Picture supply: Getty Photos

British buyers love FTSE 100 exchange-traded funds (ETFs). And that is comprehensible because the Footsie’s the UK’s fundamental inventory market index.

It may possibly pay to take a look at different ETFs although. Right here’s a product that’s delivered far increased returns than FTSE 100 tracker funds during the last decade.

Unimaginable long-term returns

The product in focus at the moment is the iShares NASDAQ 100 UCITS ETF (LSE: CNDX). That is an ETF that tracks the tech-focused Nasdaq 100 index.

Over the 10-year interval to the top of July, this fund returned 424.52% (in US greenback phrases). That compares to a return of 80.65% (in GBP phrases) for the iShares Core FTSE 100 UCITS ETF (Acc), which tracks the FTSE 100 index and contains all dividends.

It signifies that, ignoring foreign money actions, the Nasdaq 100 ETF generated roughly 5.3 instances the return from the FTSE 100 ETF.

When foreign money actions (the weak pound) are factored in, it delivered round seven instances the return of the Footsie product (ie that is the return UK buyers would have gotten).

Word that I’m ignoring all buying and selling commissions and platform charges right here.

The world’s finest tech firms

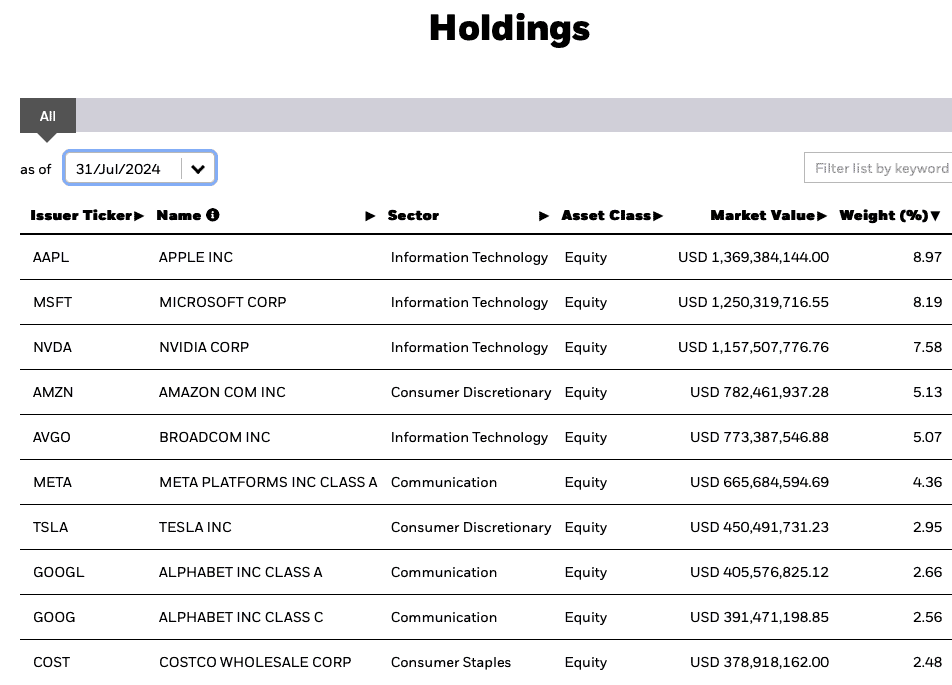

How has this index managed to generate such spectacular returns? Nicely, it comes right down to the truth that the Nasdaq 100 is residence to dominant tech firms like Apple, Microsoft, Amazon, and Nvidia, that are all rising quickly because the world turns into extra digital.

Supply: iShares

The FTSE 100, against this, is residence to quite a lot of lower-growth companies akin to BP, Shell, Unilever, and British American Tobacco. And a few of these are going through structural challenges (ie the shift to renewable power for the oil majors).

Count on volatility with this ETF

Now, I don’t personal the iShares NASDAQ 100 UCITS ETF. That’s as a result of I personal shares in quite a lot of the highest holdings straight (I’ve giant positions in Apple, Microsoft, Nvidia, Amazon, and Alphabet).

And this has labored effectively for me. I’m up 502% with Nvidia, for instance.

But when I used to be seeking to construct a effectively diversified long-term portfolio from scratch at the moment, I’d undoubtedly take into account this ETF.

It’s not a product I’d go ‘all in’ on. This is because of the truth that the Nasdaq 100 (and the underlying know-how shares) will be very risky at instances. In 2022, as an illustration, this ETF fell a whopping 32.7% (in US greenback phrases), versus a return of +4.6% (in GBP phrases) for the FTSE 100 product. That’s a nasty fall.

However I feel it may play a useful position as a part of a diversified portfolio. For instance, if I had a worldwide fairness tracker fund such because the iShares Core MSCI World UCITS ETF as a core holding, this may very well be a pleasant addition for a bit of additional zip.

I’d count on this a part of my portfolio to be risky. However in the long term, I feel it ought to do effectively for me. In spite of everything, the world’s solely going to grow to be extra digital within the years forward.