- The crypto market rallied after an aggressive Fed fee lower.

- Trump turned the primary former president to transact utilizing BTC.

The crypto market reacted positively to the primary Fed fee lower in 4 years.

On the 18th of September, the U.S. Fed dropped rates of interest by 0.50% (50 foundation factors), a surprisingly aggressive transfer that caught most economists, who anticipated a 25 bps lower, off-guard.

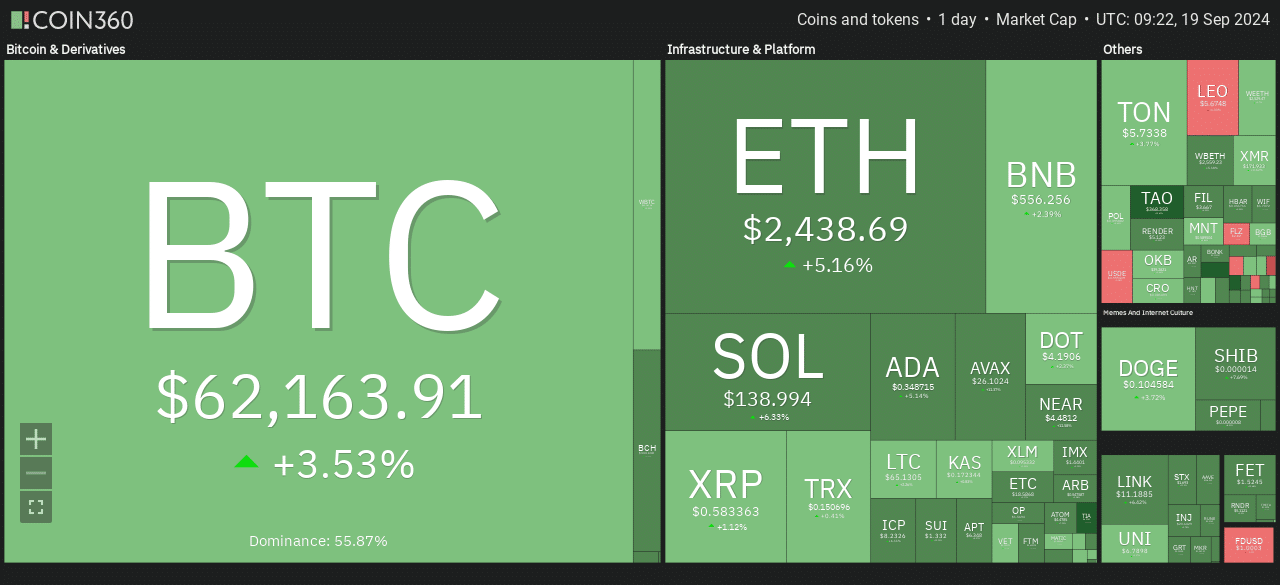

Following the Fed pivot, Bitcoin [BTC] netted 2.3% positive factors throughout the intraday buying and selling session on Wednesday. On the nineteenth of September, throughout early Asian hours, BTC climbed greater to $62.5K.

On the time of writing, the asset was valued at $62.1K, with notable positive factors throughout the sector. Ethereum [ETH] was up 5% up to now 24 hours.

However Solana [SOL] had the best each day positive factors among the many main property, with almost 6.4% positive factors over the identical interval.

Nonetheless, market pundits remained cautious, citing that the Fed’s jumbo lower might sign a slowing financial system that would unnerve danger property within the quick time period.

BitMEX’s founder Arthur Hayes referred to as the aggressive lower a ‘nuclear catastrophe for financial markets’ that would result in muted costs after two days.

He additional warned that Friday’s BoJ (Financial institution of Japan) determination could possibly be one other issue figuring out BTC’s subsequent worth path. Hayes famous,

“A weak JPY will mean stronger BTC and vice versa.”

Nonetheless, Antony Pompiliano, a BTC investor, claimed that recession worries solely mattered to short-term speculators. For long-term buyers, the Fed fee cuts had been bullish for BTC.

Trump turns into the primary president to transact utilizing BTC

On the 18th of September, Donald Trump, former US president, stopped on the well-known New York PubKey bar and paid utilizing BTC.

He purchased meals and drinks for supporters on the joint and settled the invoice by BTC. PubKey proprietor Thomas Pacchia termed the motion as “history.”

“The first transaction by a president on the Bitcoin protocol. History!”

In contrast to his first stint on the White Home, Trump has develop into pro-BTC and even introduced plans to determine it as a strategic reserve asset if elected president.

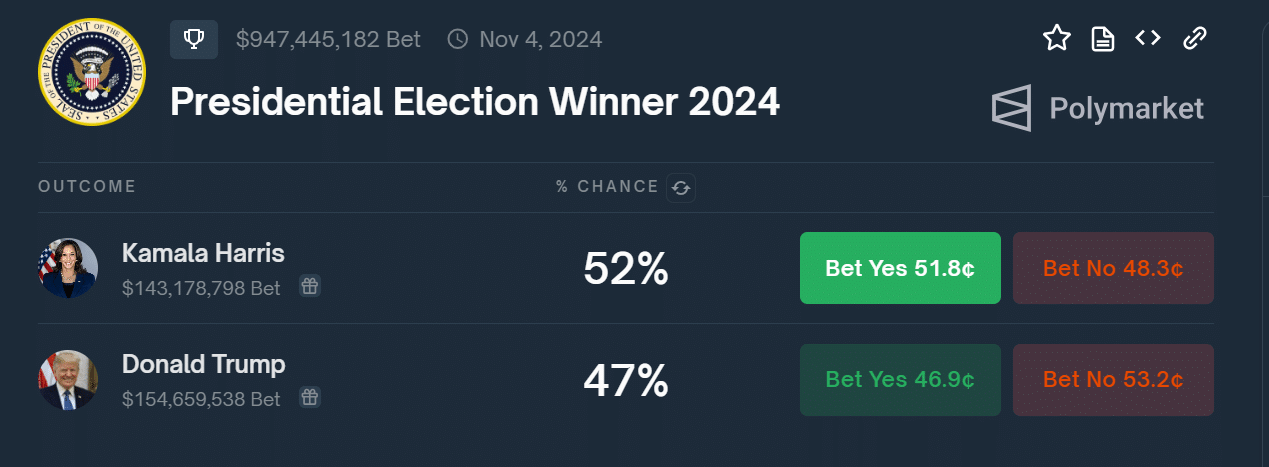

Because of this, BTC worth motion has additionally develop into more and more correlated with Trump’s odds of successful the 2024 US elections.

At press time, probabilities of a Trump win stood at 47%, as Harris dominated with a 5-point lead on the prediction web site Polymarket.

Knowledge Tree unveils RWA platform on Ethereum

Lastly, Knowledge Tree, an asset supervisor with $110 billion of property below administration, has unveiled an RWA (real-world asset) tokenization platform that can run on Ethereum.

The product, referred to as Knowledge Tree Join, will permit integration between TradFi and DeFi, per the agency. Will Peck, Head of Digital Belongings at WisdomTree, stated,

“With increasing interest in tokenized real-world assets, WisdomTree Connect … will provide access to digital funds to on-chain firms without leaving the ecosystem.”

Knowledge Tree will be part of different asset managers like BlackRock and Franklin Templeton, which have comparable merchandise geared toward offering yield-bearing merchandise for crypto companies in search of publicity to US treasury bonds as a reserve.