Picture supply: Getty Photographs

Dividend shares is usually a nice supply of passive revenue. And I feel UK traders would do properly to look near residence for alternatives.

There are three foremost causes, a few of that are extra apparent than others. One is decrease costs, one other is tax effectivity, and a 3rd is managing the danger of fluctuations in international trade charges.

Decrease costs

Usually, UK shares are inclined to commerce at decrease ranges than their US counterparts. For instance, evaluate FTSE 100 big Unilever (LSE:ULVR) with the likes of Procter & Gamble or Coca-Cola.

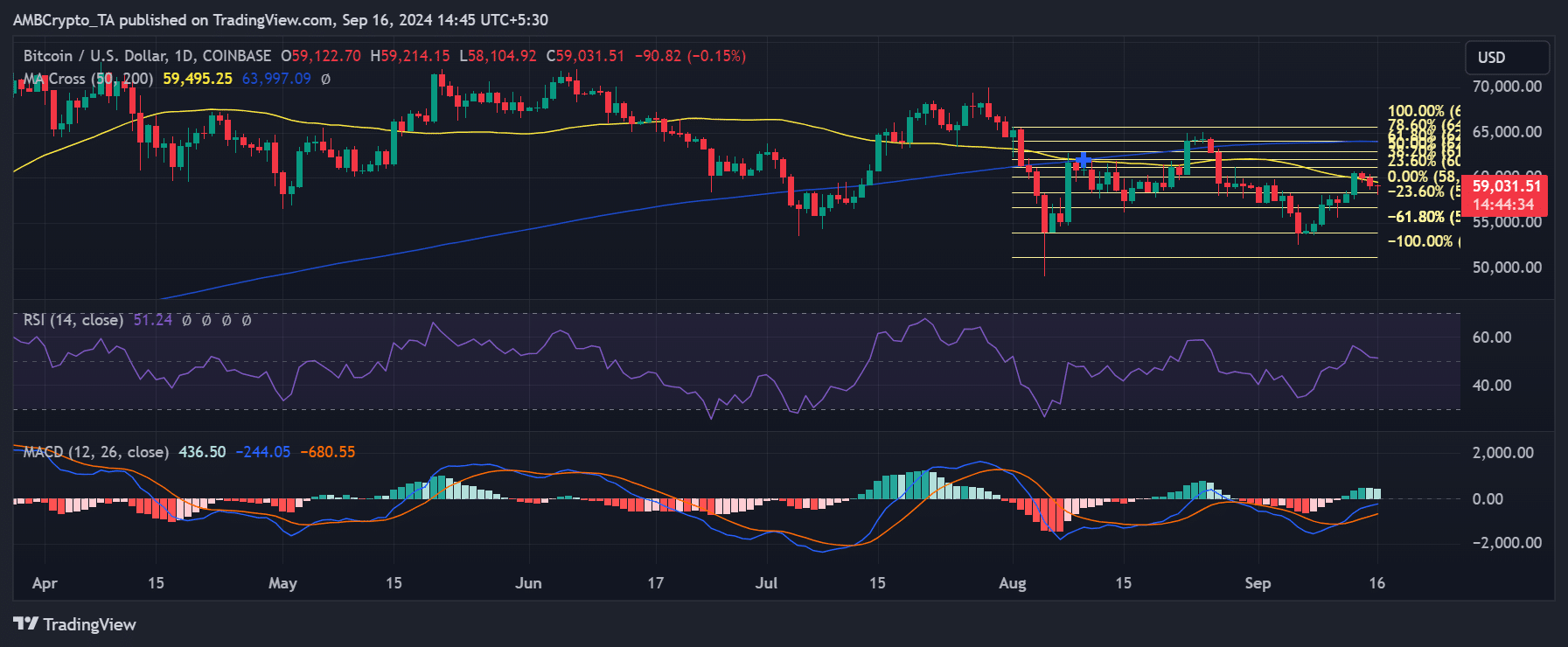

Each P&G and Coca-Cola are terrific companies, however Unilever is true up there with them. Over the past 10 years, the UK agency has achieved related – if not higher – returns on fairness.

Unilever vs. P&G vs. Coca-Cola returns on fairness 2014-24

Created at TradingView

Regardless of this, Unilever shares commerce at a price-to-earnings (P/E) a number of of twenty-two, which is decrease than P&G (29) or Coca-Cola (29). And its 3% dividend yield is larger consequently.

From a passive revenue perspective, I feel this offers traders a motive to favour the UK inventory. It affords a better dividend yield for no apparent drop off within the high quality of the underlying enterprise.

Taxes

Unilever’s dividend yield is round 3%, in comparison with 2.3% for P&G and a couple of.7% for Coca-Cola. Which may not appear like a lot, however the hole widens when taking account of tax implications.

For UK traders, dividends from US shares are topic to a 30% withholding tax (lowered to fifteen% with a W-8BEN kind). This implies shareholders within the UK shouldn’t count on the marketed yield.

After tax, that quantities to a 2% return from P&G and a 2.3% return from Coca-Cola. Unilever being listed within the UK, nevertheless, means there’s no such tax – traders ought to get the total 3%.

If somebody holds all three in an ISA (and is thus exempt from dividend tax) the distinction may be vital over time. And I feel that’s one thing passive revenue traders ought to pay attention to.

Please observe that tax therapy is dependent upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Overseas trade

There’s one last consideration to bear in mind, as properly. Distributions in US {dollars} need to be transformed again to British kilos for UK traders and the trade fee can fluctuate.

Over the past 12 months, the pound is up round 6% in opposition to the greenback. Which means a US inventory would wish to have elevated its dividend by that a lot for UK traders to obtain the identical quantity.

After all, issues can go the opposite means – a weakening pound could cause UK traders to obtain extra. However it’s an added supply of uncertainty from in any other case comparatively predictable companies.

Unilever isn’t completely insulated from this threat, with most of its income generated exterior the UK. However with its dividend declared in kilos, revenue traders ought to at the very least be clear about what they’ll get.

UK shares

There’s all the time threat with regards to investing. Even with Unilever, there’s a continuing hazard the corporate may wrestle to maintain its model portfolio in step with client preferences.

Nonetheless, incomes passive revenue is about discovering shares that may constantly generate essentially the most money. And from that perspective, I feel there are good causes for UK traders to look near residence.