20,000 in late October would now be sitting on round £25,080. That’s a improbable return in slightly below 14 weeks.

However are Amazon shares nonetheless price contemplating as we speak after this sturdy exhibiting? Let’s have a look.

Diversified enterprise

One of many issues I like about Amazon from an investing perspective is its optionality. In different phrases, it has other ways to win past on-line retail. It operates the world’s main cloud computing platform, Amazon Net Companies (AWS), and generates income by promoting warehouse capability and logistics companies.

It additionally has a fast-growing digital promoting enterprise on its e-commerce app. Sellers will pay to have their gadgets seem on the prime of search outcomes or on product pages. Amazon fees them a price each time somebody clicks on their sponsored itemizing. This can be a very worthwhile income stream, whereas the Prime subscription service retains clients coming again.

The corporate can also be investing in supply robots and drones, self-driving autos, varied synthetic intelligence (AI) initiatives, and extra. Whereas these can weigh on near-term profitability, additionally they have the ability to spice up effectivity and margins over the long term.

Regardless of being 30 years previous and subsequently no spring hen, Amazon remains to be one of the vital thrilling corporations round, for my part.

Surging income

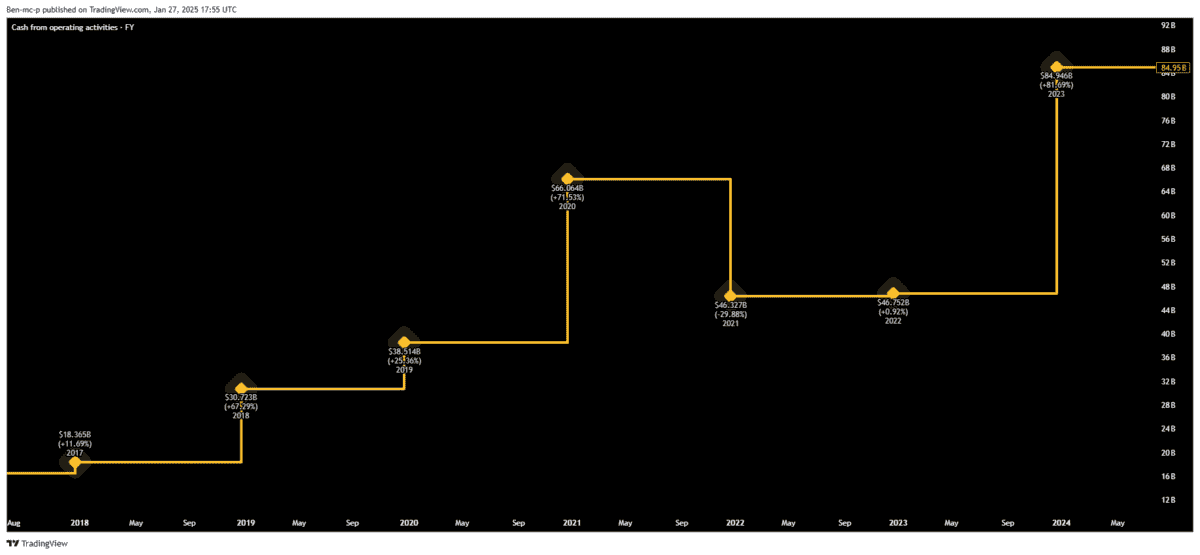

Lately, the corporate has turned itself right into a leaner beast. Consequently, its working money circulate is completely surging, as we will see under.

Plus, Wall Road analysts forecast double-digit income development over the subsequent few years. The truth is, the corporate stays on monitor to generate a mind-boggling $1trn in annual income by 2030! This assumes Amazon grows its prime line by roughly 8% yearly, which I feel is greater than sensible.

That stated, nearing such a symbolic determine might convey unfavorable headlines and extra regulatory scrutiny in future. Final 12 months, the US Federal Commerce Fee superior an antitrust lawsuit accusing Amazon of working an illegal monopoly. So potential regulation presents future dangers right here, I’d argue.

Is there any worth left?

Unsurprisingly, the inventory isn’t low cost after its monster run. It’s buying and selling at 4 occasions gross sales, whereas the ahead price-to-earnings (P/E) ratio is 37.

But I feel that is cheap worth, contemplating the corporate’s revenue margins are anticipated to proceed increasing. The P/E ratio for 2026 drops to 31, primarily based on consensus forecasts.

Nonetheless, as we noticed in 2022, Amazon inventory can even go down in addition to up. It has misplaced 50%+ of its worth on a number of events over the previous three many years. Due to this fact, it’s best-suited to long-term buyers with a abdomen for volatility.

Wanting forward over the subsequent few years, I can solely see Amazon getting bigger as areas like e-commerce, digital promoting, and cloud computing increase worldwide.

Regardless of being at a document excessive, I feel the inventory is effectively price contemplating.