- BTC holders proceed to see earnings on their investments.

- This has remained regardless of the coin’s slender worth actions.

A brand new report by Glassnode discovered that Bitcoin [BTC] holders have continued to carry unrealized earnings regardless of the main coin’s slender actions prior to now few weeks.

At press time, BTC exchanged arms at $65,625. Trending inside a horizontal channel, the coin has confronted resistance at $71,656 and has discovered help at $64,825. Nevertheless, regardless of this “sideways price movement,” BTC’s “investor profitability remains robust.”

Based on the on-chain information supplier:

“BTC prices are consolidating within a well-established trade range. Investors remain in a generally favorable position, with over 87% of the circulating supply held in profit, with a cost basis below the spot price.”

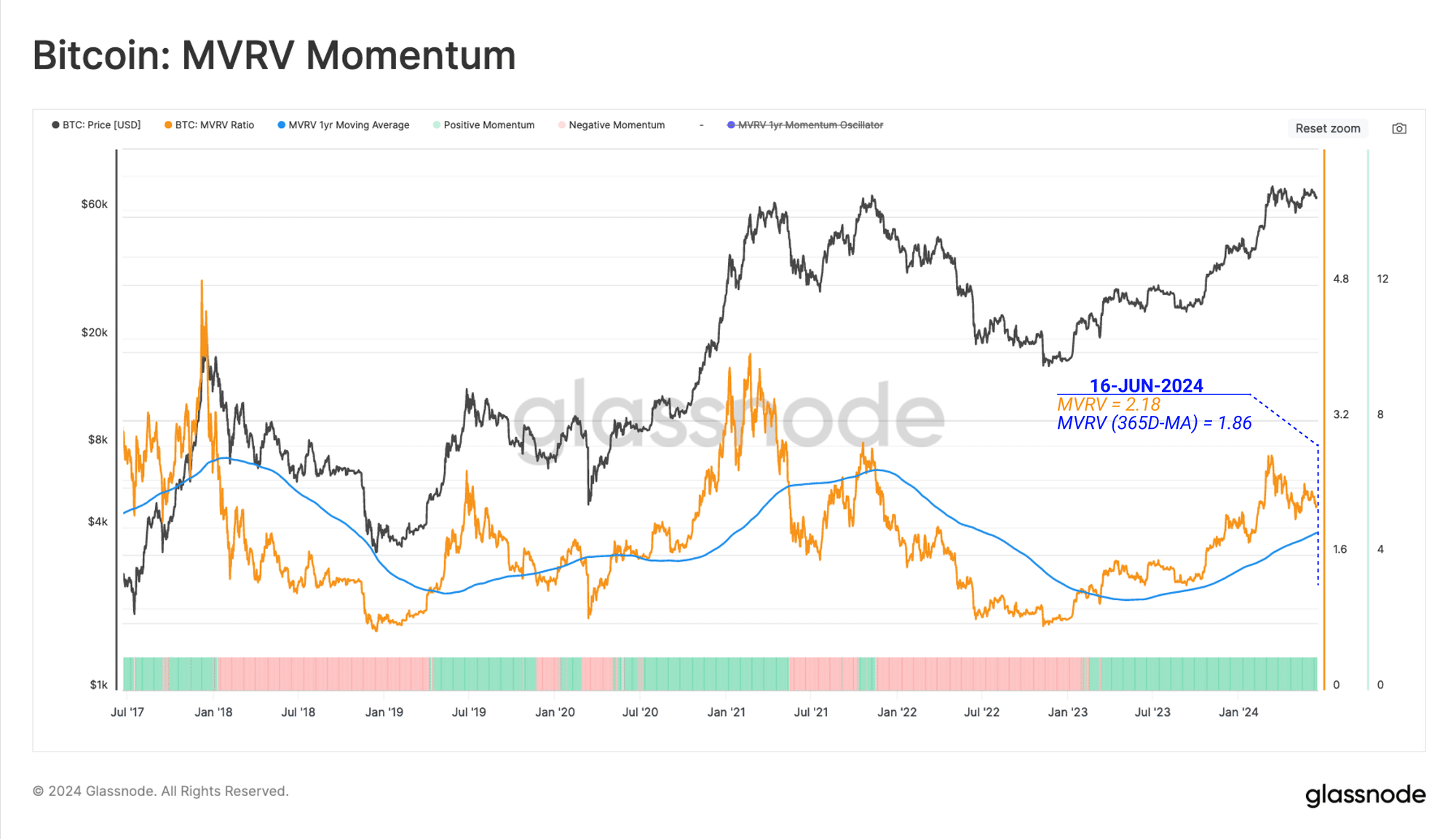

Glassnode assessed the coin’s Market Worth to Realized Worth (MVRV) ratio and located that the typical BTC coin in circulation holds an unrealized revenue of over 120%.

Curiously, regardless of how worthwhile BTC holders are, the amount of cash being processed and transferred on the Bitcoin Community since March’s all-time excessive (ATH) has declined considerably,

Glassnode famous that this decline “underscores a reduced appetite for speculation and heightened indecision in the market.”

Low trade exercise

BTC’s worth consolidation has additionally led to a decline in BTC trade flows. Glassnode discovered that BTC’s short-term holders (STHs) at present ship roughly 17,400 BTC (valued at $1.13 billion at present market costs) to exchanges each day.

These buyers have held their cash for a comparatively quick interval, usually lower than 155 days.

Their present trade inflows signify a 68% decline from 55,000 BTC despatched to exchanges by this cohort of buyers when the coin climbed to an all-time excessive of $73,000 in March.

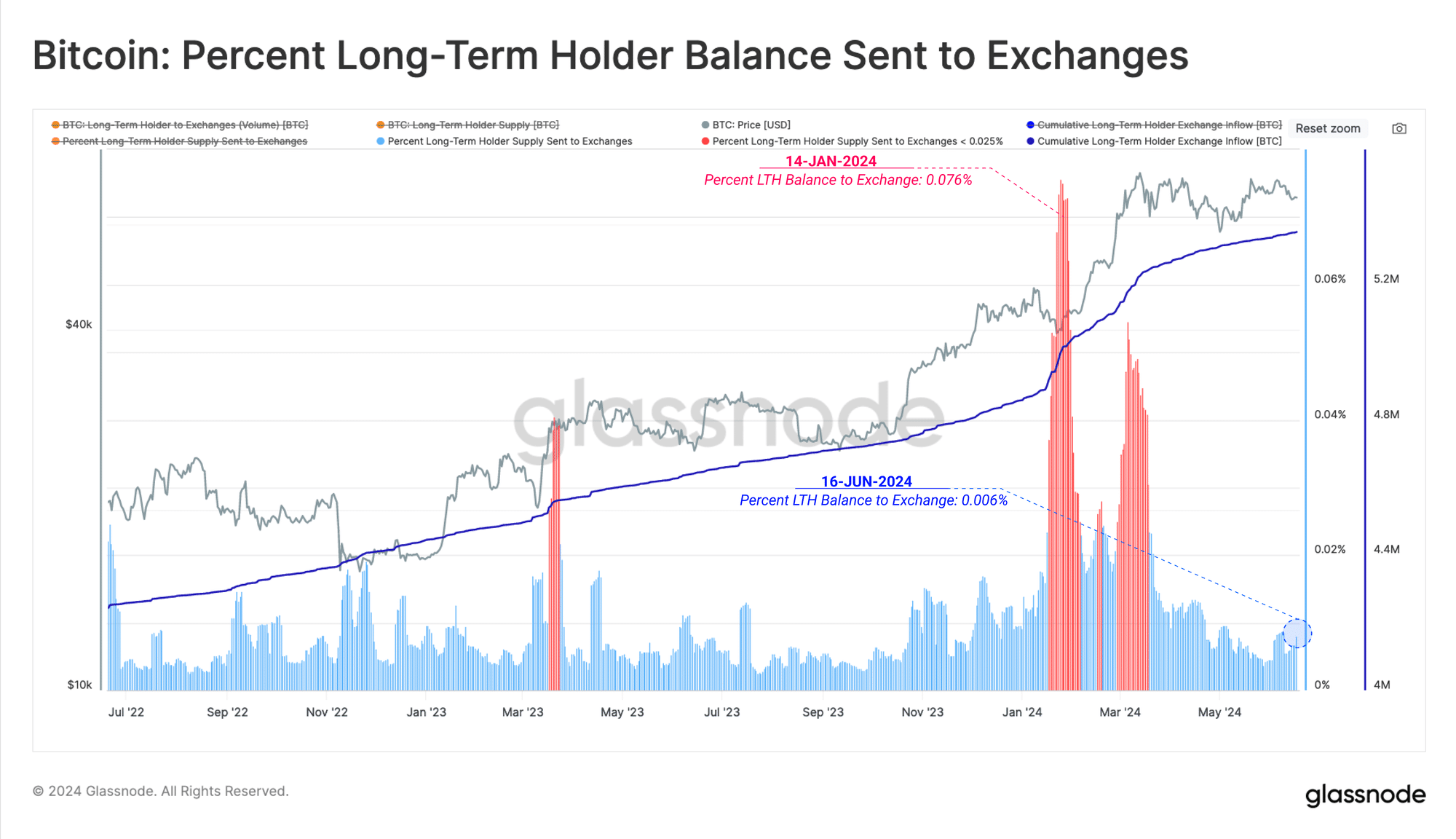

As for long-term holders (LTHs), their “distribution into exchanges is relatively low, with only a marginal 1k+ BTC/day in inflows currently.”

Glassnode mentioned:

“LTHs are sending less than 0.006% of their total holdings into exchanges, suggesting that this cohort has reached equilibrium and that higher or lower prices are required to stimulate further action.”

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The typical BTC despatched to exchanges generates a revenue of round $5,500. This has prompted some buyers who’ve held for lengthy to promote for revenue.

Because the market anticipates a rally to the $73,750 ATH, there’s sufficient demand to soak up the promoting stress. Nevertheless, it’s “not large enough to push market prices higher.”

![Simply launched: our 3 greatest dividend-focused shares to contemplate shopping for earlier than July [PREMIUM PICKS] 6 Passive retirement income](https://www.fool.co.uk/wp-content/uploads/2022/03/Passive-retirement-income.jpg)