- Bitcoin has seen extra lengthy positions in the previous few weeks.

- BTC has maintained the $60,000 worth stage within the final two days.

Bitcoin [BTC] has skilled vital volatility in current weeks, fluctuating however finally reclaiming the $60,000 stage.

Regardless of this turbulence, the vast majority of merchants have maintained a bullish outlook, favoring lengthy positions. Nonetheless, current information reveals that these lengthy positions have confronted some setbacks throughout this era.

Bitcoin merchants keep lengthy

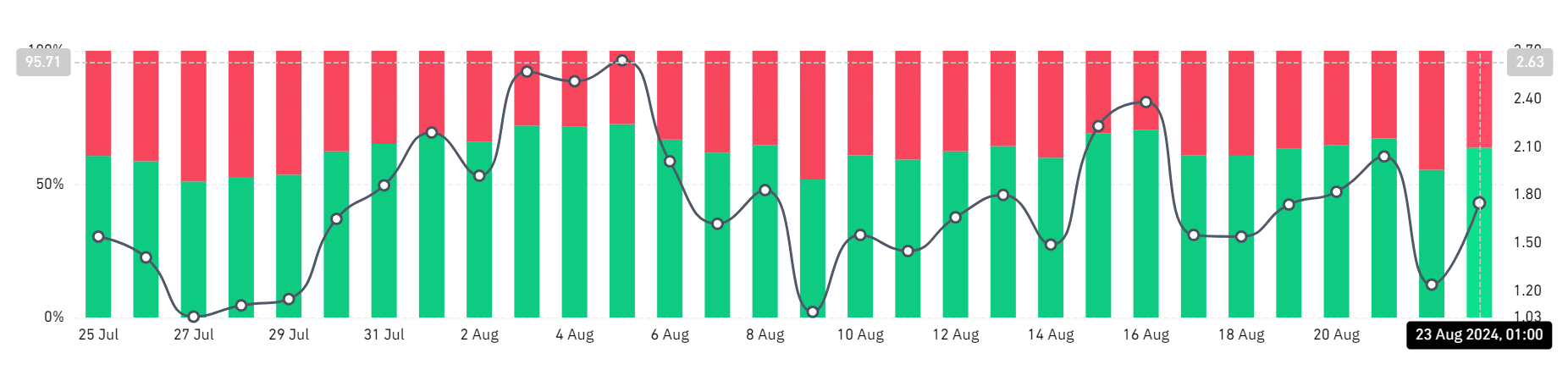

Latest information evaluation from Coinglass has make clear the ratio of lengthy to quick Bitcoin positions on Binance, the world’s largest cryptocurrency trade.

The findings reveal that, over the previous few weeks, the vast majority of accounts have maintained lengthy positions, persistently surpassing 60%. As of the most recent information, the proportion of lengthy positions has risen to over 63%.

Since July, this pattern has persevered, with lengthy positions persistently outnumbering quick positions, whilst Bitcoin’s worth dipped under the essential $60,000 mark.

This prompt that merchants remained assured in Bitcoin’s upward trajectory, no matter its worth fluctuations.

Liquidation quantity reveals the extent of volatility

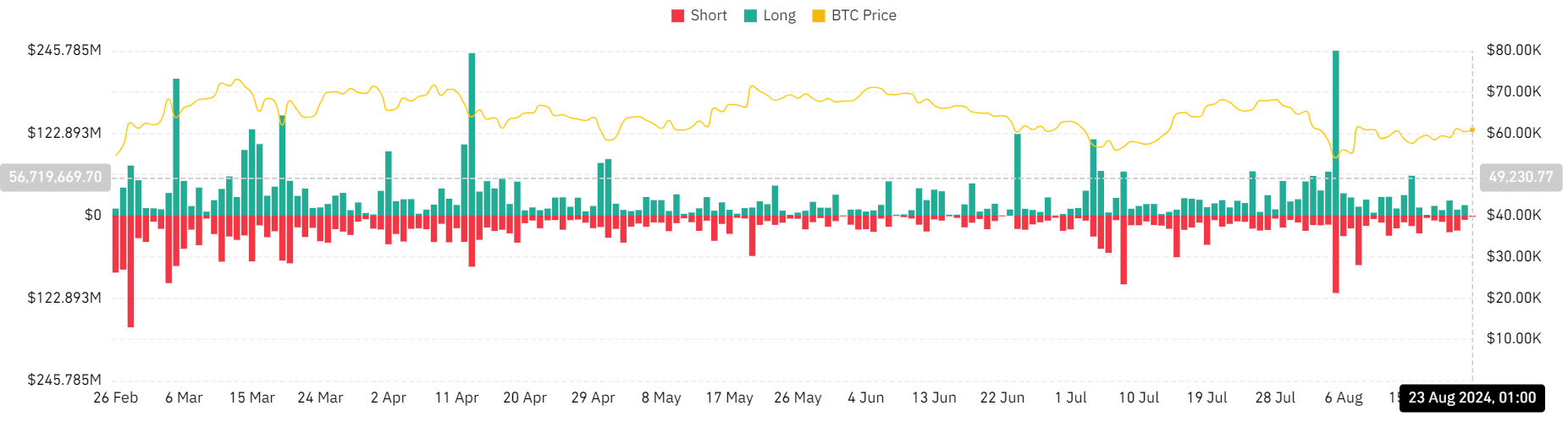

AMBCrypto’s evaluation of Bitcoin’s liquidation pattern added an intriguing dimension to the dominance of lengthy positions.

Regardless of the vast majority of accounts sustaining lengthy positions, current weeks have seen a notable improve in lengthy liquidations.

In August, lengthy liquidation quantity reached its highest stage in over a 12 months, exceeding $245 million.

When mixed with quick liquidations, this pattern turns into much more vital, highlighting the volatility and threat current within the present market regardless of the general bullish sentiment amongst merchants.

Bitcoin maintains its $60,000 worth stage

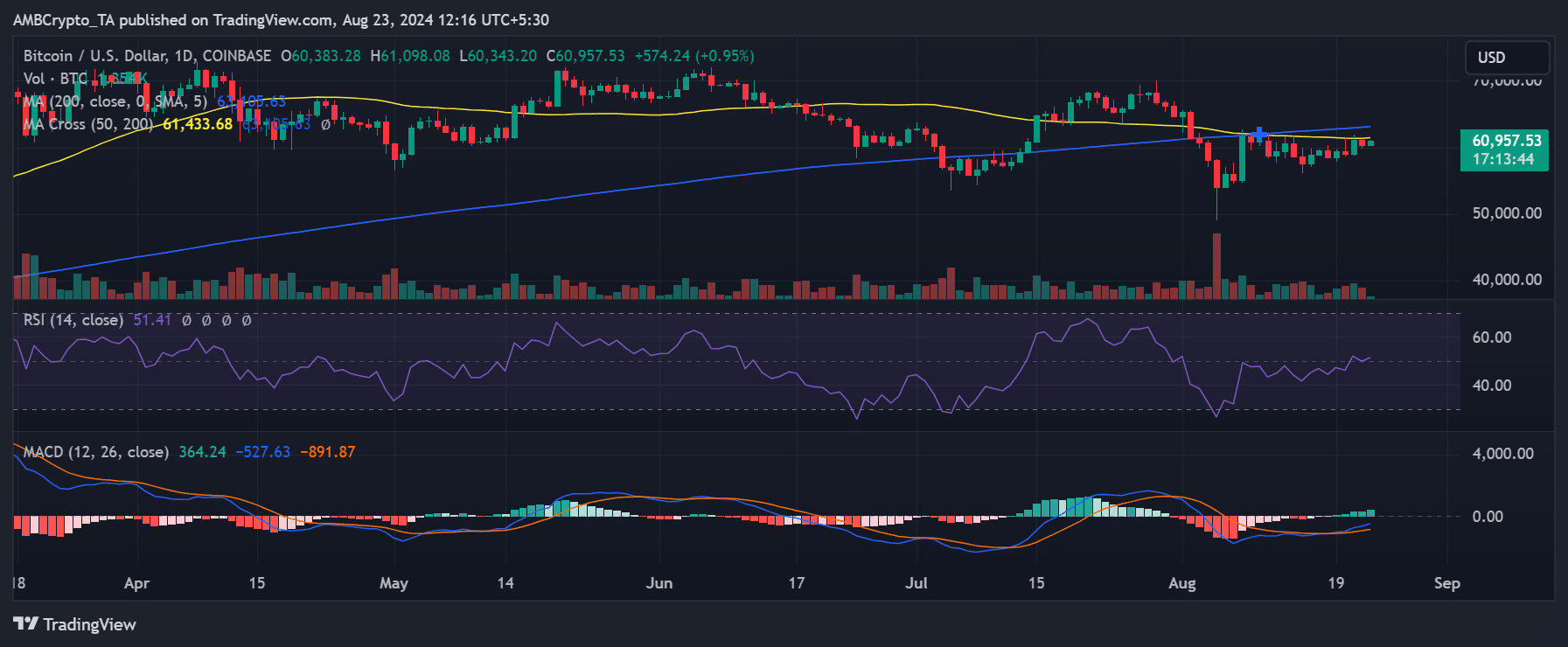

AMBCrypto’s have a look at Bitcoin’s worth pattern revealed that it has been struggling to persistently reclaim the $60,000 stage, regardless of briefly doing so in current days.

Within the earlier buying and selling session, it closed with a slight decline of over 1% but managed to remain inside the $60,000 vary.

As of press time, BTC was buying and selling at roughly $60,900, reflecting an nearly 1% improve. The king coin Bitcoin remained slightly below its short-term shifting common (yellow line), although it’s approaching it intently.

A break above this shifting common, which aligned with the resistance stage of round $61,000, would sign a possible upward pattern.

Lengthy positions to stay dominant

Bitcoin’s worth pattern, together with the Prime Dealer Lengthy Brief Ratio, indicated that lengthy positions had been more likely to stay dominant no matter worth fluctuations.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The charts revealed that even when Bitcoin’s worth dropped to round $54,000 earlier in August, the proportion of lengthy positions held regular at roughly 60%.

This prompt that merchants continued to favor lengthy positions, sustaining a bullish outlook regardless of worth declines.