- Bitcoin has reclaimed $60,000 amid a surge in OTC desk balances, indicating elevated promoting by miners.

- Analysts stay cautiously optimistic, regardless of blended indicators from community exercise and large-scale transactions.

Bitcoin [BTC] has not too long ago proven indicators of restoration after a number of weeks of consolidation under the $60,000 mark.

The main cryptocurrency has managed to climb again above this physiological stage, reaching a 24-hour excessive of $61,830 and at the moment buying and selling at $60,798, marking a 2% improve over the previous day.

This upward motion has introduced a way of reduction amongst merchants who had been involved about Bitcoin’s stagnant worth motion in latest weeks.

The resurgence in Bitcoin’s worth coincides with a major improvement in certainly one of its key metrics, which might have essential implications for the market.

Rising OTC desk: What this implies for BTC

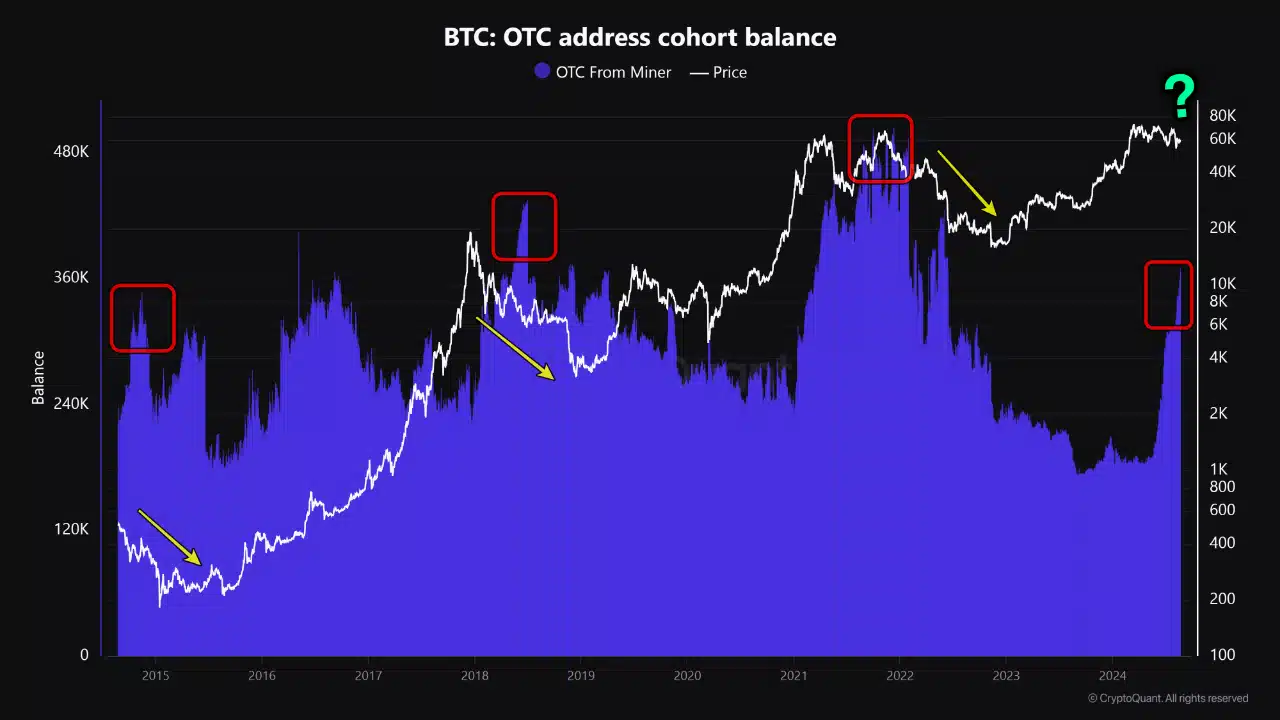

In keeping with a latest report from CryptoQuant, the steadiness of Bitcoin held in Over-the-Counter (OTC) desks has surged to a two-year excessive.

Analyst ‘Ego Hash’ reported that these balances, which characterize the quantity of Bitcoin that miners promote on to patrons by means of OTC offers, have elevated by greater than 70% over the previous three months.

Particularly, OTC desk balances have risen from 215,000 BTC in June to 368,000 BTC in August, a rise of 153,000 BTC.

This stage of OTC exercise has not been seen since June 2022. The rise in OTC desk balances is usually related to elevated promoting strain from miners, which traditionally correlates with subsequent declines in Bitcoin’s worth.

Regardless of the potential bearish implications of the rising OTC desk balances, a number of analysts and specialists within the cryptocurrency house stay optimistic about Bitcoin’s prospects.

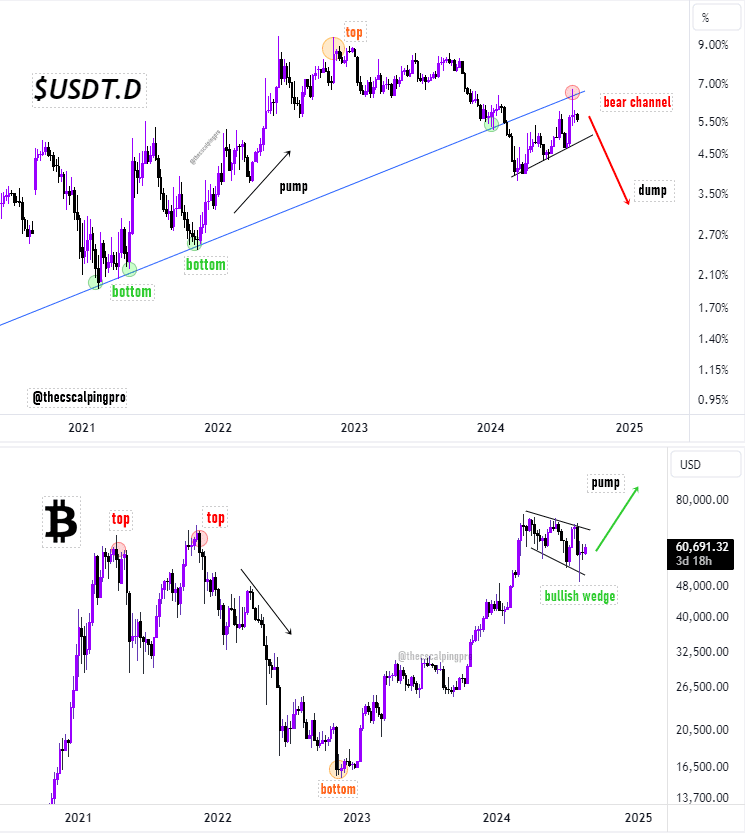

As an illustration, a distinguished crypto analyst often known as Mags earlier at this time shared a bullish outlook on X, suggesting that Bitcoin may very well be on the verge of a major worth improve.

Mags pointed to the inverse correlation between the dominance of Tether (USDT.D) and Bitcoin (BTC), noting {that a} latest breakdown in USDT.D’s trendline help might result in a bullish continuation sample for Bitcoin.

In keeping with Mags, if this state of affairs performs out, Bitcoin might probably surge to $72,000 and even greater within the close to future.

Prepared for the elevate off?

Nonetheless, past these bullish predictions, comes Bitcoin’s complicated underlying fundamentals which if assessed can be utilized to achieve a extra complete understanding of the market’s present state.

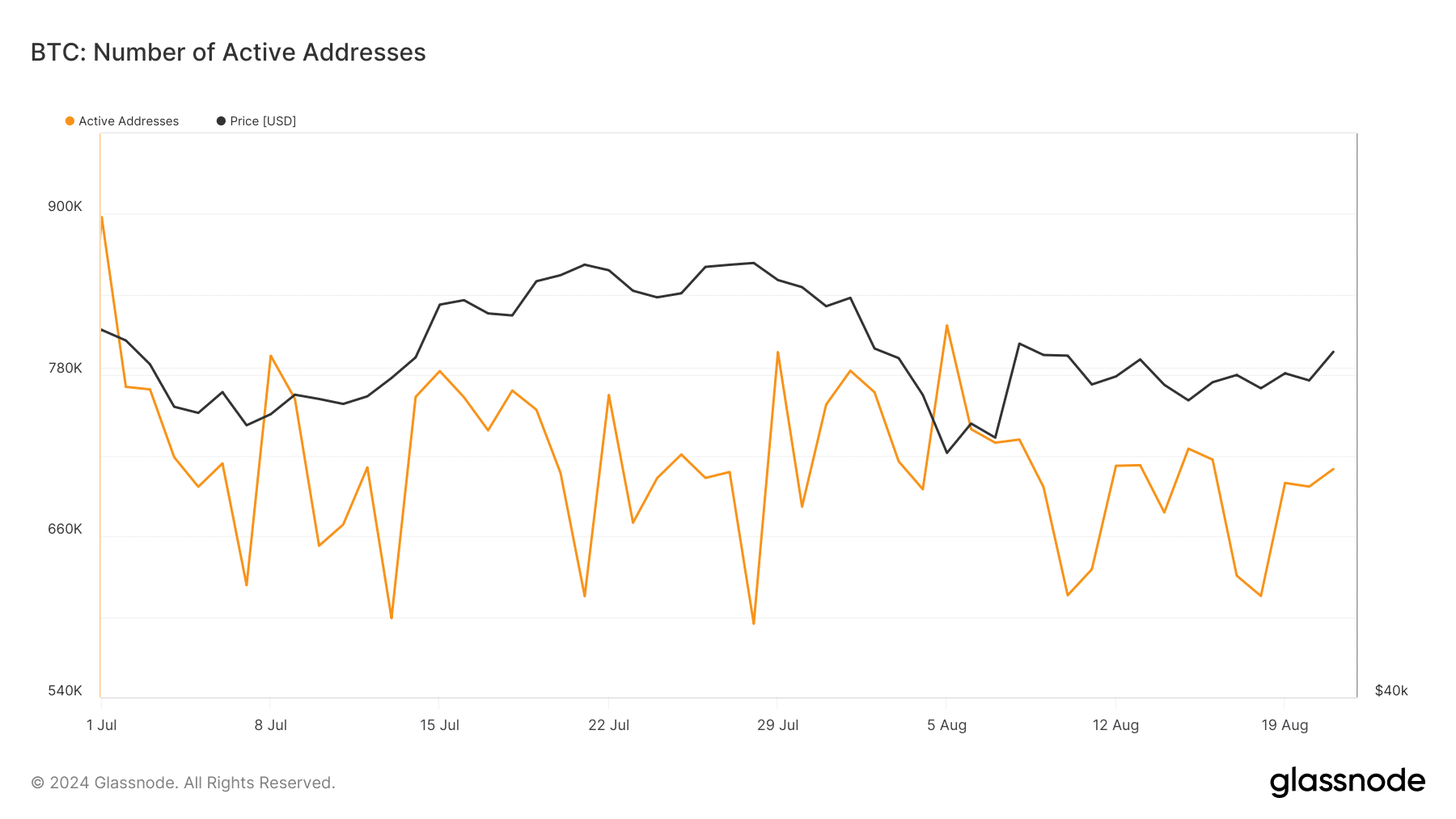

Information from Glassnode reveals that Bitcoin’s variety of energetic addresses, a key indicator of community exercise, skilled a major decline over the previous month.

The variety of energetic addresses dropped from practically 900,000 on July 1 to a low of 594,000 on July 24. Nonetheless, there was a latest rebound, with energetic addresses rising to over 700,000 as of at this time.

This restoration in community exercise means that consumer engagement with Bitcoin is starting to select up once more after a interval of decline.

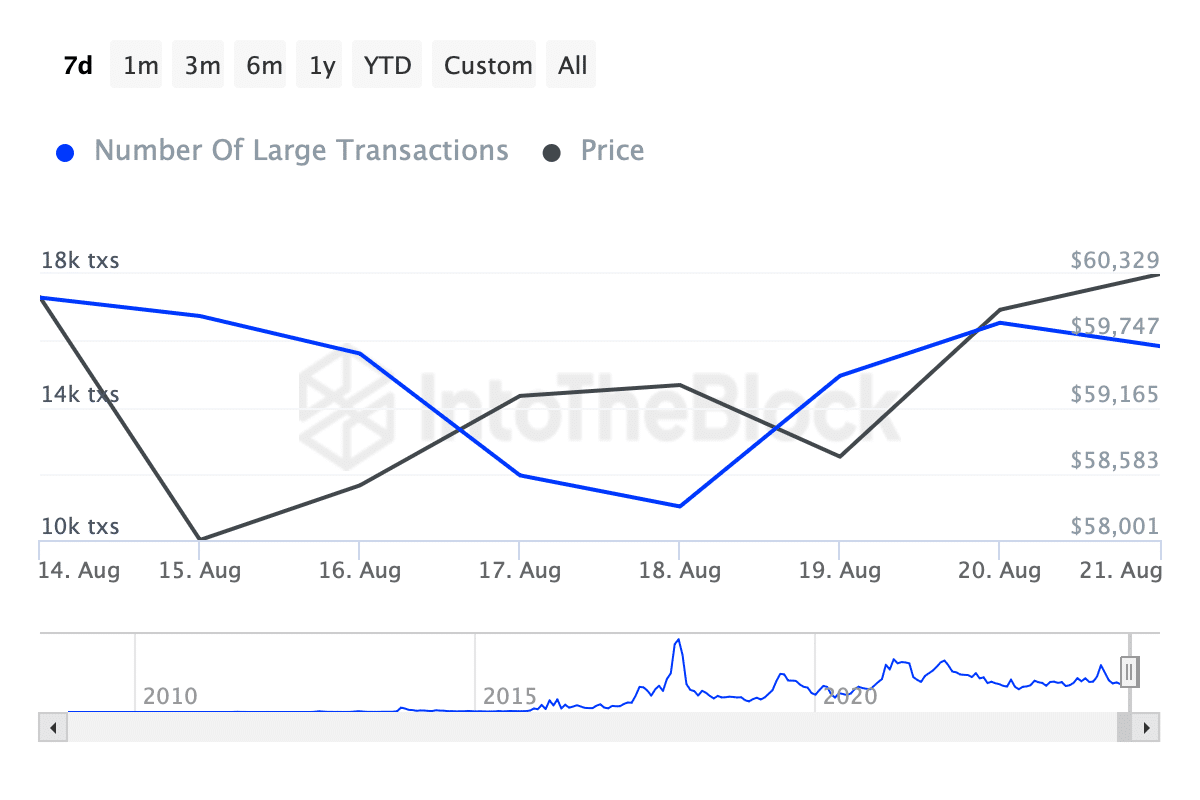

Along with community exercise, whale transactions—outlined as Bitcoin transactions larger than $100,000—have additionally seen some fluctuations.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

In keeping with knowledge from IntoTheBlock, the variety of these giant transactions has decreased barely over the previous week, dropping from over 17,000 to simply under 16,000.

Whereas this decline might point out some warning amongst giant traders, it’s not essentially a trigger for concern, as the general market sentiment stays cautiously optimistic.