Picture supply: Getty Photographs

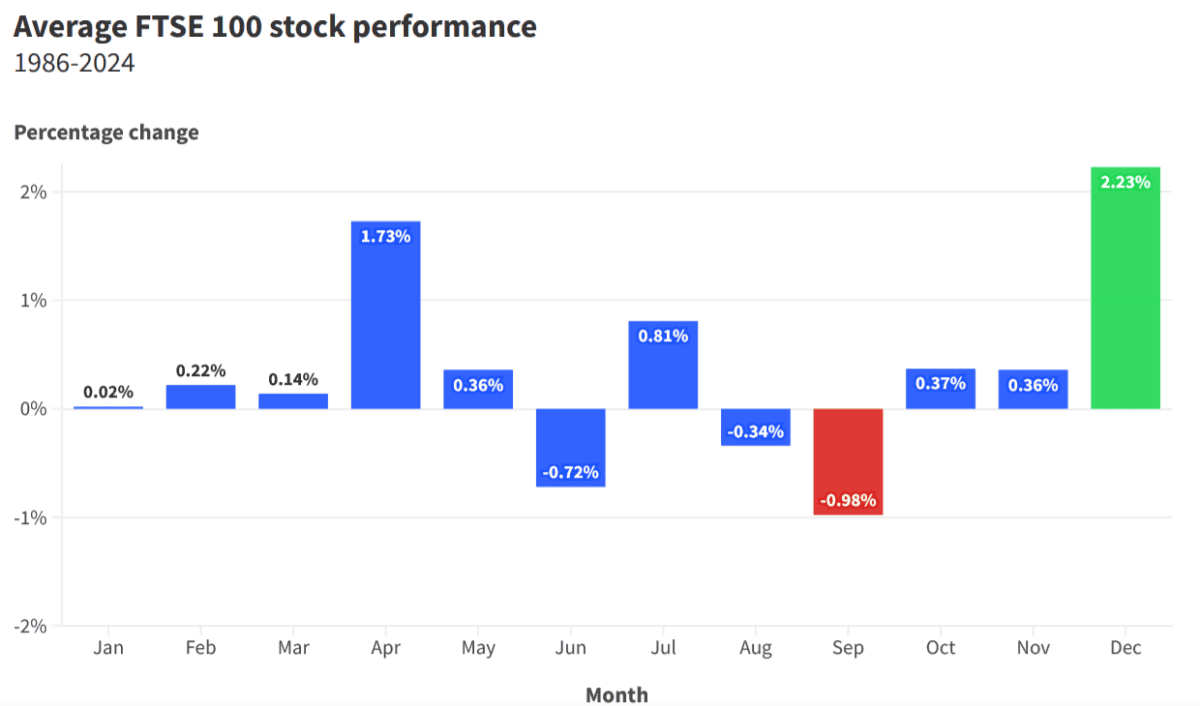

The omens aren’t good for traders who need to make massive beneficial properties in September. Information exhibits that the ninth month of the 12 months is definitely the worst for UK share costs.

In line with Finder.com, the FTSE 100 has fallen, on common, 1% every September going all the way in which again to the mid-Nineteen Eighties.

To be honest, different main worldwide indexes have additionally traditionally recorded their worst performances in September. The Euro Stoxx 50 has dropped 2.13% on common, whereas the S&P 500 and Nikkei 225 have reversed 0.88% and 0.83%, respectively.

So what ought to I do now?

What’s taking place?

Firstly, it’s value contemplating why indexes just like the Footsie fall throughout the first month of autumn.

Worth comparability skilled Finder has a number of theories. These embody:

- Institutional elements, like traders promoting near the top of the third quarter

- Funds exiting much less profitable investments earlier than the quarter finishes

- Buyers who’re coming back from summer season holidays taking income and offsetting beneficial properties with losses earlier than the top of the 12 months

- Unfavorable market expectations for September prompting promoting as a part of a ‘self-fulfilling prophecy’

What subsequent?

So the ‘September effect’ is probably going a market irregularity, then, slightly than a sound motive to promote up and head for hills.

As somebody who invests for the lengthy haul — I intention to carry the shares I purchase for no less than 5 years — I’m not nervous on the prospect of one other poor September. I’m assured that the shares I purchase will steadily acquire in worth over a chronic interval.

In actual fact, I’ll be doing the other of many traders this month. I’ll be in search of oversold bargains so as to add to my portfolio. This manner, I’ve an opportunity of creating higher capital beneficial properties by shopping for in even decrease than I might anticipate to in any other case due to September’s market anomaly.

A high dip purchase

One share I’m already taking a look at in the present day is Hochschild Mining (LSE:HOC).

The valuable metals miner has endured a poor begin to September, and now seems prefer it might be too low cost to overlook. It trades on a ahead price-to-earnings (P/E) ratio of 8.2 occasions.

Hochschild’s fall isn’t mainly all the way down to this month’s historic calm down, nevertheless. It extra doubtless displays a fall in gold and silver costs because the US greenback has risen. An appreciating buck makes it much less cost-effective to purchase and maintain dollar-denominated belongings.

Mining corporations are naturally weak to volatility on commodity markets. The excellent news for gold producers, nevertheless, is that the yellow metallic might get well strongly within the weeks and months forward.

Costs touched new report peaks above $2,500 per ounce final month, pushed by worries over financial development, battle in Europe and the Center East, and expectations of upper inflation as central banks reduce charges.

So I’d anticipate Hochschild shares to additionally rebound as metallic costs enhance. But I wouldn’t simply purchase the miner to capitalise on this. I believe it might be an ideal share to personal for the lengthy haul to handle threat in my portfolio.

And at present costs, it might be a really cost-effective approach for me to take action.