- Bitcoin charges hit a yearly low for the third consecutive week as market quantity elevated

- Repetition of 2019 divergence of BTC and SPX may spur bullish sentiments

Bitcoin [BTC] charges have hit a yearly low for the third week operating, following the market’s current stabilization, in keeping with IntoTheBlock’s remark on X.

Following this fall in the price of transacting Bitcoin, NPS, the third-largest public pension fund globally, invested $34 million in MicroStrategy’s inventory for Bitcoin publicity.

The transfer highlights a rising pattern amongst establishments to diversify into Bitcoin by means of corporations with substantial Bitcoin holdings presently of low charges. That is additionally an indication of the mainstream more and more accepting this asset class as viable.

BTC and SPX 2019 divergence repeats itself

The divergence between Bitcoin and the SPX signaled a reversal, just like 2019 when Bitcoin’s value surged after a charge lower by the Fed. This sample is repeating in 2024 with the Fed anticipated to chop charges once more.

Bitcoin’s current decline and subsequent divergence from the SPX mirrors the 2019 pattern, which led to a major value hike. Regardless of skepticism, this situation would observe a well-known cycle, reflecting a recurring market sample.

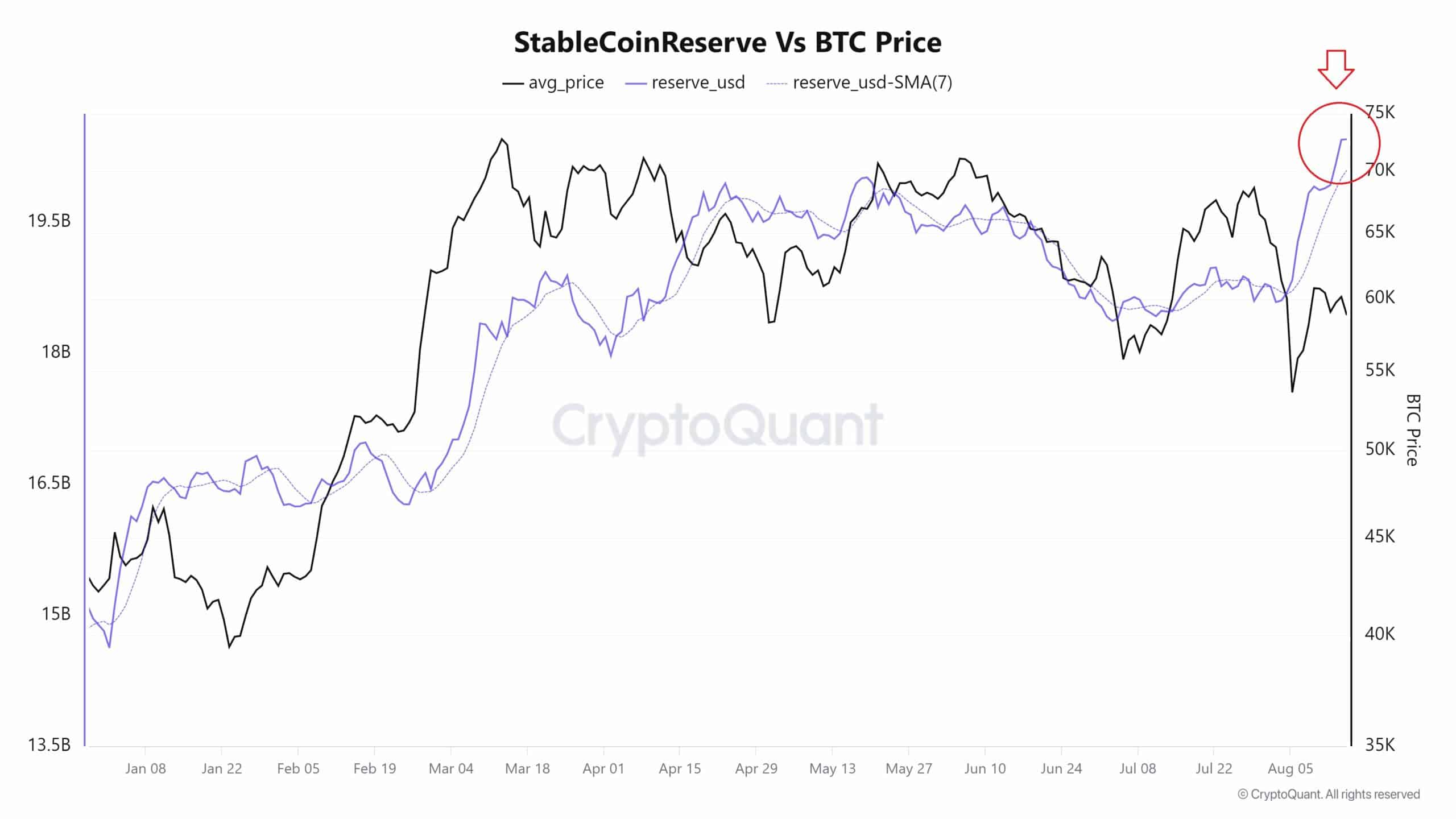

Stablecoins reserves’ affect on BTC value

Stablecoin reserves on exchanges are at file excessive proper now, boosting Bitcoin’s shopping for energy considerably.

This surge is driving main establishments to quickly accumulate Bitcoin, as will be deduced from the broadening wedge sample on the 4-hour BTC/USDT chart.

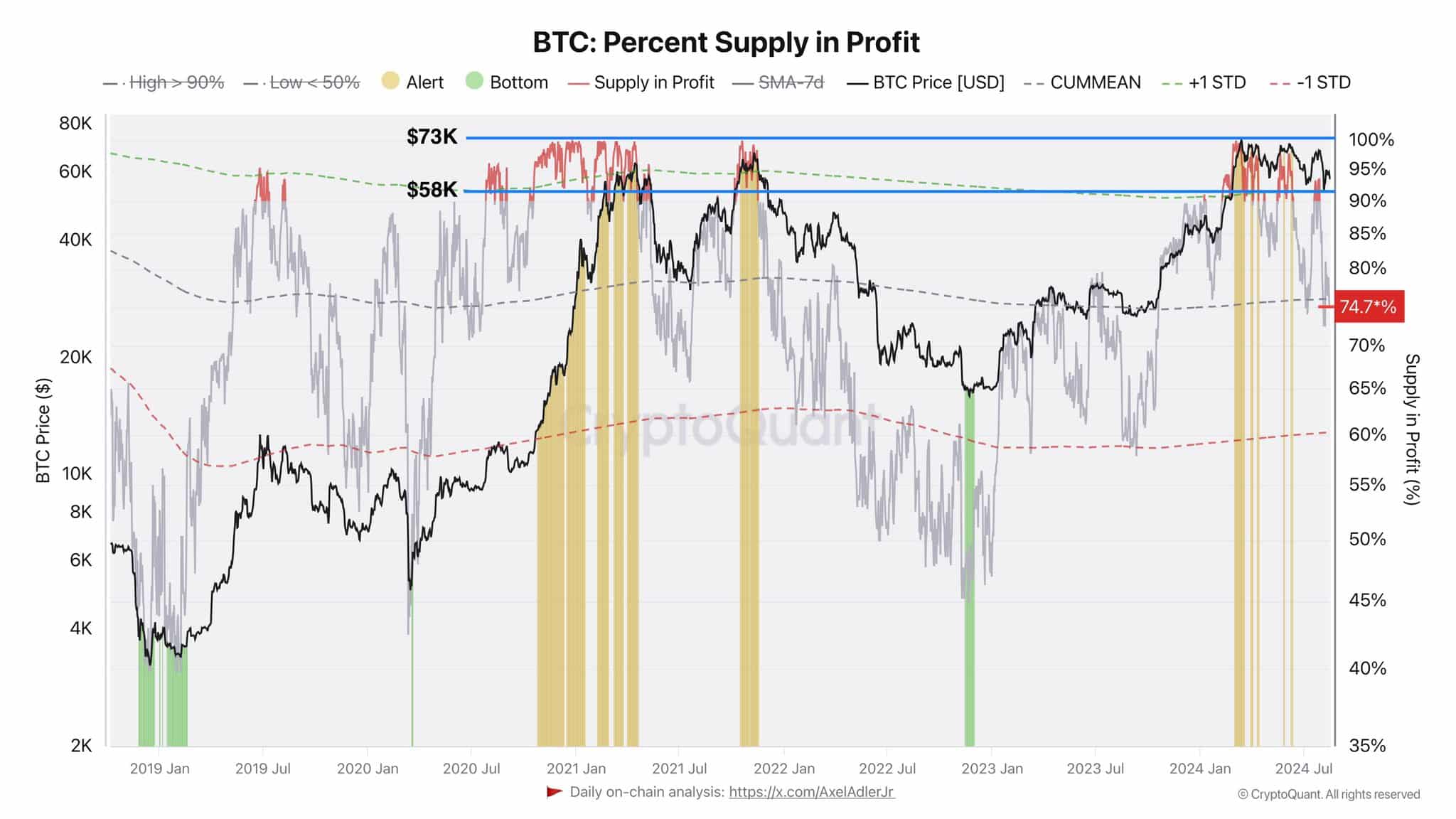

Within the first quarter of 2024, 874 establishments held Bitcoin ETFs, with the identical rising to 1,008 by the second quarter.

In truth, 1 / 4 of Bitcoin’s complete provide was purchased at $58K-73K, equal to about $300 billion. Traders who purchased on this vary are seemingly holding for future beneficial properties, suggesting that they count on Bitcoin’s value to rise additional.

Regardless of Bitcoin’s gradual value motion and low retail curiosity, institutional shopping for is accelerating although – One other signal of the crypto’s long-term development.

Mixed with current developments in Bitcoin’s market, a constructive long-term value pattern will be traced.

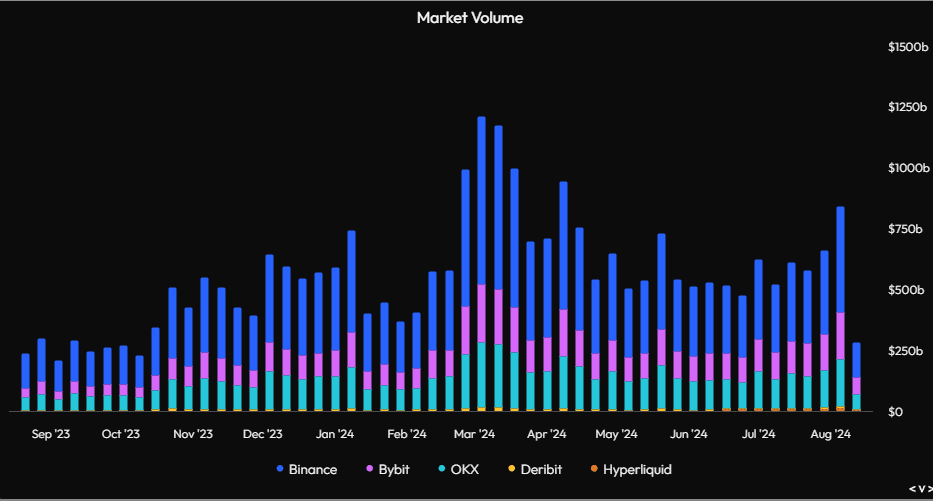

Market quantity will increase within the midst of low funding charges

Since peaking in March, market volumes have been declining for a chronic consolidation part too.

Simply final week, regardless of international market turmoil from the Japanese inventory market crash, the crypto markets noticed a major quantity hike on the charts.

This has led to heightened volatility in Bitcoin and different cryptocurrencies.

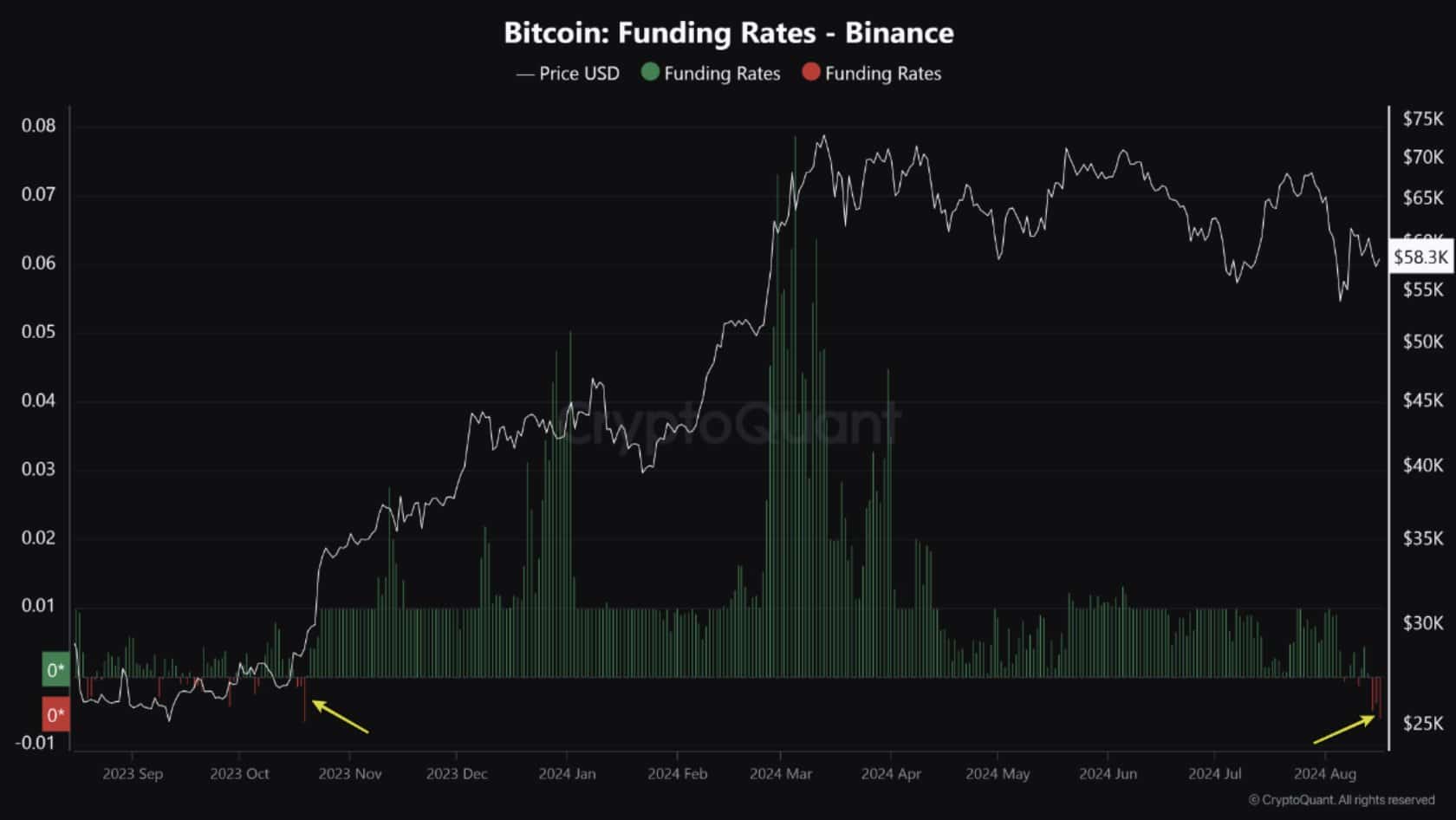

Lastly, Bitcoin funding charges on Binance have hit their lowest level of the 12 months too. The extra shorts are loaded, the upper BTC will go.

With Binance holding the most important share of Open Curiosity, some short-term bearish sentiment could also be evident too. Nevertheless, this would current a possible shopping for alternative for long-term buyers and merchants to build up extra Bitcoin.