- Market observers provide blended alerts on the Fed’s macro outlook impression on BTC and crypto.

- BTC dropped to $67K after the Fed’s choice and threatened to publish extra losses.

Bitcoin [BTC] struggled to carry above $67K after the Fed determined to take care of the present 5.25% to five.5% rate of interest for the seventh time.

Nonetheless, the Fed’s financial projection and ahead steerage throughout the assembly have stirred divergent macro views on the impression on threat property like BTC.

A JPMorgan commentary acknowledged that the Fed’s ‘monetary outlook remained uncertain.’ This was primarily based on the potential for just one lower by the tip of 2024, not like the three cuts forecasted within the March assembly.

Is BTC dealing with macro threat in Q3?

The uncertainty was additional cemented by Fed’s chair Jerome Powell’s ‘lack of confidence’ in current inflation information. The chair famous,

“It’s in all probability going to take longer to get the arrogance that we have to loosen coverage.’

On his half, Quinn Thompson, founder and CIO of crypto hedge fund Lekker Capital, seen the Fed’s outlook as a threat to crypto property. Forecasting an identical liquidity crunch that hit BTC earlier than US tax season in April, the chief stated,

‘I believe the ‘liquidity air pocket’ that started on the finish of Q1 previous to tax season continues to be with us till there’s both one other month or so of higher inflation information to bolster the present disinflationary development’

Increasing on the potential threat for crypto property, the hedge fund government added,

‘I think there is serious cascade risk in crypto, and in particular, expect most altcoins to be taken out back. The market seems to have lost any ability to bounce.’

Additional casting doubt on BTC prospects in summer time, Thompson acknowledged that the king coin has failed to collect sufficient energy to interrupt above its all-time excessive.

Nonetheless, different market observers, like crypto buying and selling agency QCP Capital, acknowledged the Fed’s ambiguity however remained bullish for the remainder of 2024. In a current Telegram replace, the agency famous,

‘We maintain a structurally bullish outlook for the remainder of the year, driven by the anticipated ETH ETF S-1 approval and potential rate cuts in September and at the year-end.’

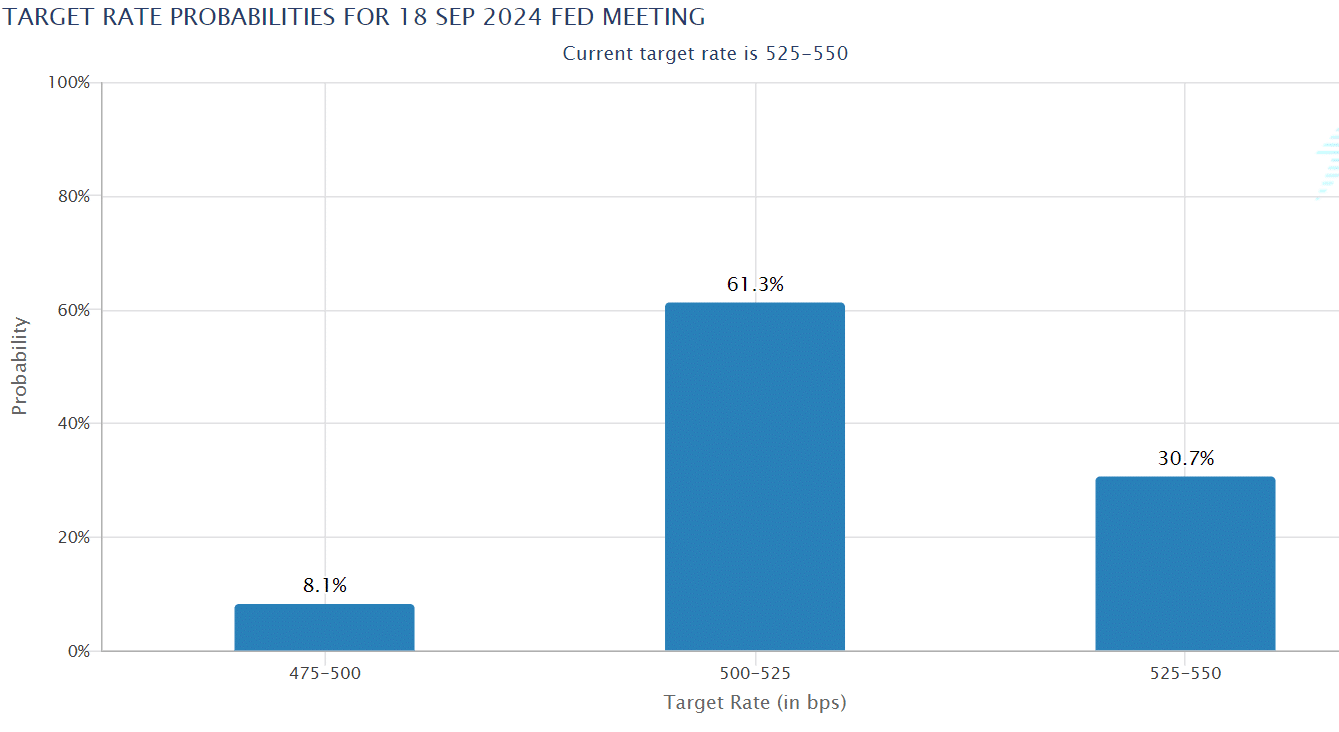

As of press time, the odds of the September charge lower have been up +60% towards 30% for retaining present charges unchanged.

One other macro analyst, TedTalksMacro, shared the optimistic outlook and seen the Could US CPI print as ‘disinflationary’ and short-term bullish for crypto.

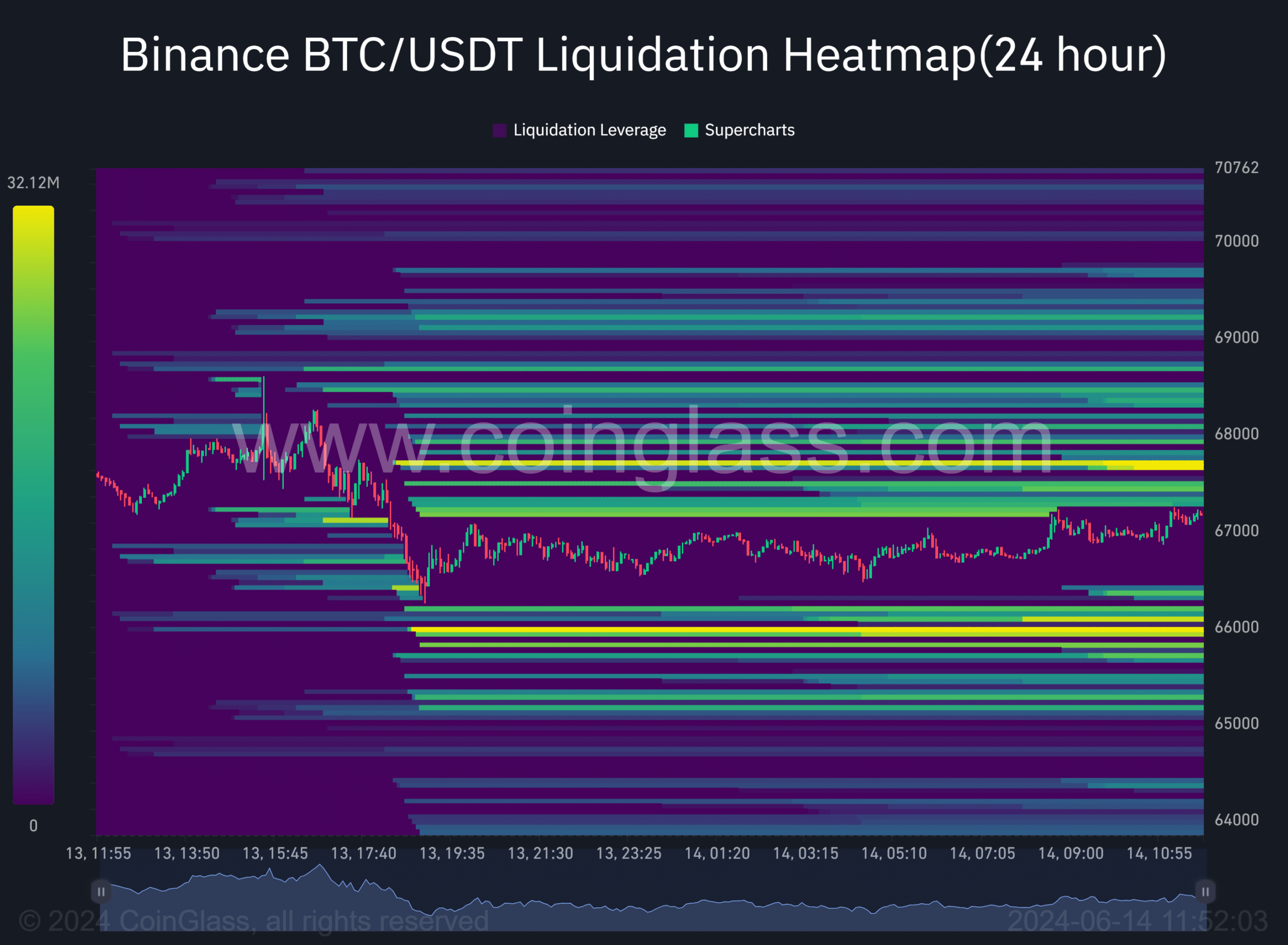

Within the meantime, the every day liquidation charts confirmed appreciable liquidity clusters at $66K and $68K (marked orange) as of press time.

Sometimes, value motion targets these liquidity areas, and it steered {that a} retest of the $66K and $68K ranges was possible within the brief time period.