- Over $3.4B Bitcoin lengthy positions threat liquidation as web taker confirmed aggressive sells.

- MSTR’s BTC holdings premium again to ranges final seen in the course of the 2021 bull run.

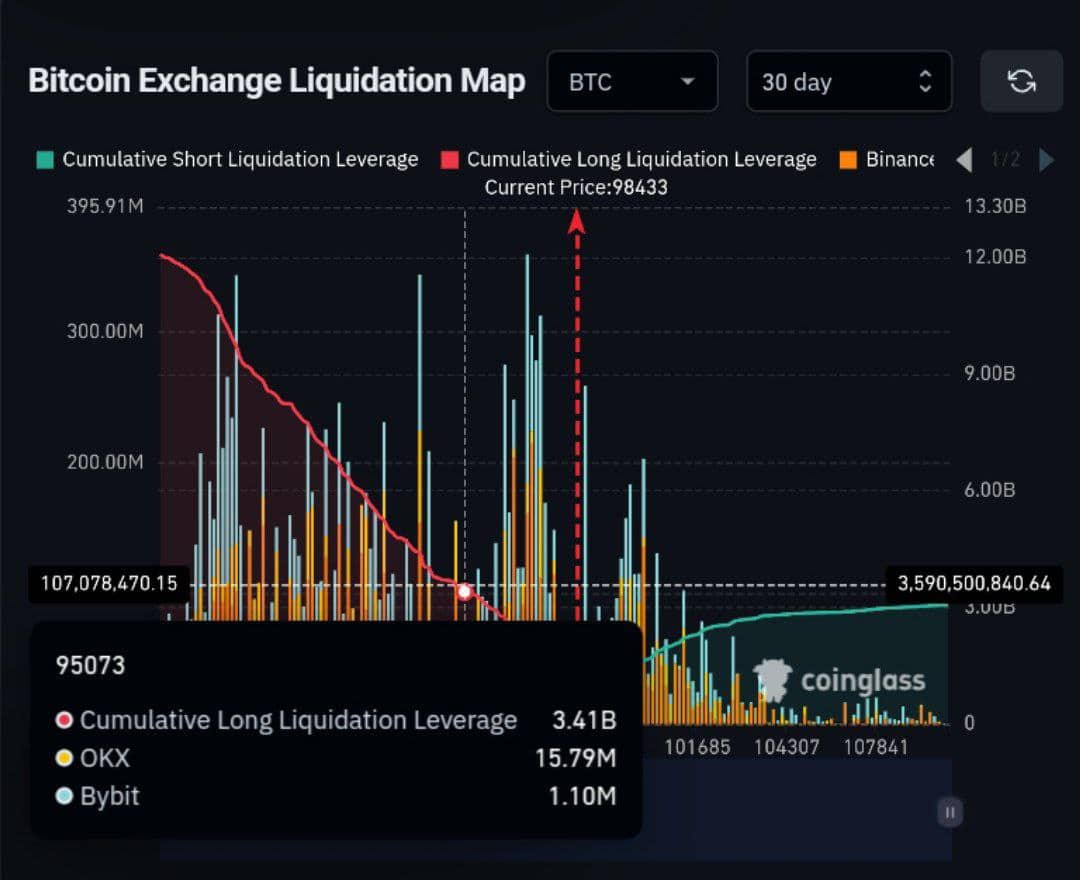

Bitcoin [BTC] confirmed that the $95K degree posed important dangers for leveraged positions. Because the market hovered near this important threshold, over $3.4 Billion in lengthy leveraged bets had been vulnerable to liquidation.

Market dynamics prompt that main gamers, sometimes called “whales,” might capitalize on this example to push costs right down to $95K, triggering these liquidations.

This tactic, recognized for flushing out over-leveraged positions, might pave the way in which for Bitcoin to rebound and goal for the $100K mark.

Merchants to remain vigilant, because the anticipated drop will not be assured however stays extremely possible given the present market setup.

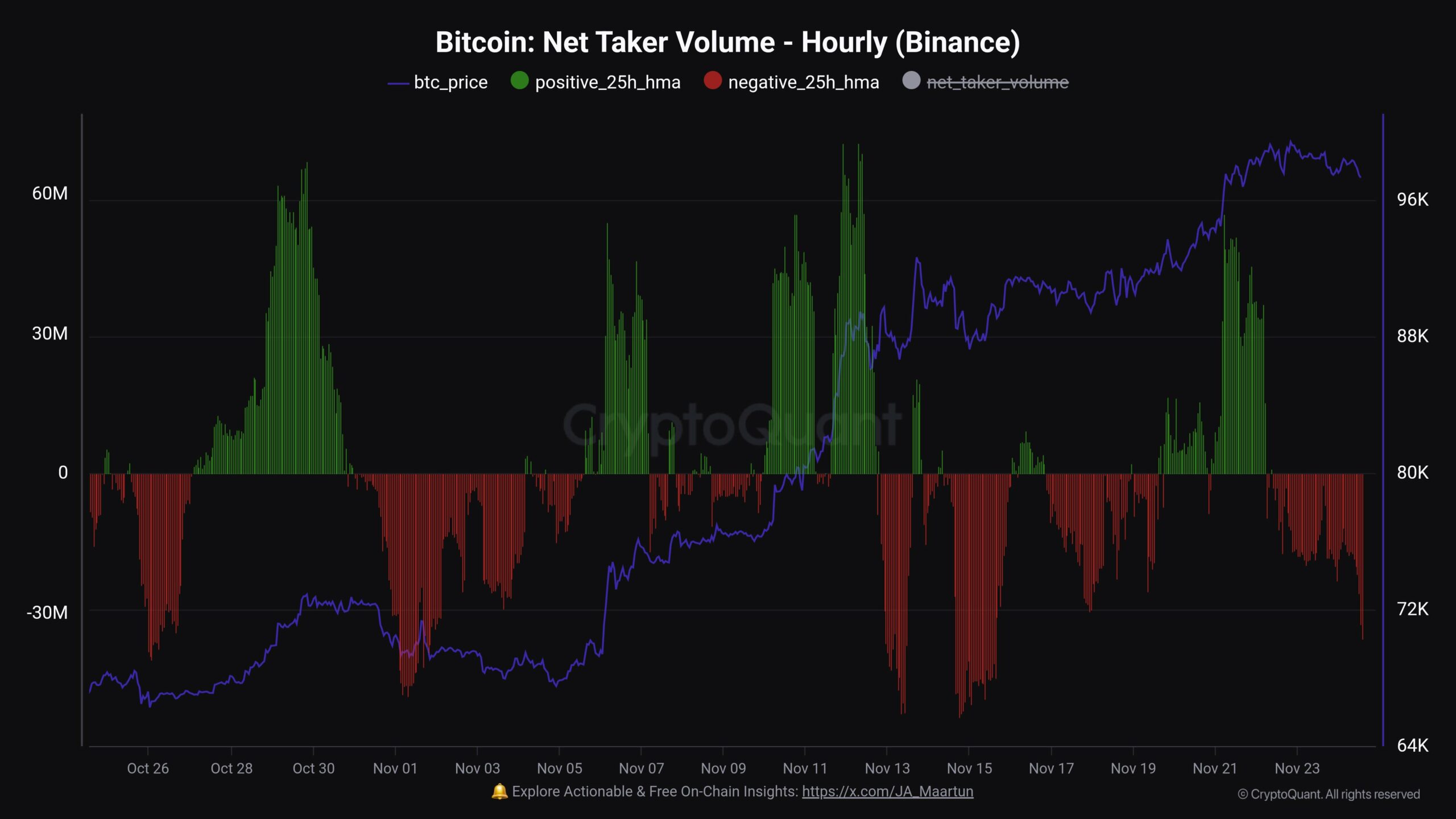

Aggressive sells and profit-taking

Additional supporting this potential drop was the Binance’s aggressive short-selling on the Bitcoin market, suggesting a possible decline to $95K to scoop up liquidity earlier than a bullish rebound to $100K.

With current information revealing important taker promoting, market sentiment leans in direction of a strategic pullback.

This transfer, closely influenced by giant merchants, could also be a tactical play to shake out over-leveraged lengthy positions.

As market dynamics trace at a manipulation tactic, merchants ought to keep cautious of potential volatility spikes.

The noticed buying and selling patterns indicated that enormous gamers may very well be positioning for a considerable worth motion, emphasizing the necessity for vigilance within the present unpredictable market atmosphere.

Why BTC’s drop possibly short-lived

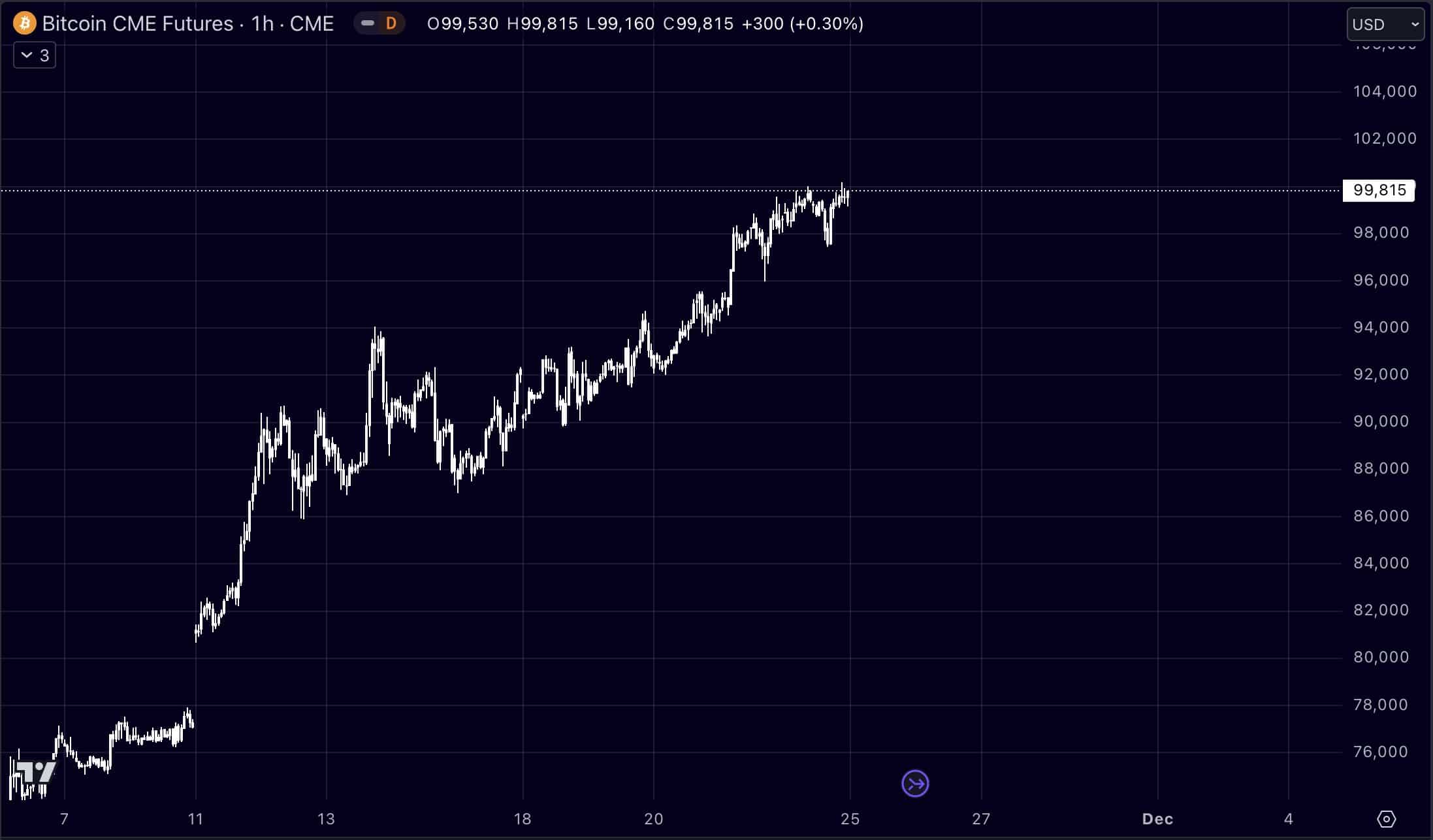

Firstly, Bitcoin’s journey in direction of the $100K mark confirmed a mixture of volatility and anticipation. Buying and selling on the CME revealed Bitcoin flirting with $99.8K, hinting on the imminent breach of the $100K barrier.

This proximity to the milestone in a significant futures market prompt that BTC might quickly see related ranges throughout numerous exchanges. Regardless of this, a retreat to $97K signaled potential fluctuations forward.

With the CME’s pricing persistently on the upper aspect, the shut at $99.8K underscores a bullish sentiment, but merchants ought to brace for potential sharp corrections or additional climbs past $100K.

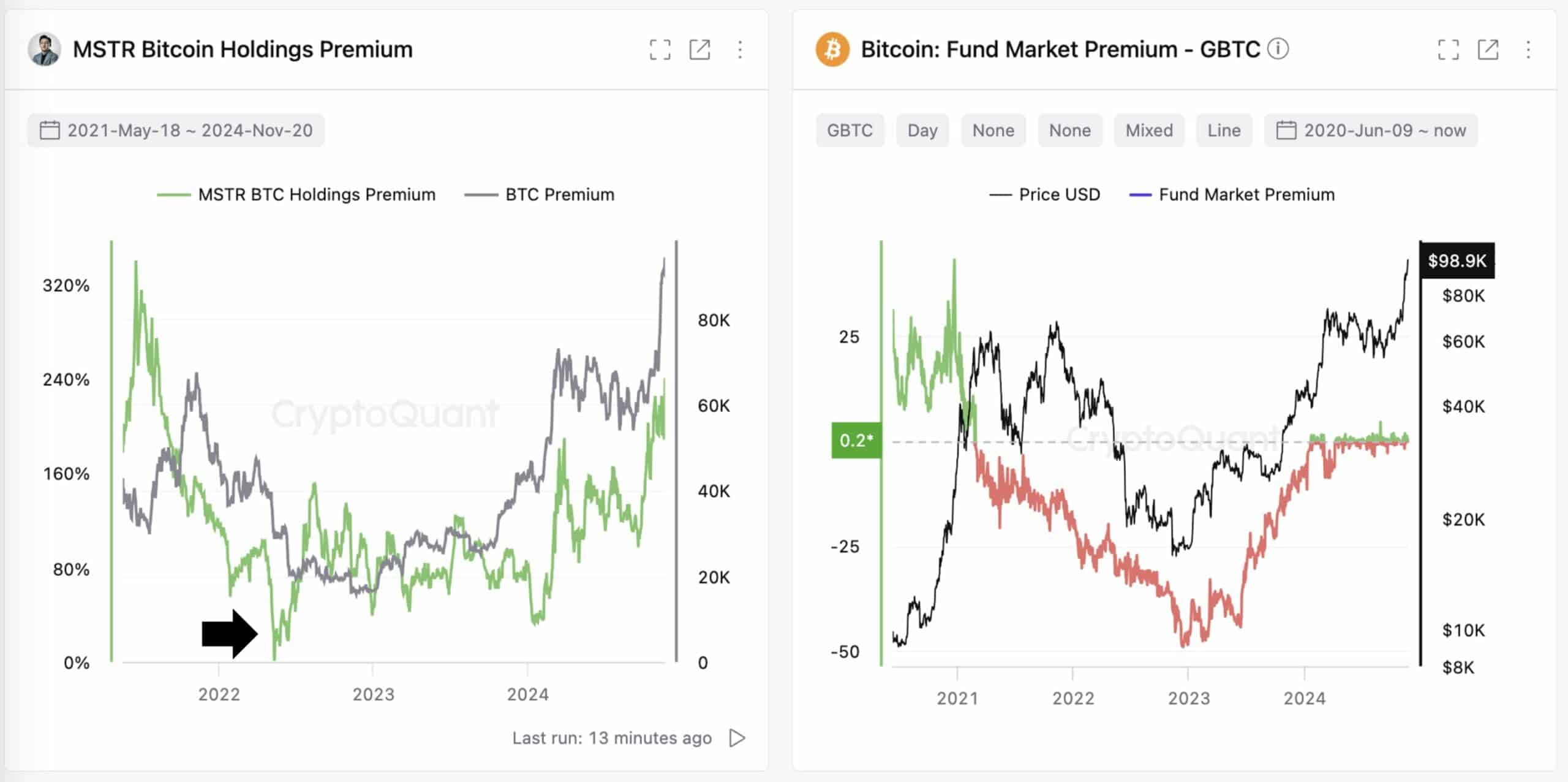

Once more, MicroStrategy’s Bitcoin holdings premium has returned to the highs of the 2021 bull run, reflecting the sooner market optimism.

Not like GBTC, which noticed a -48% low cost within the downturn, MicroStrategy’s premium persistently stayed optimistic.

This indicated Michael Saylor’s efficient threat administration in unstable occasions, additional supporting that BTC’s energy was nonetheless in.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Because the market once more reveals indicators of vitality, Saylor’s strategy to sustaining stability regardless of the 2022 bear market pressures indicated his important affect and foresight within the cryptocurrency area.

This resilience prompt a strategic positioning that might favor long-term traders trying to leverage Bitcoin’s market cycles. The market stays on edge, illustrating the everyday dynamism of crypto buying and selling.