Coinspeaker

Bitcoin Slips Beneath $68K amid Skinny Bid Liquidity, Analysts Warn of Additional Decline

Bitcoin (BTC) value is going through renewed downward stress, dipping beneath $68,000 in the course of the June eleventh Asia buying and selling session. Analysts are warning of additional losses, with some fearing a possible drop to $60,000.

Picture: TradingView

This bearish sentiment stems from a 3.88% decline that pushed Bitcoin to lows round $66,800 within the final 24 hours, in accordance to TradingView. The important thing assist level of $69,000 failed to carry, and skinny order e book liquidity exacerbated the downward transfer.

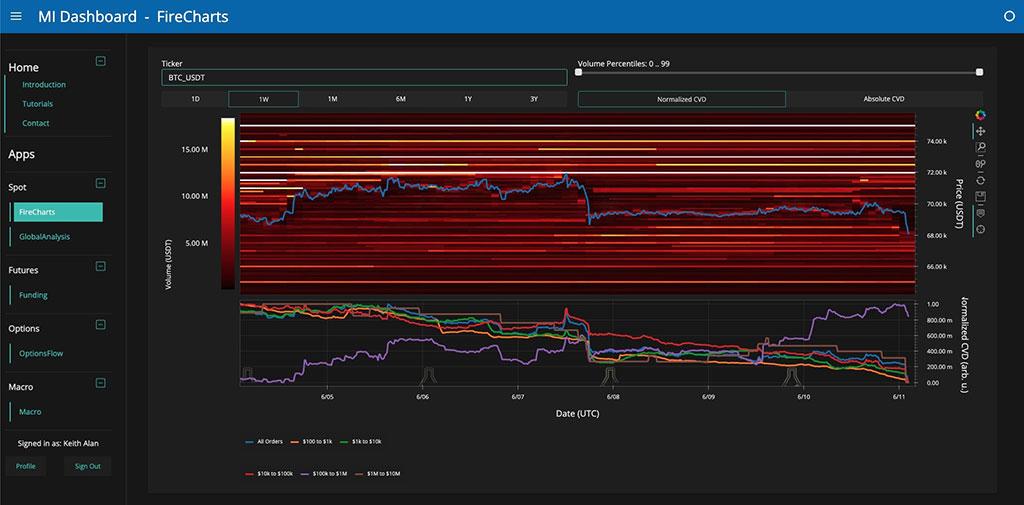

Market analysts are significantly involved by the lack of robust shopping for stress, usually referred to as “bid liquidity.” Keith Alan, co-founder of Materials Indicators, highlighted the weak shopping for stress in a recent YouTube replace:

“Sure we have some laddered bid support in here, but not a heavy, heavy concentration of it – and really, it’s not even heavy down to $60,000 if I can be completely honest.”

$69K Assist Fails amid Bearish Alerts

Additional technical evaluation by Materials Indicators suggests a bearish outlook. With the newest value drop, Bitcoin has decisively rejected each the $69,000 assist stage and the 21-day shifting common, an important indicator of short-term tendencies.

Picture: Materials Indicators

“Support at the 21-Day Moving Average and the R/S Flip at $69k have both been invalidated,” the evaluation said. “This move isn’t over. In fact I expect these killer whale games to continue up to and through JPow’s comments on Wednesday and economic reports on Thursday.”

This weeokay, Bitcoin and the broader crypto market might experience volatility due to approaching US financial knowledge launchs. Key occasions to observe embody the Shopper Value Index (CPI), the Producer Value Index (PPI), the Federal Reserve’s interest charge choice, and Jerome Powell’s press conference.

Widespread dealer Skew shared his view on the correlation between these occasions. He noticed that CPI and PPI have been on the greater finish of their vary, whereas the FOMC has led to native lows. Skew talked about that the approaching days can be attention-grabbing.

Will Bulls Defend $65,000?

Whereas the chance of a drop to $60,000 exists, some analysts stay cautiously optimistic. Credible Crypto, one other outstanding commercer, suggests that large-volume commercers’ actions might forestall a steeper decline. He factors to the presence of “spot absorption” on dips, indicating shopping for curiosity even at lower cost factors.

He additionally noticed the swift removing of promote orders (resistance) at $72,000 as soon as the value began to reverse. This means that some whales could be strategically manipulating the market.

Credible Crypto believes there’s a decent likelihood we’d hit vary lows of $62K-65K after which reverse. Whereas there’s no guarantee, we must always know quickly primarily based on value motion within the subsequent 24 hours.

Bitcoin Slips Beneath $68K amid Skinny Bid Liquidity, Analysts Warn of Additional Decline