Picture supply: Getty Photos

The FTSE 100 is filled with nice worth UK dividend shares paying excessive charges of passive earnings, however why cease there? Smaller corporations also can provide beautiful yields and a few are mega-cheap, together with this hidden FTSE 250 gem.

OSB Group (LSE: OSB) caught my eye a number of weeks in the past. I might have purchased it there after which, however I’m absolutely invested and didn’t have money to spare. I’m not giving up on it, although.

OSB is a specialist mortgage lender that funds buy-to-let, self-employed, antagonistic credit score, and business mortgages utilizing retail deposits from its financial savings franchises Kent Reliance and Constitution Financial savings Financial institution.

FTSE 250 high-yield share

OSB is probably not a well-recognized identify however can hint its roots again to 1898, when it was based because the Chatham & District Reliance Constructing Society. It was renamed because the Kent Reliance in 1986, then floated in 2014 because the OneSavings Financial institution at 170p per share.

At this time, OSB trades at 390p however efficiency has been patchy currently. The shares are up 16.97% over 12 months, however solely 5.41% over 5 years (which incorporates the pandemic, after all).

It’s had a bumpy three months, falling 13.1%, following a disappointing set of half-year outcomes on 15 August.

The board trimmed forecast full-year web curiosity margins from 250 foundation factors to between 230 and 240 factors, blaming elevated mortgage market competitors. Markets anticipate the Financial institution of England to chop rates of interest in November and December this 12 months, and that would squeeze OSB’s margins additional.

Falling rates of interest may have an upside, although, by boosting property market exercise, and demand for mortgages.

However there’s one other hazard. OSB is chargeable for writing 9% of all new buy-to-let mortgages. Sadly, that is additionally being squeezed. The press is stuffed with landlords saying they’re promoting up, as tax breaks are squeezed, renters are handed extra rights, and power efficiency guidelines probably tightened.

Labour’s upcoming Renters’ Rights invoice is including to the sense of dread, whereas increased borrowing prices don’t assist. The panic might have been overdone besides, it’s the notion that issues.

Grime-cheap shopping for alternative

These dangers are largely mirrored in at this time’s all-time low price-to-earnings valuation of simply 5.15 instances earnings. The reward, after all, is that supersized yield of 8.21%.

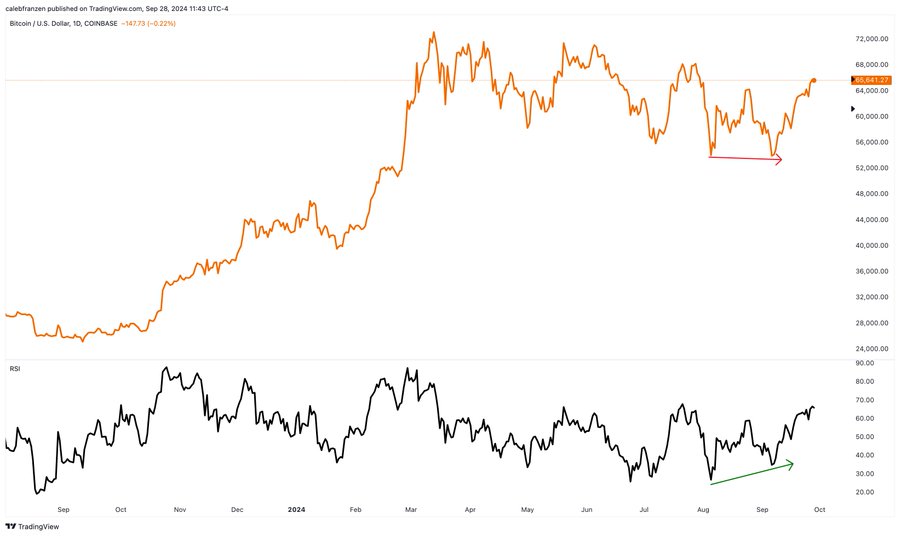

So is the dividend sustainable? It’s coated 2.6 instances by earnings, which is reassuring. In August, the board was completely happy to hike the interim dividend 5% to 10.7p per share. Dividends per share have risen fairly steadily however the tempo of progress has stalled over the past couple of years, as this chart reveals.

Chart by TradingView

The board was nonetheless completely happy to approve a brand new £50m share buyback, which started final month.

The ten analysts providing one-year OSB worth targets have set a median determine of 554p. That’s up 39.85% from at this time’s worth. Think about that plus an 8% yield? It isn’t assured, after all.

If markets recuperate, OSB could lead on the cost. There are dangers however given the scale of that second earnings stream it’s the primary inventory I’ll purchase in October. I simply have to rake the money collectively.