Mainstream Bitcoin ETFs are having a nasty time recently, as $706 million of outflows have been recorded. This makes it one of many largest units of withdrawals since Could, exhibiting rising unease amongst traders.

This has been pushed by the fall in BTC worth to its lowest since early August. The sentiment amongst traders can be altering drastically amidst uncertainty that pervades the market. Markets attribute this alteration in fortunes to seasonal developments and hypothesis of US fee cuts.

Big Internet Outflows

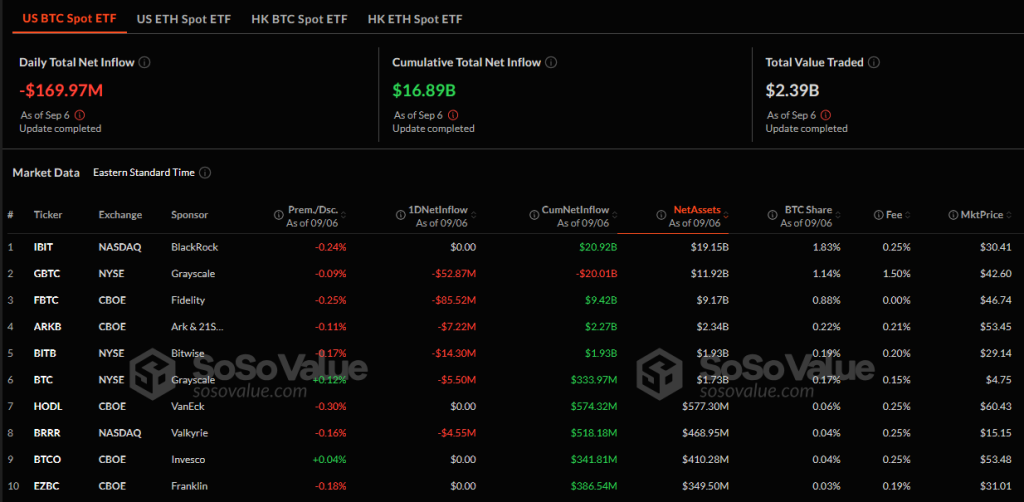

In the newest information accessible, which is from September 6, internet outflows from 12 spot Bitcoin ETFs hit a excessive of $170 million. Constancy and Grayscale had been on the high, with Constancy’s FBTC amassing near $86 million in outflows on the day to mark its seventh consecutive session in unfavorable flows.

Within the meantime, grayscale’s GBTC suffered heavy losses, with virtually $53 million in outflows. Since its creation, GBTC misplaced greater than $20 billion. This fund, in simply eight days, has witnessed a staggering outflow of $280 million and has been affected by losses beginning on August twenty seventh in a row.

Supply: SoSoValue

Different notable outflows included Bitwise’s BITB, which misplaced over $14 million; ARK 21Shares’ ARKB had outflows of $7.2 million; Grayscale’s BTC Mini Belief misplaced virtually $6 million, whereas Valkyrie’s BRRR fell by $4.5 million. These outflows level to a bigger sample underlined by declining investor confidence in Bitcoin ETFs throughout instances of market volatility.

As of at the moment, the market cap of cryptocurrencies stood at $1.91 trillion. Chart: TradingView.com

These have pushed concern and made traders extra risk-off. From a technical perspective, Bitcoin may also be making a “death cross,” which might indicate extra worth drop.

Analysts are divided on whether or not Bitcoin will get away from this droop or proceed to fall, relying on the way it intersects with key resistance and help ranges.

The Ripple Impact On Ethereum

Not solely Bitcoin is underneath the recent seat right here. Moreover registering outflows of roughly $91 million have been Ethereum ETFs. This determine displays extra unfavorable angle within the bitcoin market.

Lack of investor confidence is obvious since many are altering their stance in view of present market developments.

Most fascinating is the interaction between Bitcoin and Ethereum, as a result of each property have been, for fairly some time, thought-about indicators of the crypto market’s common well being.

Wanting Forward

It begs the query: the place to now for Bitcoin and different cryptocurrencies? The setting is troublesome at current, although some analysts really feel this generally is a good shopping for alternative for the long-term investor.

The market volatility is nothing new; seasoned traders are conscious of such downturns which can be as a rule adopted by vital recoveries. However for the traders eager to get into the market in the mean time, warning is suggested.

The latest outflows from Bitcoin ETFs mark a crucial juncture for the cryptocurrency market. Shaken investor confidence, mixed with exterior financial elements, makes the following few weeks extraordinarily vital for deciding the long run course of Bitcoin and Ethereum.

Featured picture from StormGain, chart from TradingView