- Bitcoin declined by 8.42% on the weekly charts, fueling a hike in bearish market sentiment

- Accumulation development rating nearing 0 may have implications for the cryptocurrency

Over the previous few months, Bitcoin has seen some excessive volatility on the value charts. Whereas 2024 has seen BTC hit a report excessive of $73k and higher market favourability because the launch of ETFs, it has additionally seen increased volatility.

On the time of writing, BTC was buying and selling at $54,239 after an 8.42% decline over the previous week.

And but, it’s nonetheless displaying some indicators of life with a current hike in buying and selling quantity. In truth, figures for a similar surged by 63.13% to $48.6 billion during the last 24 hours. What does this imply for BTC’s market outlook over the brief and long run although? Can Bitcoin totally recuperate now?

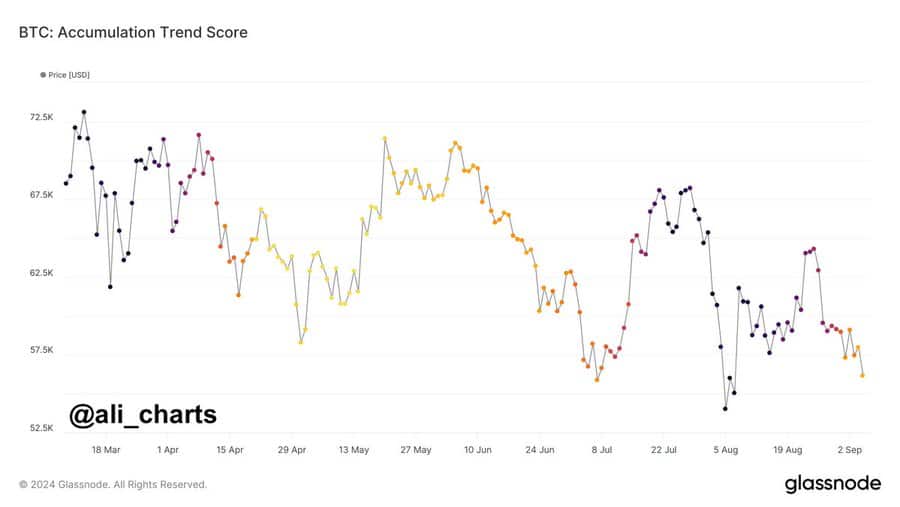

Properly, in line with in style crypto analyst Ali Martinez’s suggestion, BTC could also be seeing diminished participation. He made this assertion by citing the declining accumulation development rating.

Market sentiment evaluation

In accordance with Martinez, the buildup development rating is nearing 0 proper now. Because of this market members are both distributing or not accumulating BTC.

In context, the buildup development rating displays the relative measurement of entities which are actively accumulating cash on-chain by way of BTC holdings. A price near 1 means that members are accumulating cash. A price nearer to 0 signifies members are distributing their holdings.

Thus, when the buildup development rating flashes 0, it suggests no patrons from any cohort and implies distribution. Each time BTC hits a low in a bear cycle, it sees a hike in accumulation as traders purchase the dip. Nevertheless, after the bear market cycle persists, a scarcity of accumulation happens as they lack confidence within the cycle.

Primarily based on this evaluation, the buildup rating is nearing 0 from the tip of August to early September 2024. This implies higher distribution and weakening accumulation amongst members. Such a situation suggests bigger gamers and long-term holders are usually not shopping for – A sign of bearish sentiment.

That is additionally an indication of insecurity amongst traders over the near-term rally. These market circumstances lead to promoting strain, resulting in a value decline on the charts.

What do the value charts say?

Now, whereas the metrics highlighted by Martinez supplied an in depth outlook of the prevailing market sentiment, the broader market did bear the burnt of its current restoration.

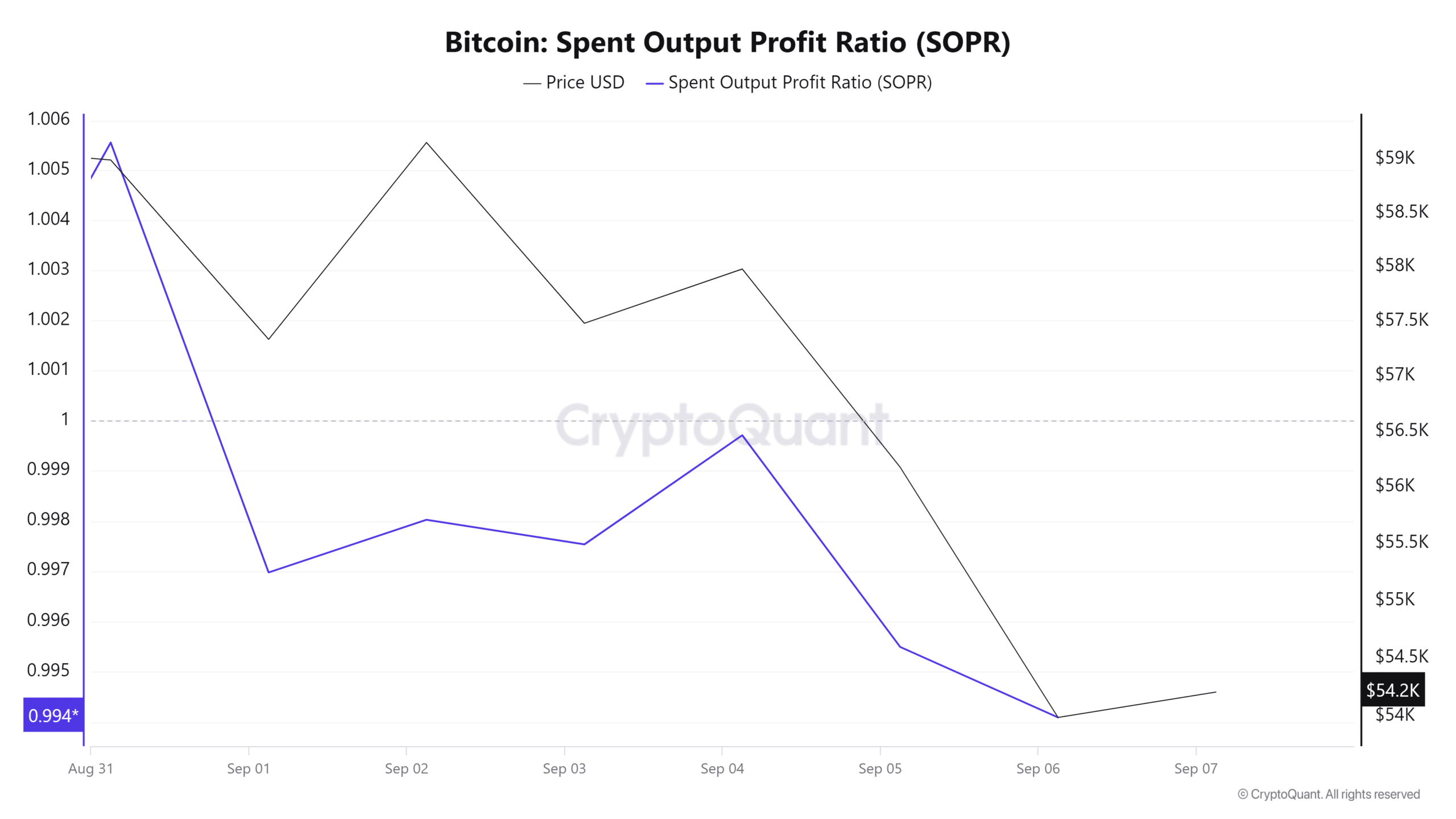

For starters, Bitcoin’s massive holder SOPR has declined from 2.4 to 1.6 over the previous 7 days. This confirmed that though long-term holders are promoting at a revenue, the dimensions of the revenue is lowering. Due to this fact, merchants are promoting at a loss as they’re changing into much less assured within the short-term to medium-term outlook for the asset.

This situation additionally appeared to counsel that traders are pessimistic about future value hikes and they’re getting ready for an additional bearish situation.

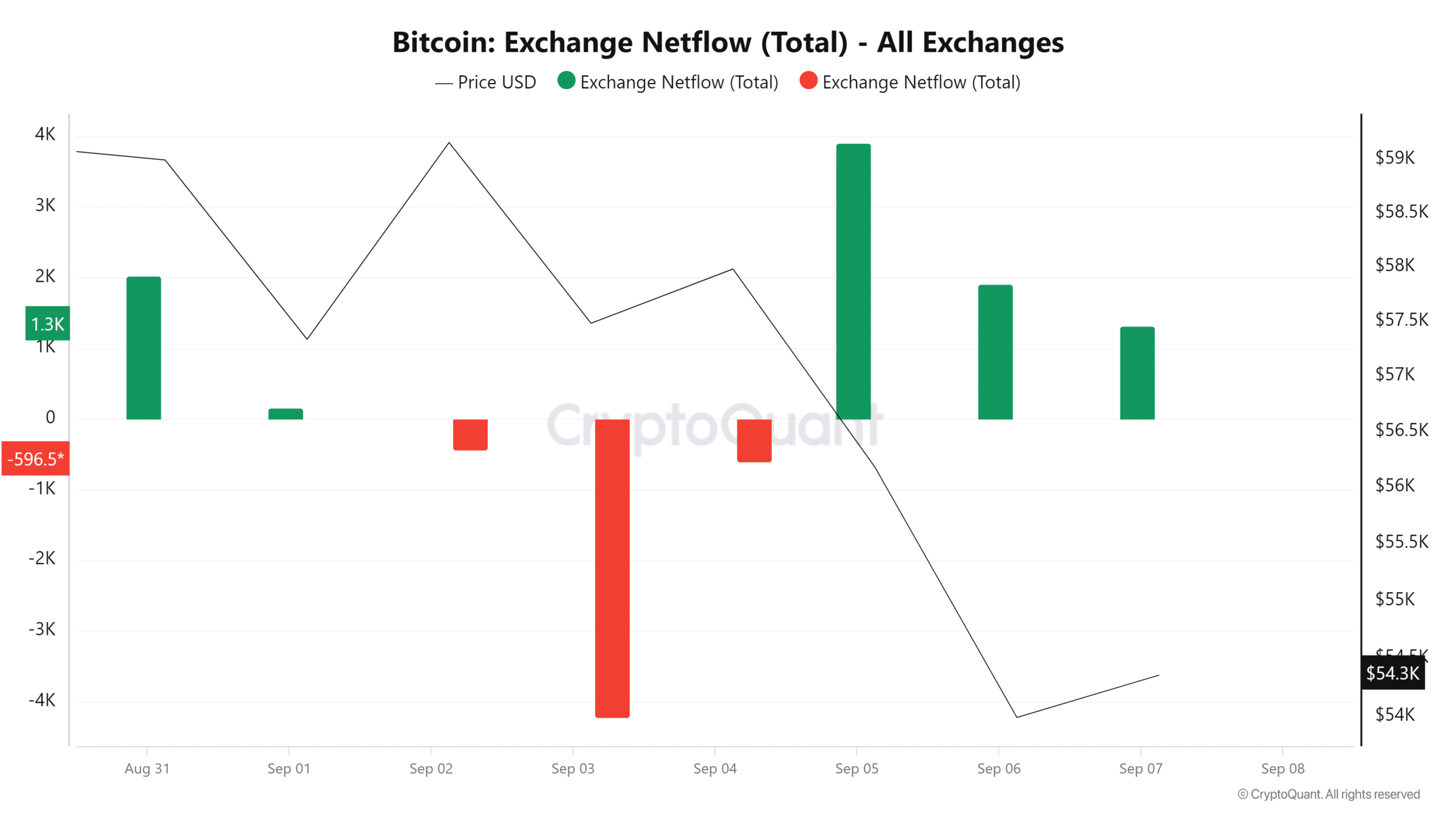

Moreover, Bitcoin’s trade netflows have remained comparatively optimistic over the previous 7 days. In 7 days, 4 days have seen optimistic trade netflows – An indication that extra traders are getting ready to shut their positions. Right here, a hike in inflows into exchanges can lead to distribution, if it results in promoting.

In mild of all these components, it may be predicted that if the promoting strain persists, BTC will threat declining beneath $50k.