- BTC’s open curiosity additionally dropped by 3% within the final 24 hours, reflecting decrease curiosity or concern amongst buyers.

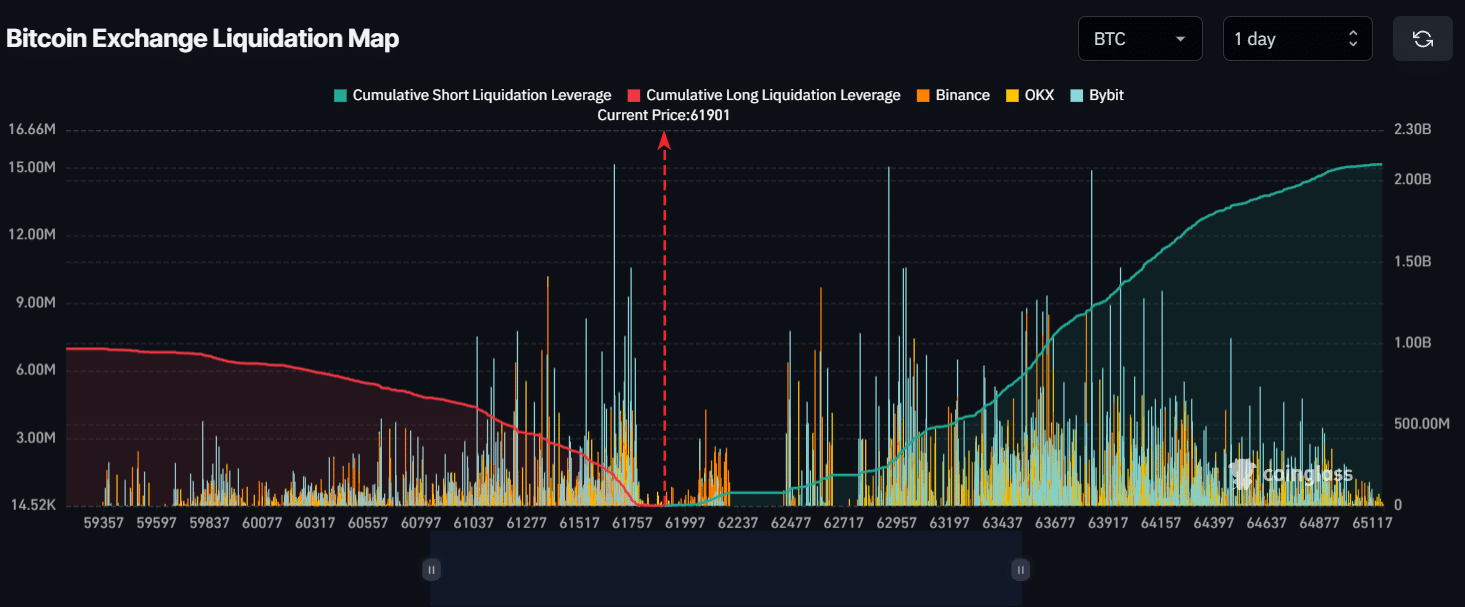

- If BTC worth falls to $61,670, almost $192 million of lengthy positions will likely be liquidated.

Binance, the world’s largest cryptocurrency change, was discovered to have made some inner changes on twenty seventh August.

In line with a report, the Binance Bitcoin Chilly pockets which holds 75,177 Bitcoin [BTC], transferred a big 30,000 BTC to its sizzling pockets and the remaining 45,177 BTC to a different pockets tackle “3PXB”.

Binance transfers 75,177 BTC

As of press time, Binance has not disclosed the rationale behind this notable BTC switch. Nevertheless, this switch occurred following the continuing cash laundering controversy replace in Nigeria towards Binance and its government.

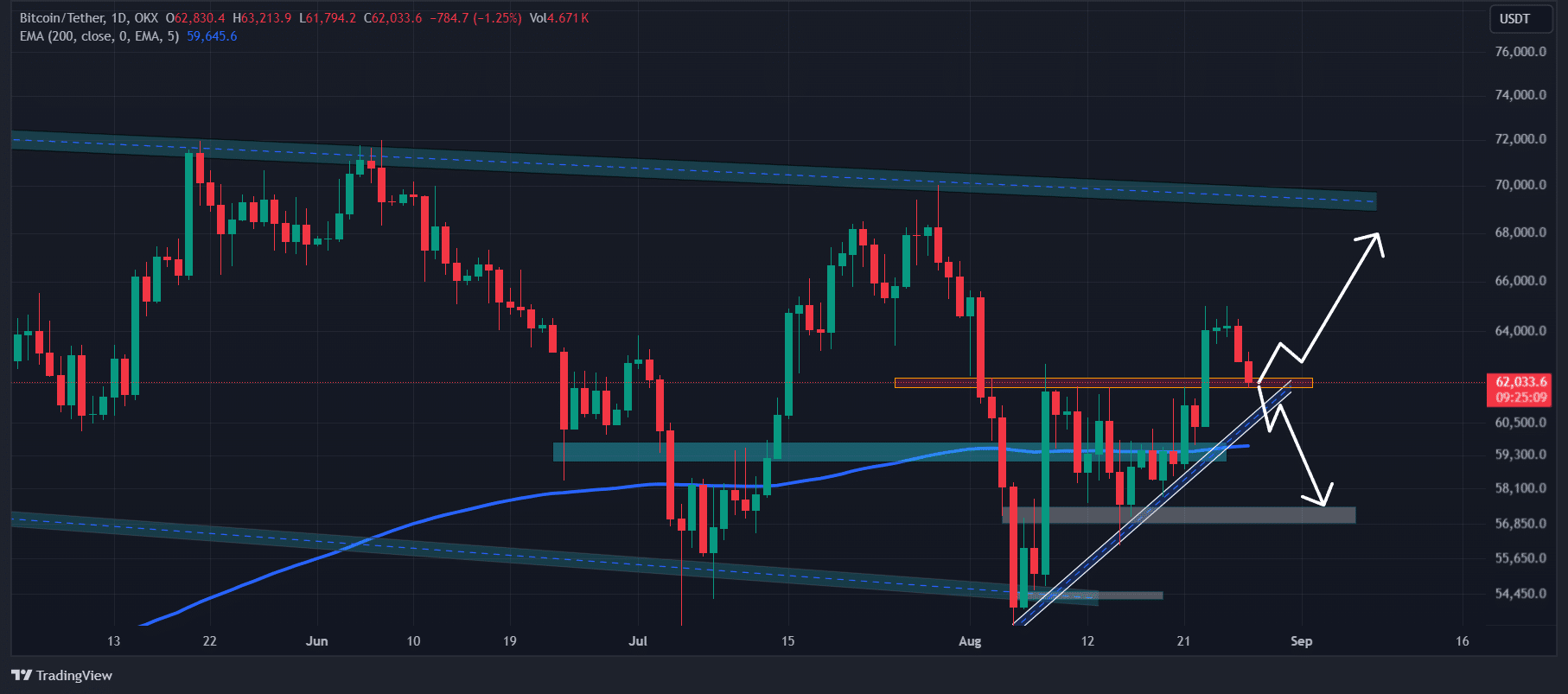

With these vital BTC transactions, skilled technical evaluation signifies a bearish outlook for Bitcoin. Presently, BTC is in an uptrend because it maintains itself above the 200 Exponential Shifting Common (EMA) on a every day timeframe.

In addition to this uptrend, it’s presently there at an important breakout stage of $61,850 stage, which it beforehand broke following the speed reduce announcement.

Based mostly on the worth motion and historic worth momentum, if BTC experiences a worth reversal from this important stage, there’s a excessive risk of a big worth rally to the $68,000 stage within the coming days.

Conversely, if BTC continues to fall, we might even see a serious crash within the coming days.

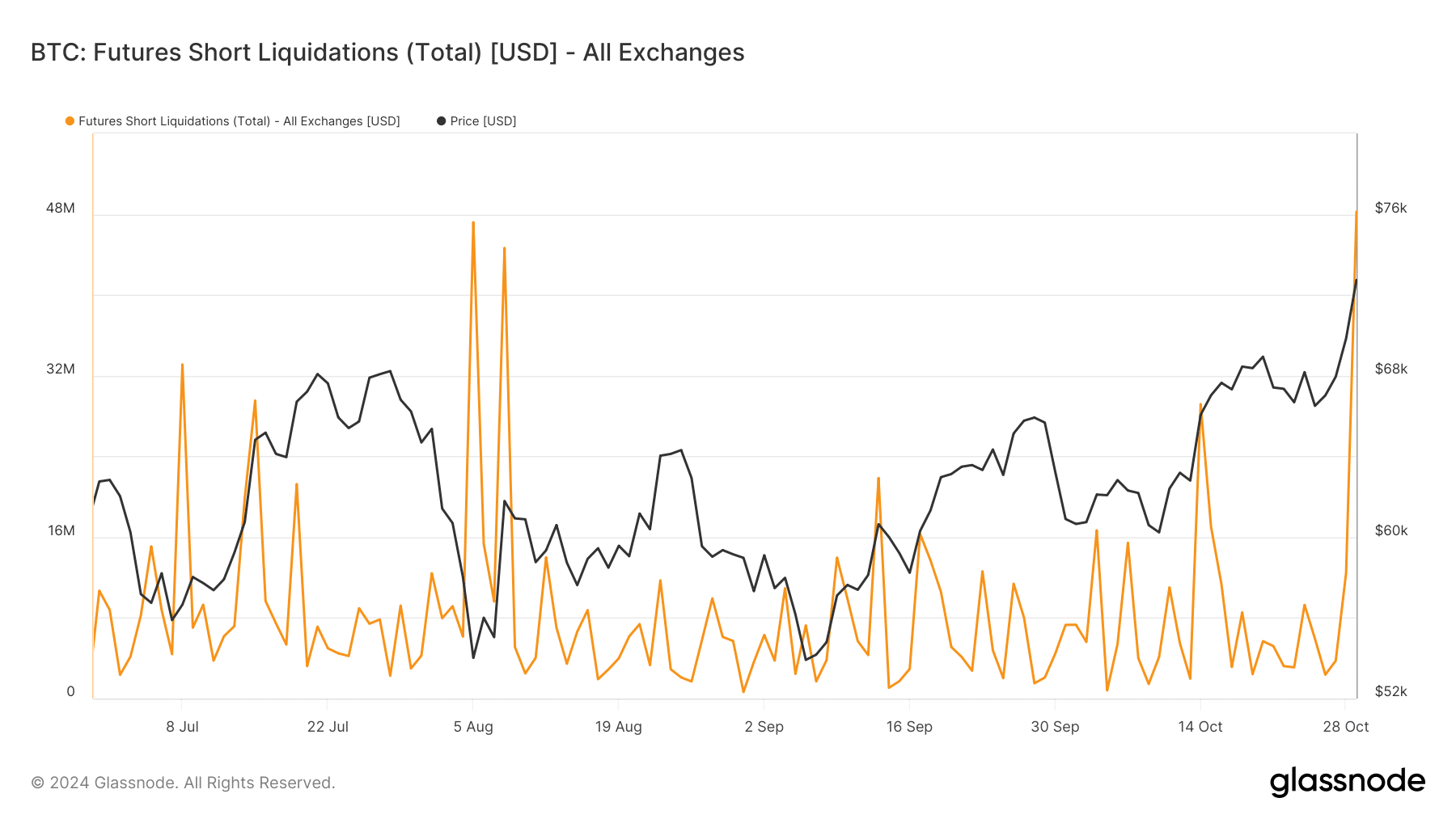

At press time, BTC was buying and selling close to the $61,900 stage and has skilled a worth decline of over 2.6% within the final 24 hours. In the meantime, its buying and selling quantity has elevated by 33% throughout the identical interval, indicating greater participation from merchants amid the latest worth decline.

Moreover, BTC’s open curiosity additionally dropped by 3% within the final 24 hours, reflecting decrease curiosity or concern amongst buyers concerning the continuing worth drop.

Main liquidation ranges

Presently, the foremost liquidation ranges are close to $61,670 on the decrease facet and $63,900 stage on the higher facet, as merchants are over-leveraged at these ranges, in response to the on-chain analytic agency CoinGlass.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

If the sentiment stays bearish and the worth falls to $61,670, almost $192 million of lengthy positions will likely be liquidated.

Conversely, if sentiment shifts and the worth rises to the $63,900 stage, almost $271 million value of quick positions will likely be liquidated.