- BTC has dropped under its 200-day transferring common for the second time, the primary being July 2024.

- An analyst predicted a drop to BTC’s realized worth of $31500.

Bitcoin [BTC], has skilled excessive volatility during the last months. Since hitting a neighborhood excessive of $70016 in July, it has failed to take care of an upward momentum. Actually, during the last month, it has declined by 4.63%.

Nevertheless, over the previous week, BTC has tried to reverse the development by rising by 4.16% weekly. Regardless of these makes an attempt, it has did not maintain the momentum.

As of this writing, BTC was buying and selling at $58093. This marked a 0.40% decline over the previous day.

Equally, the crypto’s buying and selling quantity dropped by 19.90% to $29.7 billion over the previous 24 hours.

This market indecision and lack of clear trajectory has left market analysts seeing an extra decline earlier than a reversal. Inasmuch, in style Crypto analyst Ali Martinez a drop to its realized worth citing its 200-day transferring common

Market sentiment

In response to his evaluation, when Bitcoin trades above its 200-day transferring common, it indicated robust returns. Nevertheless, when it drops under this stage, it units the crypto for a sustained decline.

Due to this fact, because it has traded under $64000, over the previous month, it recommended a possible drop to its realized worth of $31500.

In context, when BTC markets commerce under the 200-day common, it’s stated to be in a downtrend. Whereas, when it trades above the 200-day transferring common, it’s thought-about bullish.

Traditionally, when BTC falls under its 200-day transferring common, costs are likely to drop shortly after. First, in the course of the 2016-2017 bull market, BTC fell under the 200-day SMA for 3 consecutive months.

Throughout the 2018-2019 cycle, it fell under the 200-day MA in mid-2019 earlier than COVID-19 disrupted the sample. In August 2023, it fell under 200-day MA till October, which was accompanied by a worth decline.

Lately, on the 4th of July, BTC dropped by 2% to commerce at $57300 thus falling under its 200-day transferring common of $58720.

Nevertheless, when BTC breaks above this trendline costs are likely to surge. For example, in October 2023, when costs broke above the 200-day MA, BTC was buying and selling at $28000.

A breakout from this trendline fueled expectations for ETFs thus paving the best way for ATH at $73737. In July when it broke out from the trendline, its costs recovered to $70016.

What Bitcoin charts point out

Undoubtedly, as Martinez posited, a drop under the 200-day MA indicated a decline, per historic information. However what do different indicators say?

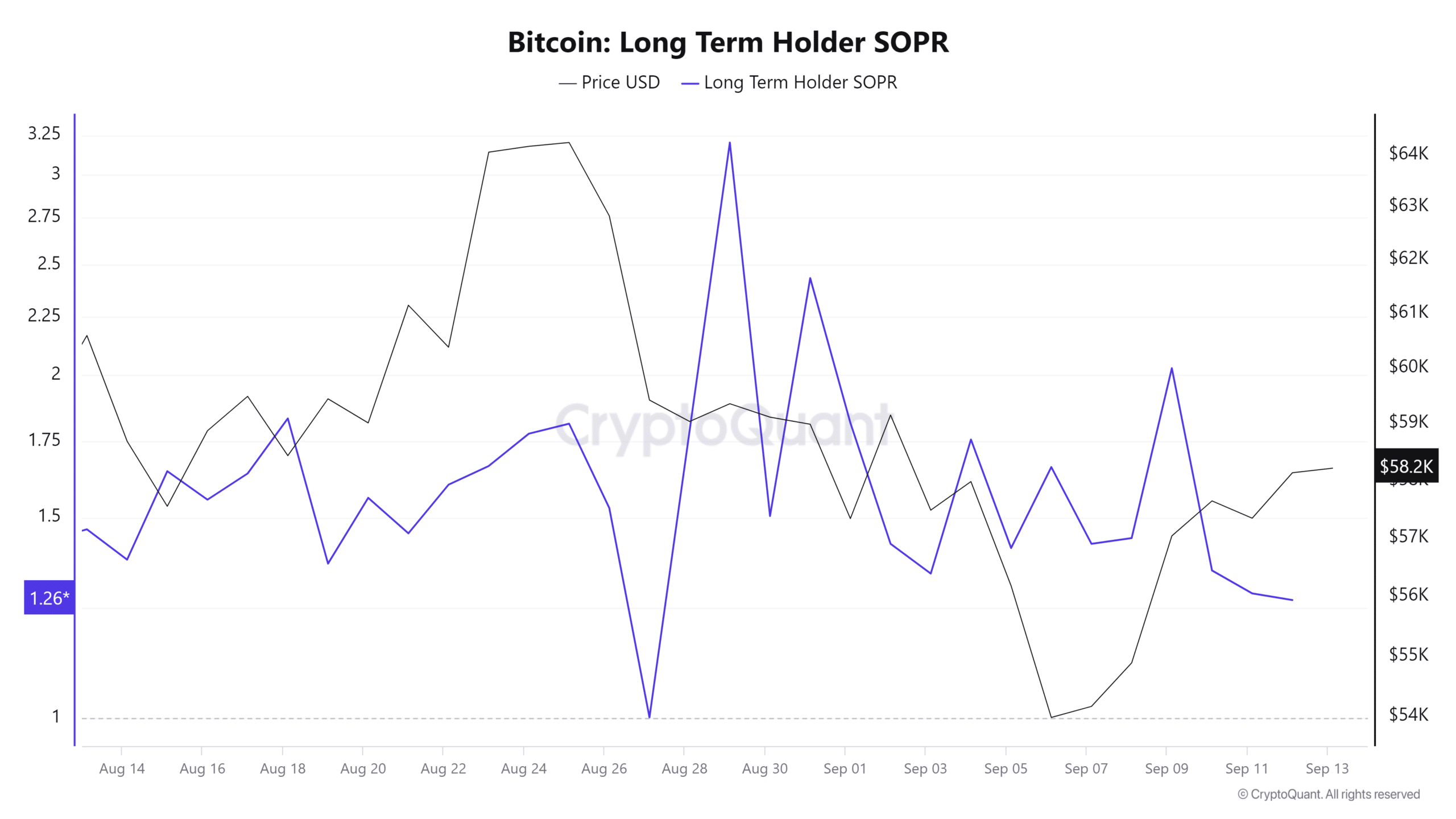

For starters, Bitcoin’s long-term holders SOPR has been on a declining channel because the twenty ninth of August. The LTH SOPR has declined from 3.2 to 1.2, indicating bearish sentiment amongst long-term buyers.

This implied they not anticipated BTC to get better, thus promoting to keep away from additional losses.

Such market conduct leads to promoting stress, driving costs down.

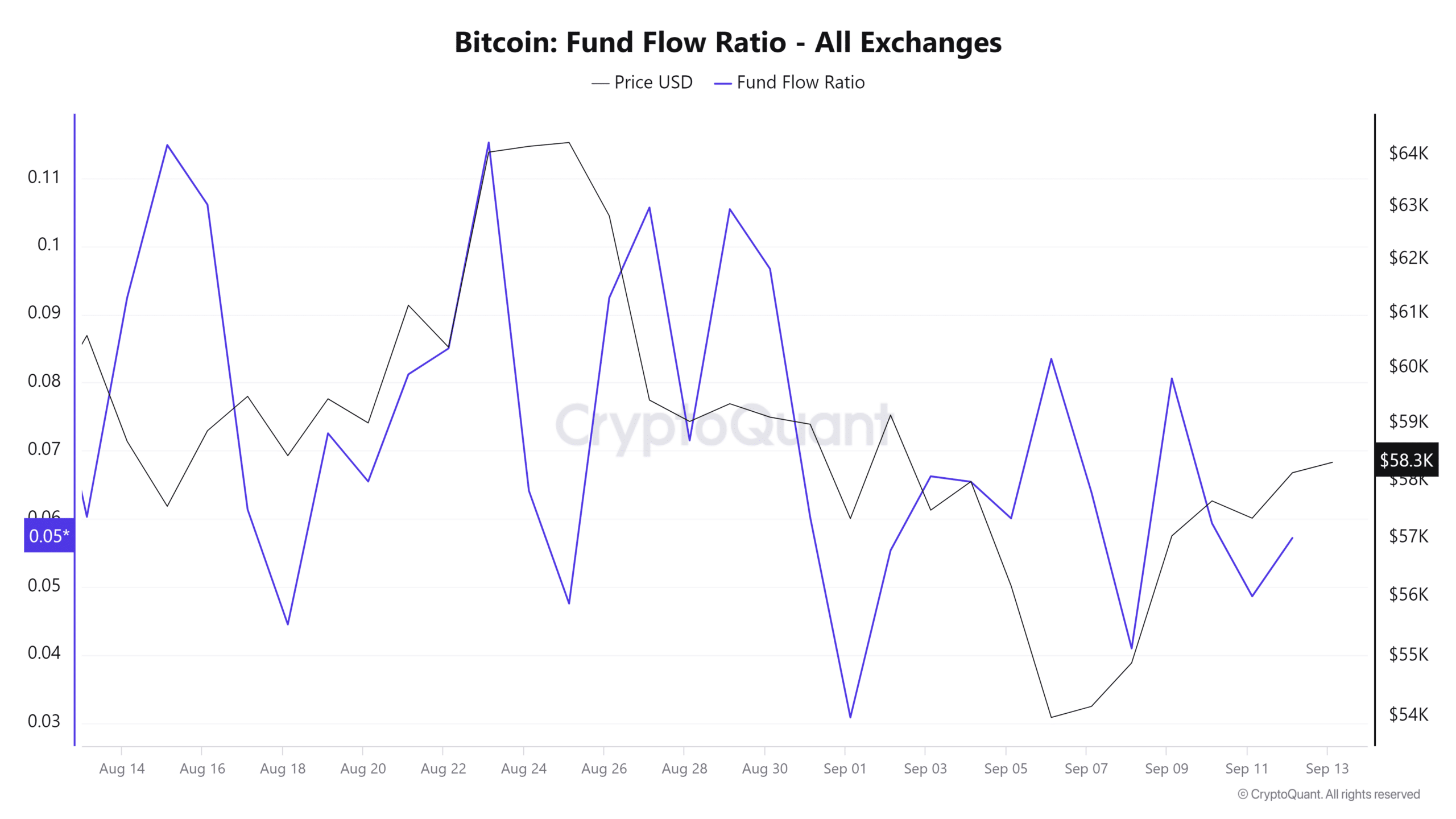

Moreover, Bitcoin’s Fund Move Ratio has declined over the previous month, implying much less capital influx relative to total buying and selling quantity.

This recommended that buyers lacked confidence they usually weren’t committing new funds. When buyers shut their positions, it leads to promoting stress, which additional pushes costs down.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Due to this fact, as Martinez posits, a drop under the 200-day MA implied additional decline. Primarily based on present market sentiment, BTC was positioned to say no to $54147 within the quick time period.

Nevertheless, a breakout from this trendline will push costs as much as $64727.