- U.S inflation was regular in July, elevating Fed charge reduce odds

- Nonetheless, BTC’s value remained subdued and will keep range-bound

U.S inflation continues to be regular, reinforcing market expectations of a possible Fed charge reduce in September. This charge reduce is predicted to assist enhance Bitcoin [BTC] and different threat property. In response to the U.S Bureau of Financial Evaluation (BEA), the July Core PCE (Private Consumption Expenditure) Value Index got here in at 2.5% on a yearly foundation.

The PCE Value Index hiked by 0.2% final month, much like June’s studying, and matched analysts’ estimates. The info measures value modifications for items and companies, excluding meals and power, and is the Fed’s favourite variable for monitoring inflation and making financial coverage choices.

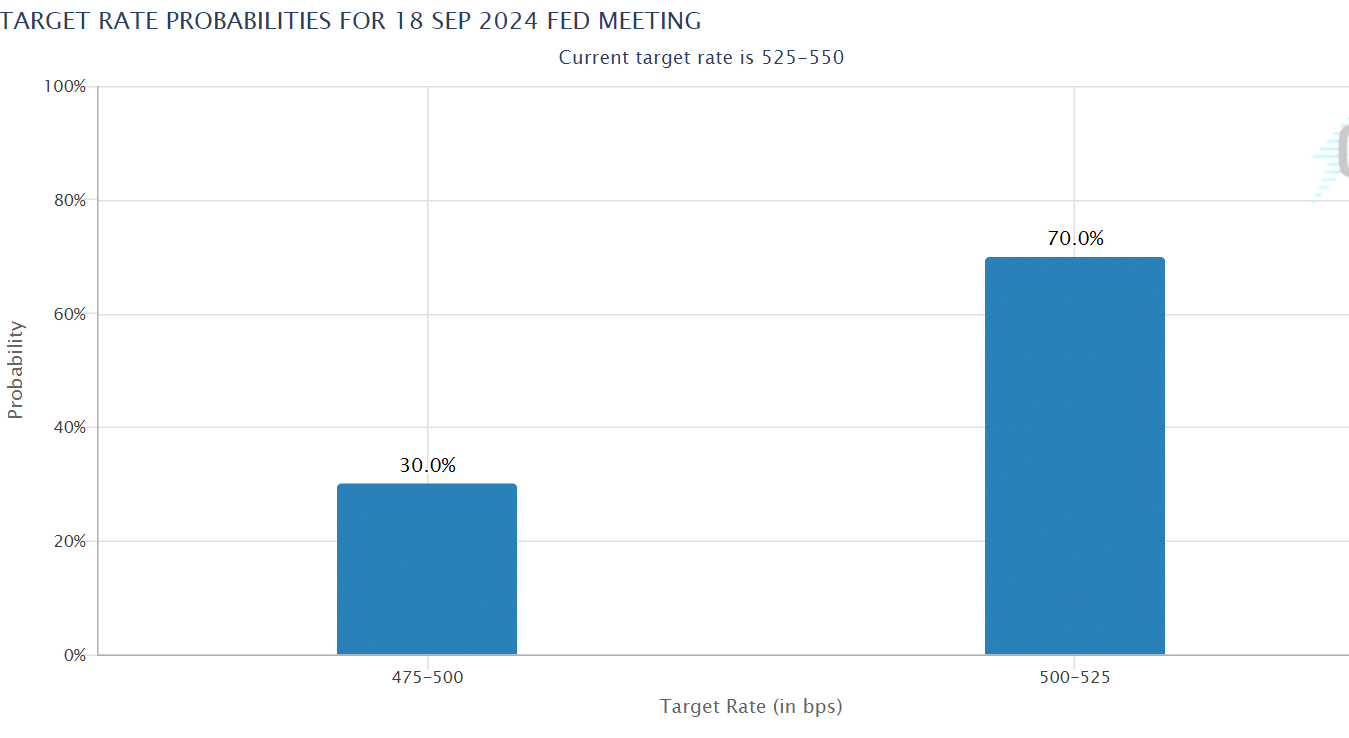

September Fed charge cuts soar to 70%

That being mentioned, the regular July inflation knowledge strengthened the market’s conviction of a possible 25 foundation level (bps) Fed charge reduce in September. In response to the CME FedWatch device, curiosity merchants are actually pricing odds of 70% on a September charge reduce.

That may translate to a 4% soar from the 66% odds seen earlier than the July inflation knowledge was launched. In the meantime, some merchants have been pricing a 30% likelihood for a 50 bps charge reduce throughout subsequent month’s Fed assembly.

Bitcoin’s value stays muted

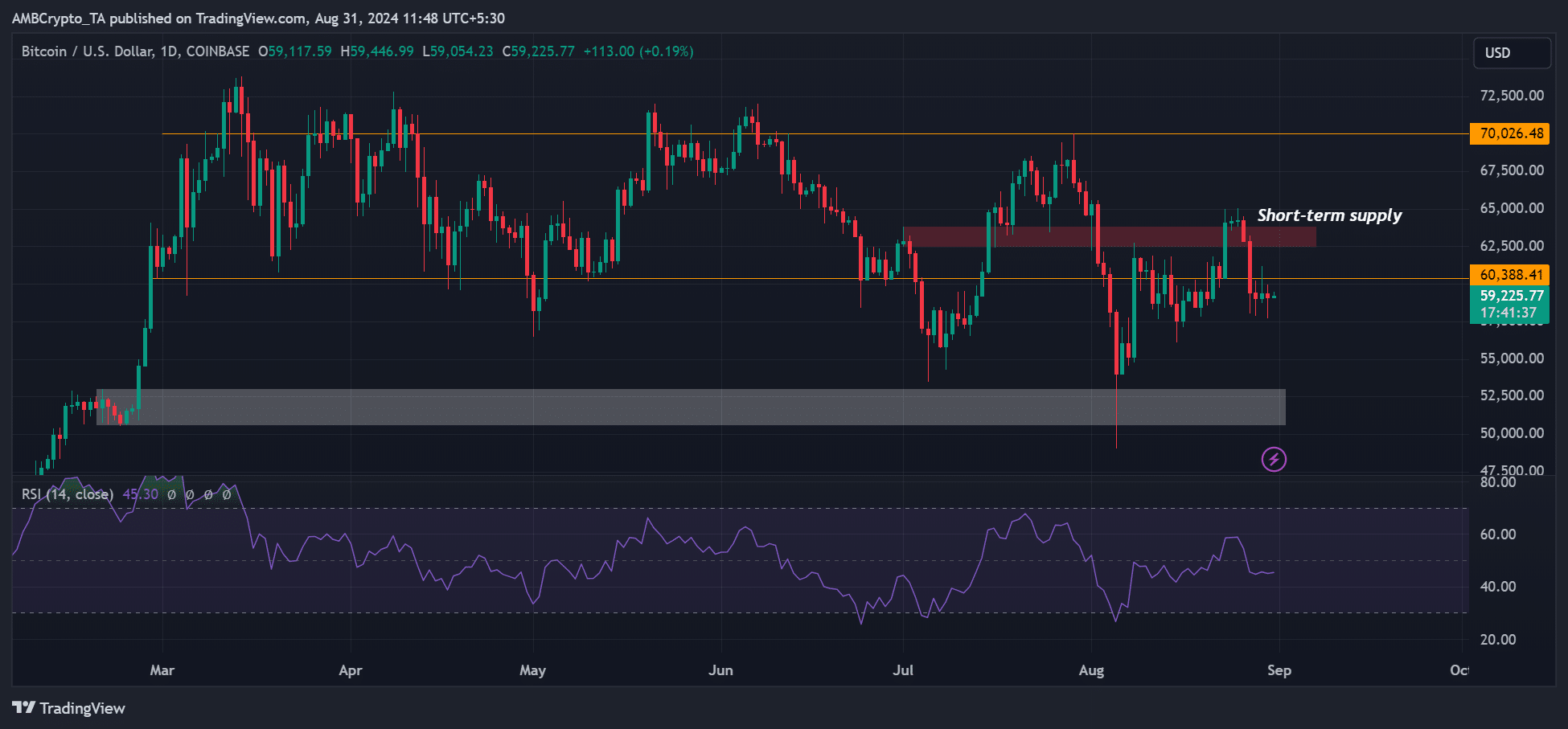

The info tipped U.S equities to edge increased whereas BTC and the crypto markets tanked and consolidated. BTC moved barely to $59.9k, earlier than dropping to $57k on Friday after the inflation knowledge was first launched.

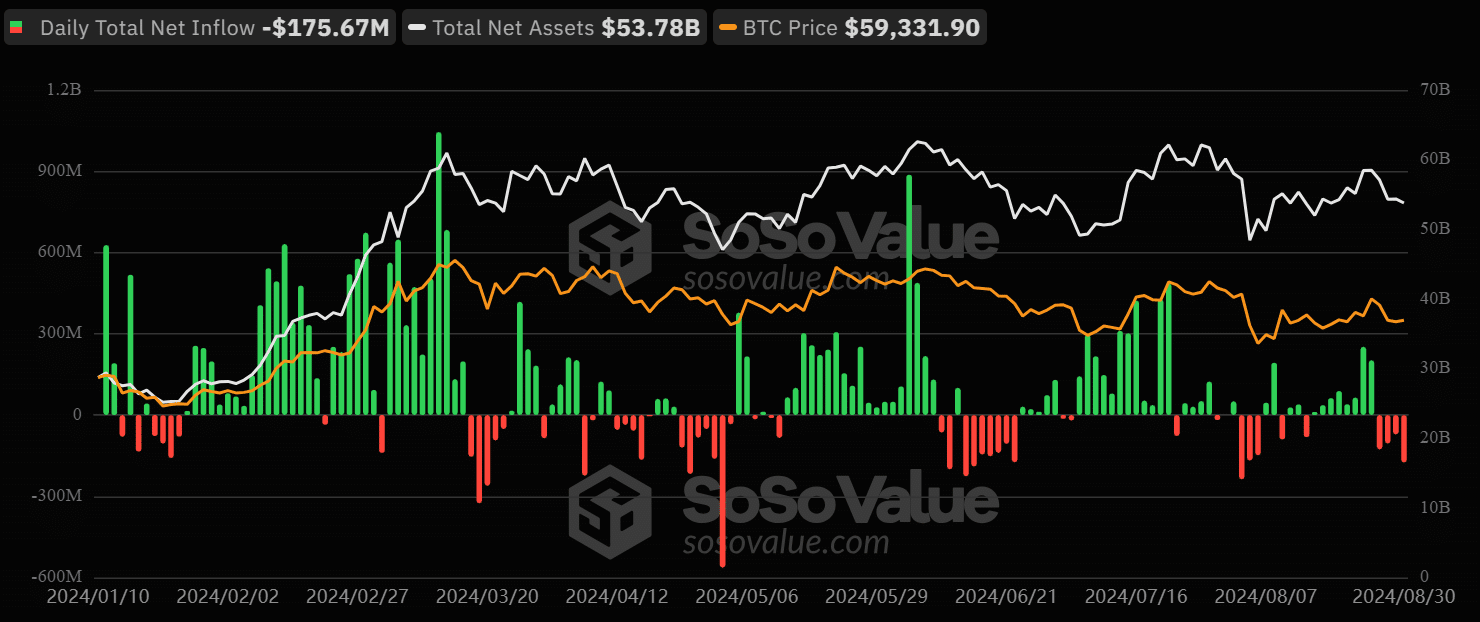

On the time of writing, the cryptocurrency was buying and selling at $59.2k, marking the fourth day it has remained beneath $60k. The weak sentiment and risk-off buyers’ method was additionally evident throughout U.S spot BTC ETFs.

Since Tuesday, the merchandise have recorded web outflows of $277 million, illustrating that the regular July inflation wasn’t sufficient to interrupt the weak development.

Nonetheless, crypto buying and selling agency QCP Capital famous {that a} presumably weaker U.S jobs report subsequent week may affirm a ‘strong case’ for a Fed charge reduce in September. Within the meantime, the buying and selling agency projected that BTC may stay range-bound.

“With the recent macro news proving to have little effect on the crypto market, we believe BTC is likely to remain range-bound within 58k-65k in the short term as the market awaits positive catalysts to break out of this range.”