The Bitcoin value started Friday, August 16 from beneath the $57,000 stage, following a sudden 7% fall on Thursday. Whereas the premier cryptocurrency is exhibiting good indicators of restoration, a distinguished crypto analyst has defined how the newest value decline might have pushed the BTC value right into a bearish part.

Bitcoin MVRV Drops Beneath 1-Yr SMA – Influence On Value?

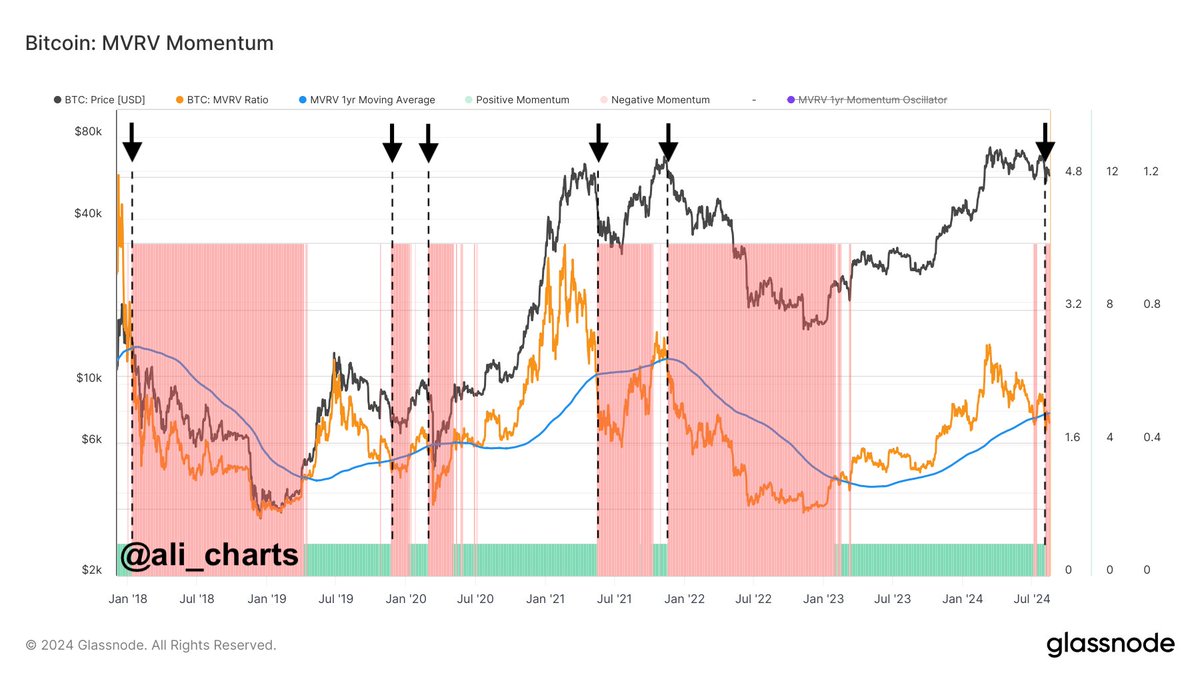

In a put up on the X platform, standard crypto analyst Ali Martinez shared that the Bitcoin value has skilled a shift in its cycle following the newest value dip. This on-chain revelation is predicated on the Glassnode MVRV (Market Worth to Realized Worth) Momentum indicator, which serves as a instrument for figuring out macro market traits.

The MVRV Momentum indicator primarily consists of the MVRV ratio and the 1-year easy transferring common (SMA). When the MVRV ratio breaks above this SMA, it signifies a transition into the bull market. In the meantime, a break under the 1-year easy transferring common alerts a shift to the bearish part.

Usually, robust breaches above the MVRV 1-year SMA counsel that enormous volumes of Bitcoin have been acquired under the present value, exhibiting that the holders are actually in revenue. On the flip facet, when there’s a robust break beneath the transferring common, it signifies that enormous volumes of BTC have been bought above the present value, with the holders within the pink.

A chart exhibiting the Bitcoin value and the MVRV momentum indicator | Supply: Ali_charts/X

In keeping with Martinez, the BTC cycle transitioned to a bearish part after the Bitcoin value slumped under $61,500. This newest vital break of the MVRV ratio beneath the SMA reveals {that a} vital quantity of BTC was acquired above $61,500. Nonetheless, the cash are actually in loss, which can probably result in heavy distribution by traders who wish to in the reduction of their losses.

When a lot of traders are within the pink, there’s an elevated stress to promote, which might put additional downward stress on the Bitcoin value. Finally, this might result in a state of affairs the place falling costs lead to extra asset offloading, thereby strengthening the momentum of the bearish part.

Bitcoin Value At A Look

As of this writing, the value of Bitcoin continues to hover round $59,000, reflecting a 2.5% enhance previously 24 hours. Nonetheless, the premier cryptocurrency is down by practically 3% on the weekly timeframe, in accordance with information from CoinGecko.

The worth of Bitcoin hovers across the $59,000 stage on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView