- BTC crossed over to the $60,000 value stage at press time.

- Brief holders have suffered extra losses with the value volatility.

Bitcoin [BTC] has confronted vital challenges in sustaining its place above the $60,000 value stage, incessantly dipping under this key threshold in latest weeks.

This volatility has notably impacted short-term Bitcoin holders, a lot of whom are actually holding their property at a loss because of the fluctuating value.

Brief Bitcoin holders at a loss

A latest report has revealed that over 80% of short-term Bitcoin holders had been holding their BTC at a loss at press time. This meant that their Bitcoin investments had been value lower than what they initially paid.

This case arose as Bitcoin continues to wrestle across the $60,000 value stage.

The evaluation drew parallels between the present state of affairs and comparable market situations in 2018, 2019, and mid-2021.

In these durations, a big proportion of short-term holders had been additionally held at a loss, which led to elevated panic promoting. This conduct contributed to extended bearish developments as buyers rushed to chop their losses.

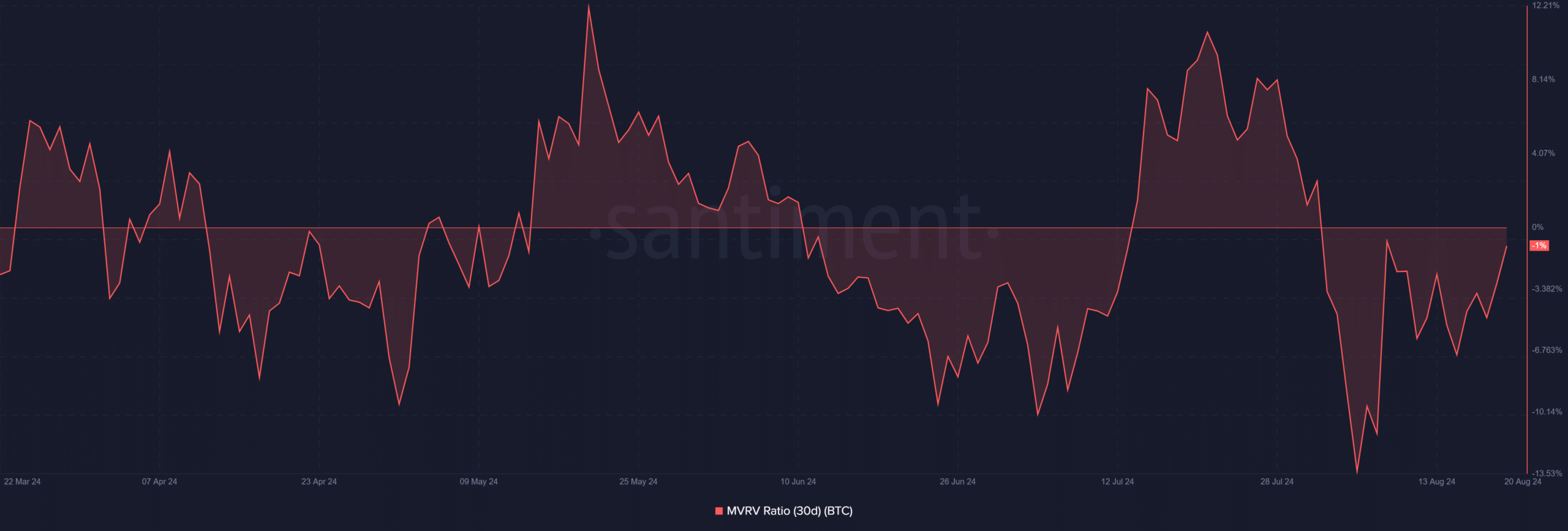

AMBCrypto’s evaluation of the 30-day Market Worth to Realized Worth (MVRV) on Santiment confirmed the challenges confronted by short-term Bitcoin holders.

The metric indicated that these holders have been in a loss place for a number of weeks. The MVRV has been under zero because the starting of the month, reflecting that the majority short-term holders had been underwater.

The MVRV has remained under zero for an prolonged interval, signaling that short-term holders have typically been holding at a loss.

On the fifth of August, the MVRV dropped to round -13%, highlighting the extent of the losses.

As of the 18th of August, the MVRV had improved to roughly -5%, nonetheless in adverse territory however displaying some restoration.

Within the final 48 hours, the scenario improved additional, with the MVRV rising to round 1% as of this writing. This optimistic shift is essentially because of the latest value beneficial properties, which alleviated some stress on short-term holders.

Extra Bitcoin holders stay worthwhile total

Shifting the main target from short-term holders to the general Bitcoin holder base reveals a extra optimistic outlook.

In line with knowledge from IntoTheBlock, a considerable majority of Bitcoin holders had been nonetheless in revenue regardless of latest value fluctuations.

Particularly, over 80% of all Bitcoin addresses, equal to roughly 45.45 million addresses, had been “in the money,” that means they held BTC at a value increased than their buy value.

Moreover, about 6.9 million addresses, or round 12.9% of the whole, had been “out of the money,” that means these holders had been at a loss, based mostly on press time costs. 2% of the addresses had been at breakeven.

Whereas short-term holders have been extra affected by the latest value declines, the general market remains to be largely in revenue.

Which means reactions from short-term holders, who usually tend to promote at a loss, are unlikely to have a major affect on the broader BTC value development.

Bitcoin value within the final 48 hours

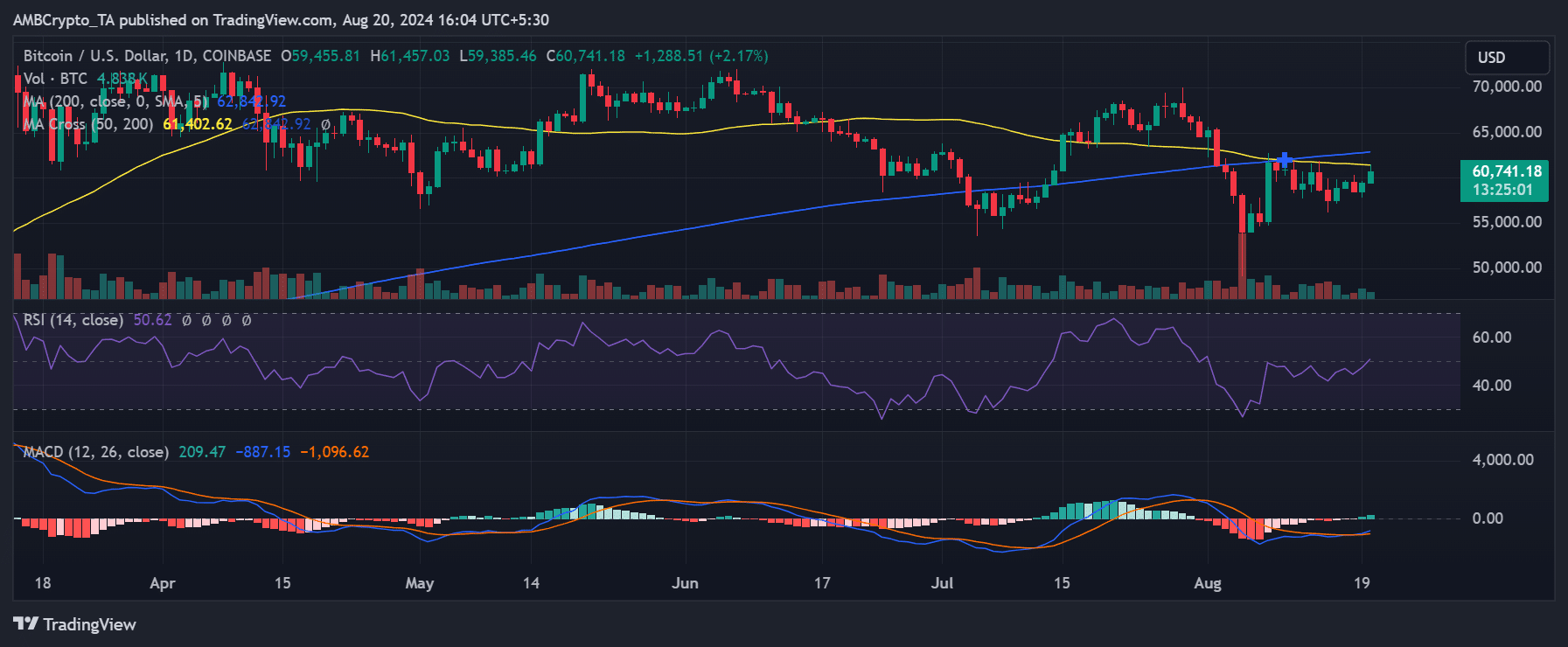

As of this writing, Bitcoin has seen a value enhance of over 2%, pushing it to roughly $60,800. This follows an virtually 1% rise within the earlier buying and selling session, which introduced its value to round $59,452.

The latest beneficial properties have introduced Bitcoin nearer to a essential resistance stage marked by its short-term transferring common (yellow line) across the $60,000 mark.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Suppose Bitcoin can break via the $60,000 resistance offered by the short-term transferring common.

In that case, the subsequent main resistance stage lies at round $63,000, marked by the long-term transferring common (blue line). This stage would be the subsequent essential goal for Bitcoin to achieve because it continues its upward development.