Picture supply: Getty Pictures

Most of my Shares and Shares ISA portfolio’s made up of high quality development shares and regular dividend-payers. Nevertheless, I do reserve a small a part of it (not more than 5%) for a handful of ‘moonshot’ shares.

These are pioneering corporations that aren’t earning profits at present, however could nicely do in future. After all, this strategy is inherently dangerous, which is why it’s a small (however enjoyable) a part of my total technique.

Right here’s why my largest moonshot place at present is Joby Aviation (NYSE: JOBY).

The Uber of the skies

Think about gliding effortlessly in close to silence above traffic-congested cityscapes earlier than arriving in Leeds from Manchester Airport. A journey that might normally have taken 90 minutes by street has taken simply quarter-hour by air — and it was a zero-emission journey!

Toyota-backed Joby Aviation’s main the cost to make this a actuality. Its electrical flying taxi — identified formally as electrical vertical takeoff and touchdown (eVTOL) plane — can carry 4 passengers and a pilot.

It hopes to start out business operations by the top of 2025. For shoppers, it will be just like ordering an Uber, which is why Joby has been dubbed the ‘Uber of the skies’.

Certainly, the ride-hailing large offered its eVTOL division (Uber Elevate) to the agency in 2020 and have become a major shareholder. There are plans to finally combine air taxis into the Uber app.

Offers

Delta Air Traces additionally has a big stake in Joby, with whom it plans to launch an air taxi service working between Manhattan and JFK Airport. Every flight will reportedly take round seven minutes in comparison with 50-75 minutes by automobile.

The goal is for higher-end Uber Black pricing earlier than transferring to common taxi pricing over time.

In February, the corporate signed a deal to function air taxis completely in Dubai for six years, beginning as early as 2026. It is going to additionally introduce its plane in Saudi Arabia by way of direct gross sales.

Within the UK, it’s utilized to the Civil Aviation Authority, with plans to hyperlink cities akin to Liverpool, Manchester and Leeds.

Dangers

As thrilling as all this sounds, eVTOLs first want regulatory approval. And that is the large threat right here. The corporate may not in the end get regulatory approval or there could also be important delays.

Furthermore, there may be competitors within the area, notably from Archer Aviation (backed by United Airways and Stellantis).

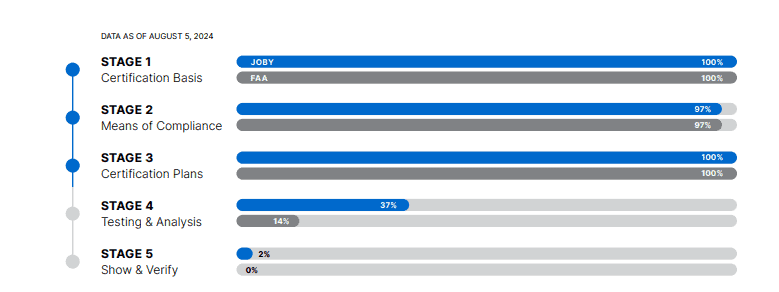

Nevertheless, Joby was the primary firm to finish the primary, second and third of 5 phases of the certification course of wanted for business service. As of 5 August, 37% of the fourth stage was accomplished on the Joby facet.

It misplaced $123m in Q2, but additionally had no debt and money of $825m. This could comfortably be sufficient to fund a business launch. However to develop past the 4 plane at present in flight testing, the corporate will nearly definitely want further capital.

A possible $1trn market

Down 52% since itemizing in late 2020, the inventory’s at present $5. This provides a market-cap of $3.6bn.

In future, eVTOLs might develop into a brand new type of mass transportation on account of being quicker and greener. They could change helicopters and even disrupt prepare companies.

Morgan Stanley estimates that this city air mobility market might attain $1trn by 2040! That’s why it’s my dangerous moonshot.