- Miners are going through one of many steepest declines in income in years.

- Reviews prompt that the power generated could possibly be put to raised use for extra income.

Bitcoin Miners have skilled a major income decline over the previous few months, with earnings hitting among the lowest ranges in years.

Nevertheless, latest experiences counsel that Bitcoin miners may need a promising alternative to offset these losses by transitioning to Synthetic Intelligence (AI).

Bitcoin Miners may generate extra income, says VanEck report

Bitcoin Miners have been going through a decline in income attributable to a wide range of elements, together with decrease Bitcoin costs, rising mining problem, and rising operational prices.

Nevertheless, a latest report from VanEck means that miners may offset these losses by partially transitioning into the Synthetic Intelligence (AI) business.

In keeping with the report, Bitcoin miners possess the power infrastructure that the AI and high-performance computing (HPC) sectors desperately want.

By redirecting a few of their sources to help these industries, miners may generate a further $13.9 billion in yearly income by 2027.

The VanEck report highlights that this shift could possibly be essential for miners, lots of whom are fighting weak stability sheets. These monetary challenges usually stem from extreme debt, over-issuance of shares, excessive govt compensation, or a mix of those elements.

Diversifying into the AI sector may present miners with a much-needed increase to their profitability and long-term sustainability.

Bitcoin miner sees income decline

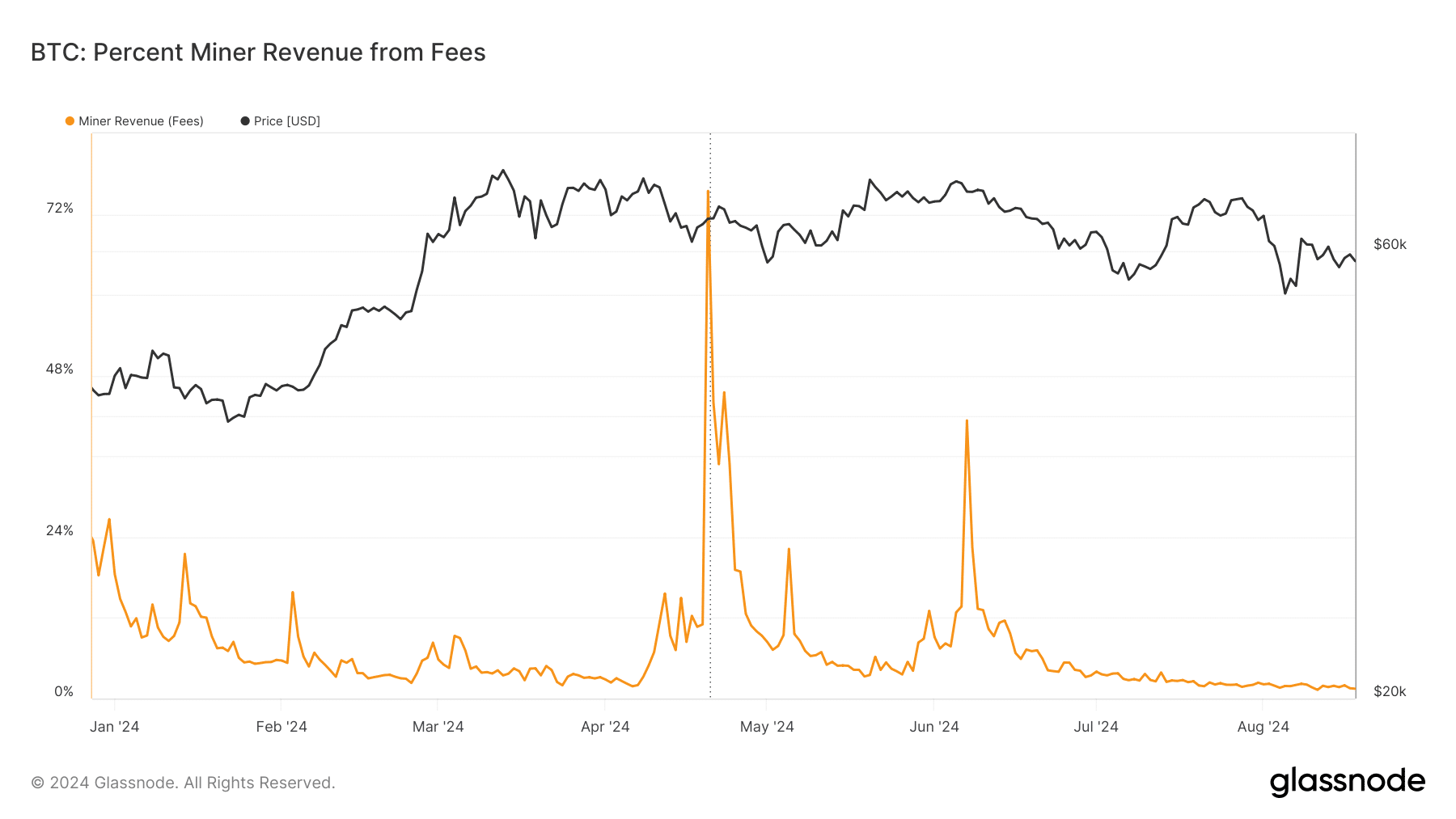

A latest evaluation of Bitcoin miner income on Glassnode reveals vital fluctuations all through 2024, with notable spikes in late April/early Could and June.

In late April and early Could 2024, miner income surged by over 70%, adopted by one other vital spike in June 2024, reaching roughly 40%.

Nevertheless, after these peaks, the chart exhibits a dramatic decline in miner income, dropping to round 0%.

This sharp decline underscores a important problem for Bitcoin miners: their heavy reliance on block rewards for almost all of their earnings.

On condition that the proportion of income generated from transaction charges usually stays low, usually beneath 10%, miners are predominantly depending on block rewards to maintain their operations.

The reliance on block rewards poses a major long-term threat as a result of these rewards halve roughly each 4 years as a part of Bitcoin’s programmed financial coverage.

Bitcoin worth struggles beneath $60,000

As of this writing, Bitcoin (BTC) is buying and selling at roughly $58,600, reflecting a modest enhance of lower than 1%. Over time, there was a powerful correlation between the worth of Bitcoin and the income generated by Bitcoin miners.

Presently, Bitcoin is going through vital challenges in reclaiming its psychological degree of $60,000, which it has struggled to breach in latest weeks.

Learn Bitcoin (BTC) Value Prediction 2024-25

The continuing problem in surpassing this key degree is compounded by bearish market sentiment.

An evaluation of Bitcoin’s Relative Power Index (RSI) signifies that it’s beneath the impartial line, signaling that the market continues to be in a bearish development.