- Bitcoin pattern power prophesy fulfilled.

- Bitcoin volatility dwindling as p.c in revenue reduces.

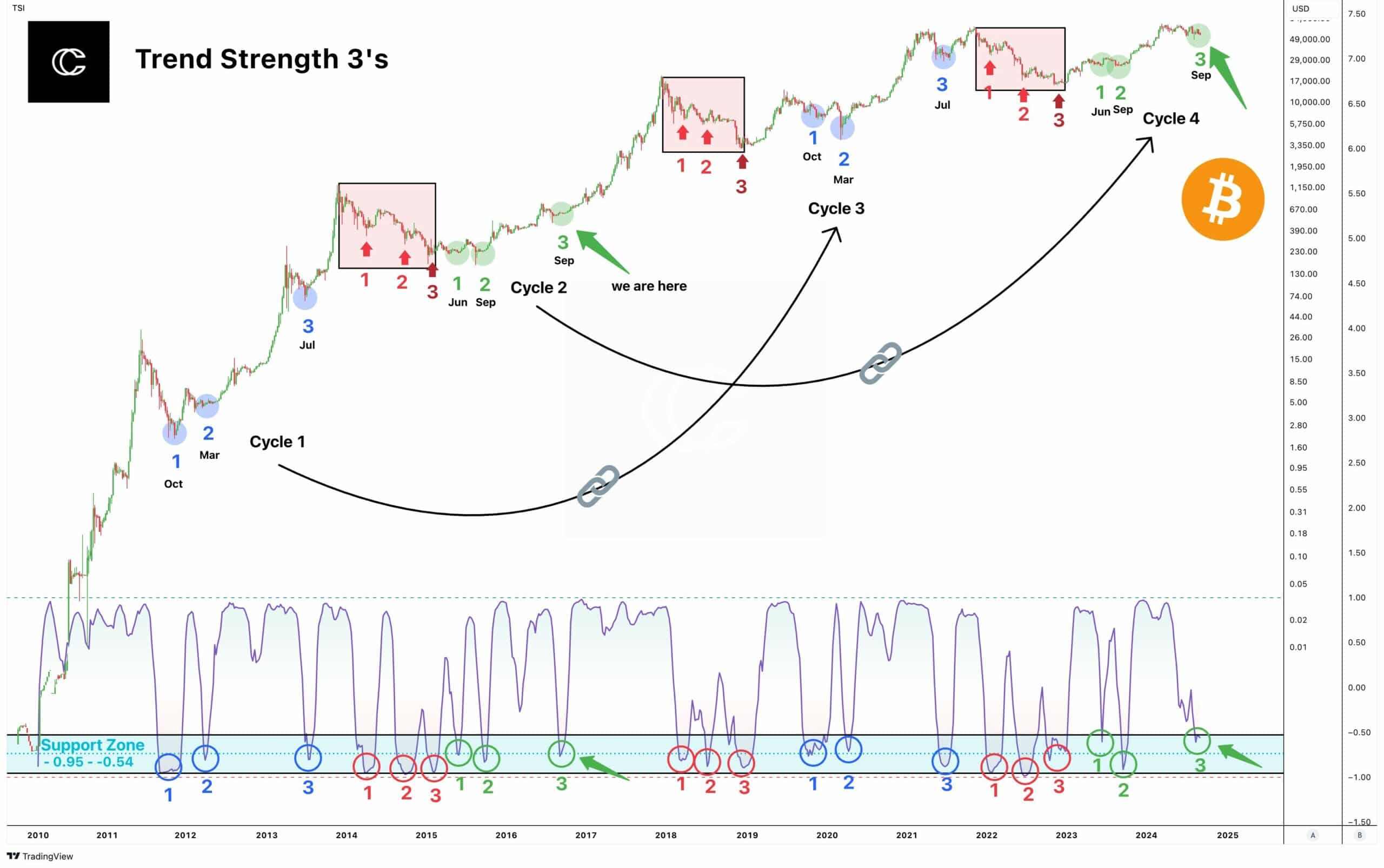

Bitcoin [BTC] has as soon as once more demonstrated its cyclical nature, with the Bitcoin Pattern Energy Prophecy being fulfilled.

In 2016, Bitcoin’s worth dipped into the assist zone in September, and the identical sample has emerged in 2024.

All through these alternating cycles, the market’s motion has remained constant. This sample of three dips into the assist zone throughout the identical cycle has traditionally led to a worth transfer larger.

As in earlier years, the present cycle may imply that Bitcoin’s worth could possibly be organising for an additional surge on the charts.

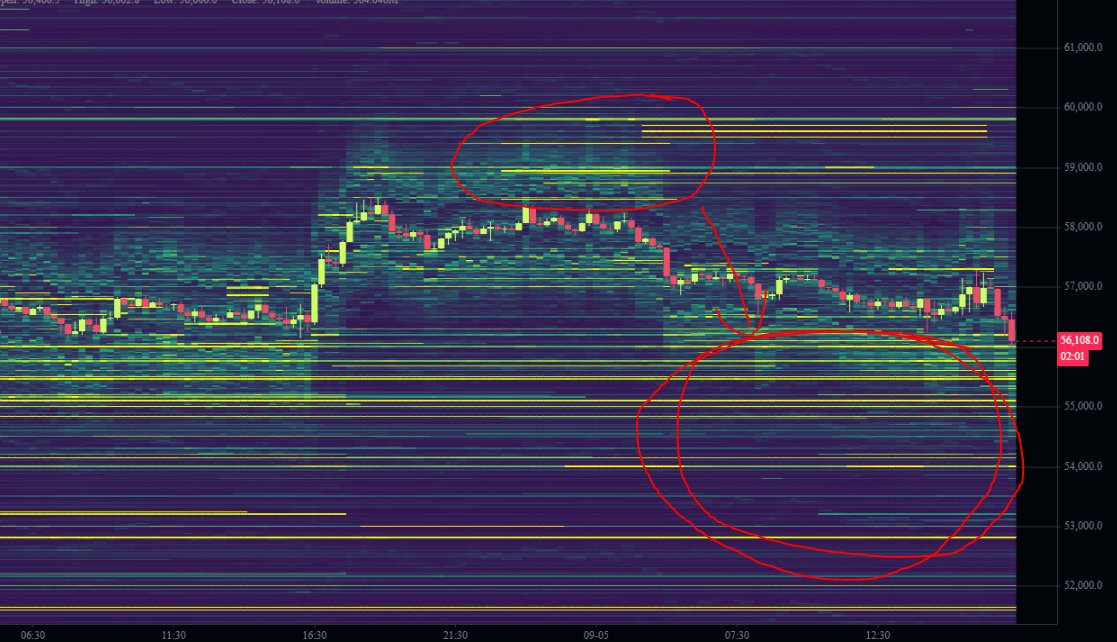

On the time of writing, Bitcoin was buying and selling at a key assist stage across the $56k worth vary, with a powerful resistance stage at $65k. This newly-formed assist stage may both set off a bounce or lead to additional decline.

If Bitcoin fails to carry above $56k, it might proceed to go south and retest $49k earlier than making any substantial restoration. Nevertheless, holding this stage may sign a transfer larger for BTC within the coming weeks.

Liquidity ranges

By way of liquidity, promote orders have pushed Bitcoin’s worth down, permitting purchase orders to be crammed. There are quite a few bids resting under the $59k-level, and this has been the case for the previous six months.

Curiously, the value has remained flat regardless of vital whale exercise, as massive holders pushed costs decrease to build up extra BTC.

Right here, it’s value stating that Binance’s order books revealed a method of filling bids at these ranges earlier than the value rises once more.

Bitcoin’s volatility is dwindling

One other issue influencing Bitcoin’s trajectory is its volatility. With BTC now buying and selling at round $56k, it’s considerably much less unstable than in 2021 — Round 4 to six instances much less unstable, in actual fact.

The $60,000-level, as soon as thought-about a speculative prime, has now turn out to be a consolidation zone the place long-term holders accumulate Bitcoin.

Because of this $60,000 is now the brand new flooring, an important worth level that Bitcoin may not revisit for a while as new assist ranges are established.

Worry and greed index

Market sentiment, at press time, additionally appeared to reflect the worry seen on the backside in 2022. The pervasive worry available in the market has many buyers on the sidelines, however this might sign a possibility for a reversal.

With institutional adoption growing and extra initiatives constructing on Bitcoin’s community, this present downturn may signify a major shopping for alternative.

The truth is, historical past has proven that such worry can typically precede main upward strikes in worth.

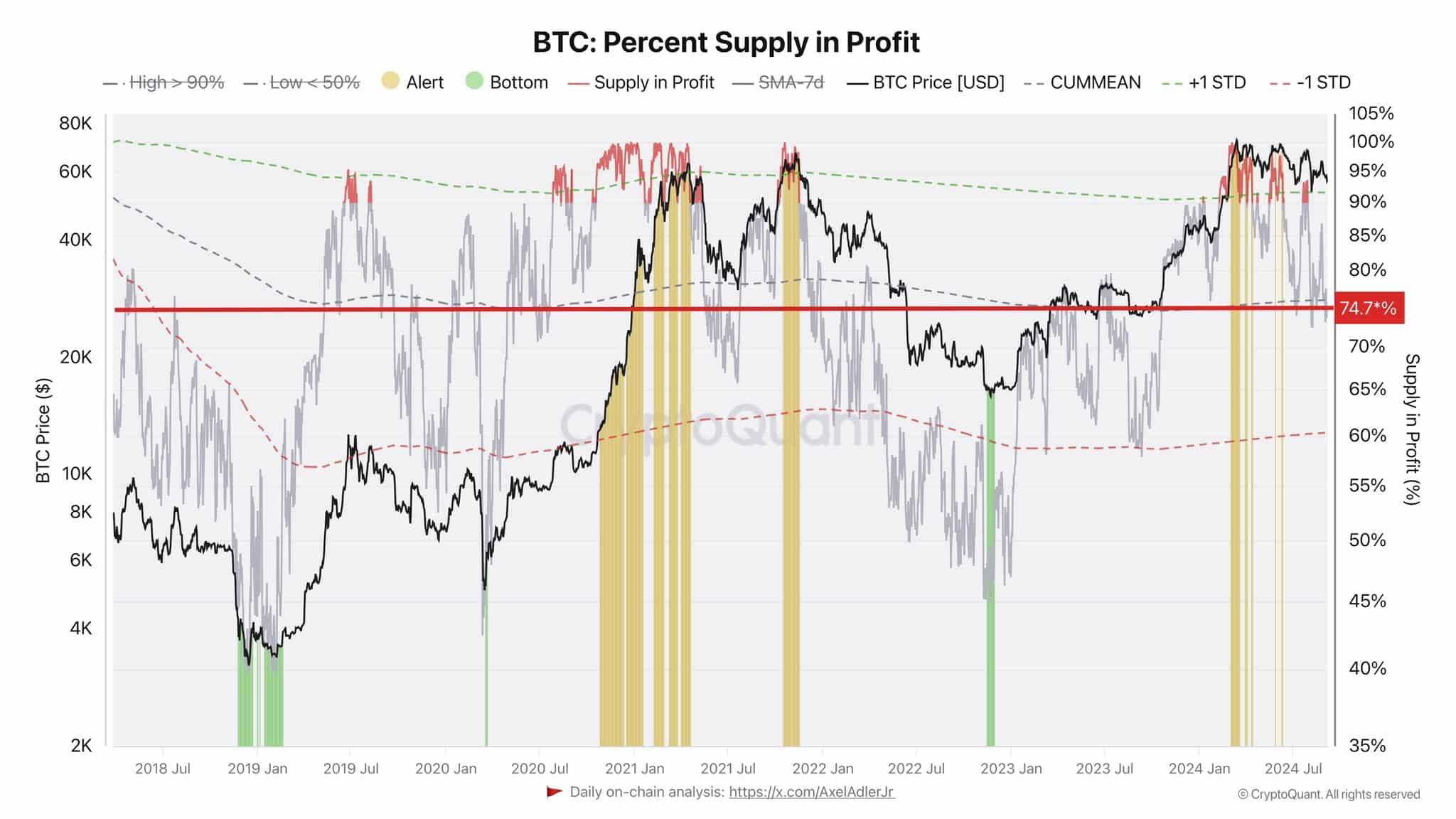

Proportion provide in revenue

Regardless of the uncertainty, nonetheless, the share of Bitcoin provide in revenue has dropped by 25%, which means fewer buyers are making good points. Roughly 4,938,183 BTC are at the moment held at a revenue, valued at round $280 billion.

This fall in worthwhile positions means that now is perhaps the time for long-term holders to HODL. Particularly because the market could possibly be poised for a restoration and better BTC costs within the close to future.