- Crypto shorts suffered an enormous $147M loss as Bitcoin hit $63K.

- Nonetheless, its resurgence shouldn’t be off the desk.

Bitcoin [BTC] bulls have propelled a breakout, reaching $63K after weeks of consolidation, spurred by Fed price cuts.

Alongside macroeconomic components, BTC spinoff markets have confirmed a squeeze, leading to $147M in losses for crypto shorts.

As BTC approaches the $64K excessive, stakeholders should strategize to push it previous the important thing $70K resistance, because it gained’t be a simple activity. Why? AMBCrypto investigates.

Unfolding the squeeze

Traditionally, over the previous 180 days since BTC final hit its ATH of $73K in March, bulls have examined the $71K stage 4 instances. Every time, robust resistance held, stopping a brand new ATH.

Based on AMBCrypto, Bitcoin should maintain $64K to focus on the following resistance at $68K – examined twice since June. If the bulls succeed, $71K may very well be inside attain.

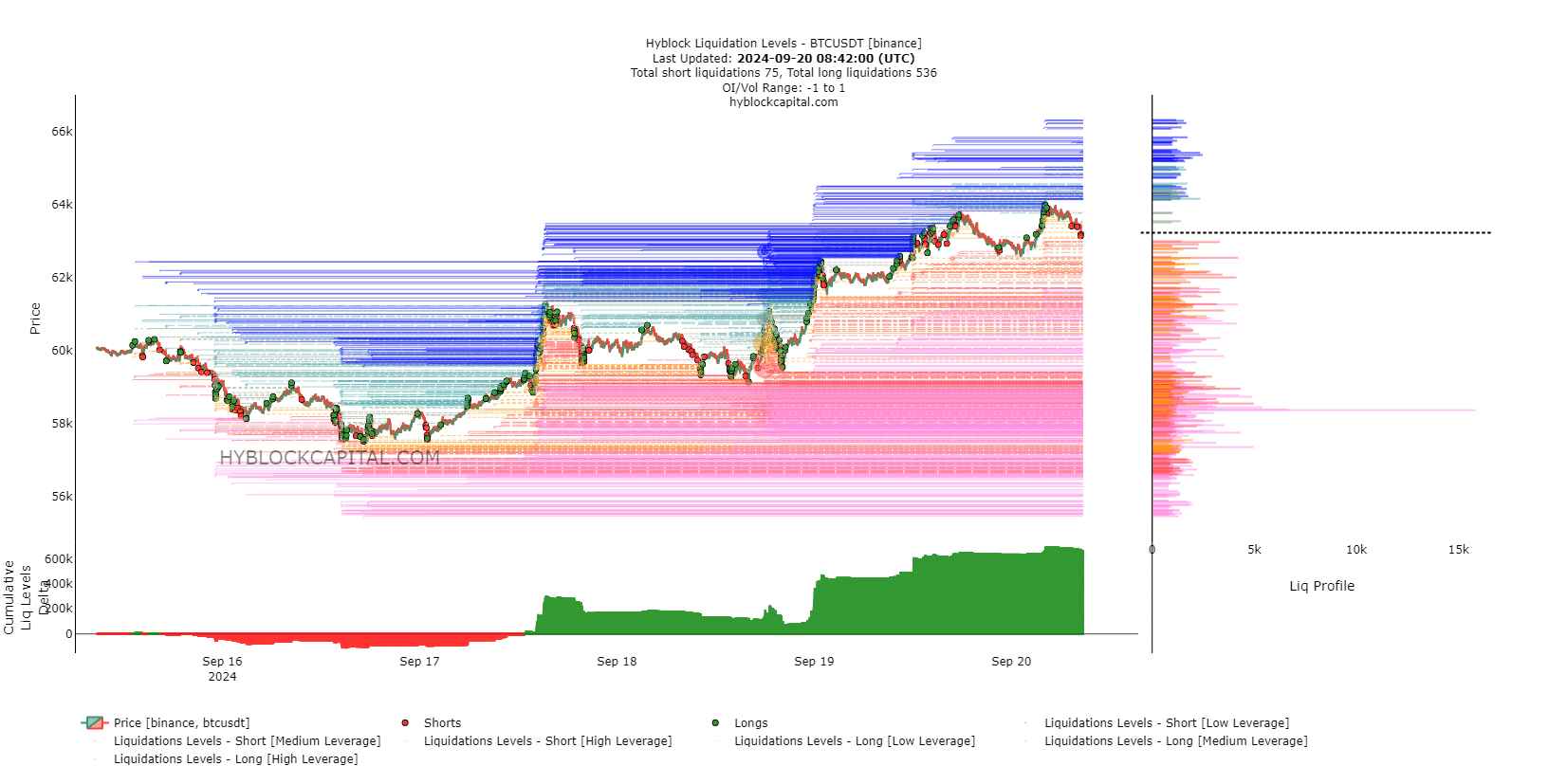

In the meantime, a major spike in Open Curiosity(OI) possible contributed to the surge, prompting crypto shorts to shut their positions and leading to $147M in losses.

Notably, the present OI motion mirrors the late-August pattern when Bitcoin examined $64K, suggesting that BTC could also be approaching that value once more.

Nonetheless, if the same pattern unfolds, the probability of a breakout diminishes, as BTC bears may re-enter the market, thwarting one other try at breaking by way of.

In easy phrases, regardless of the speed minimize, Bitcoin nonetheless faces vital challenges in testing $64K earlier than a wider breakout might be anticipated. So, had been the losses from crypto shorts as a result of a “short” squeeze?

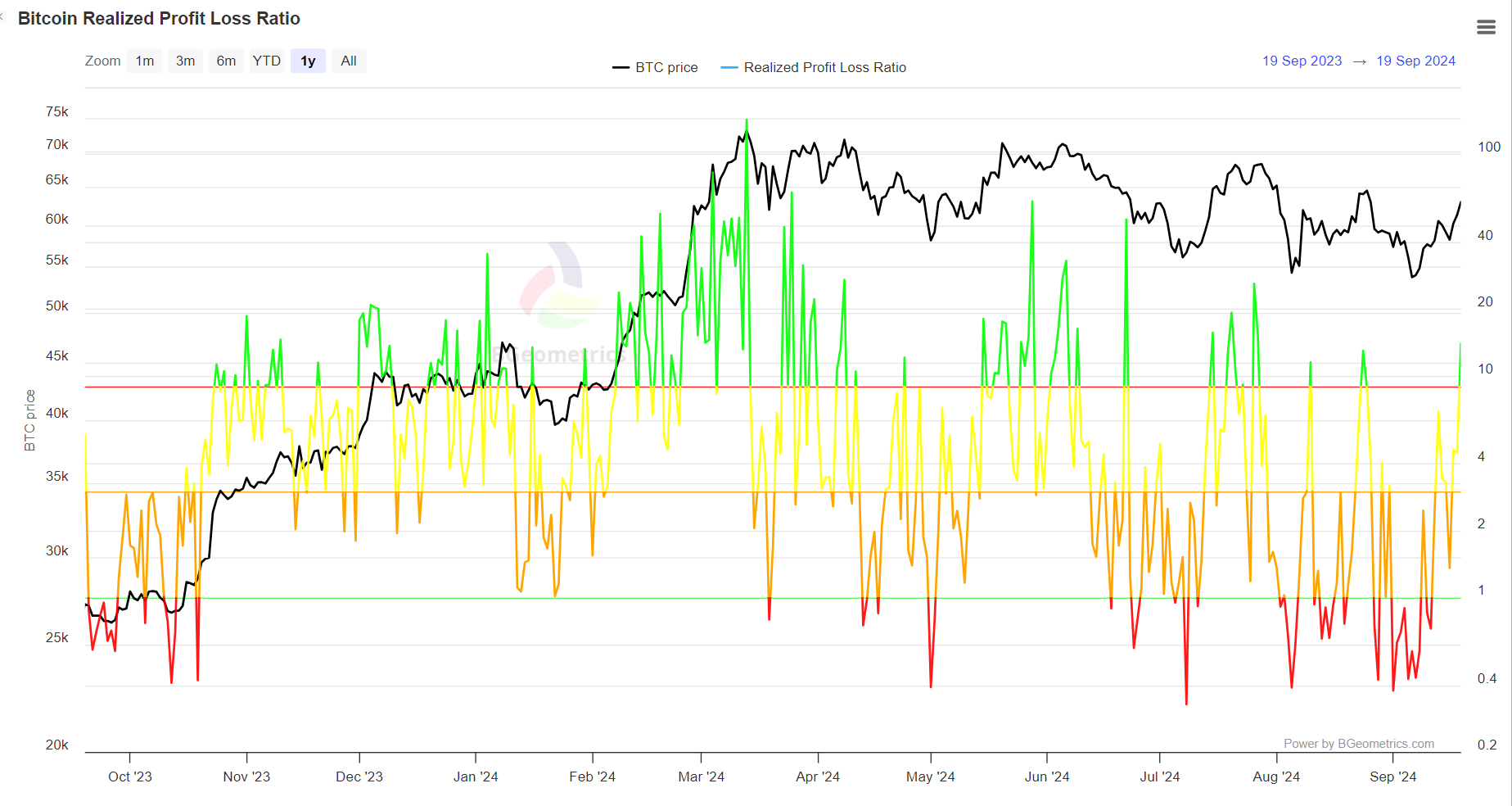

Stakeholders in internet revenue

The chart under signifies the positions of stakeholders in response to cost modifications. Presently, a good portion of consumers are within the revenue zone, marked by the inexperienced wig.

Traditionally, surges on this ratio have coincided with market tops. Nonetheless, over the past $64K peak, the spike was short-lived as crypto shorts shortly cashed in on their features.

If this pattern repeats, a breakout may stall as merchants exit earlier than the rally fades, reinforcing the quick squeeze speculation.

Furthermore, if crypto shorts resurge, bulls could have to seize one other alternative to push BTC towards $70K.

BTC would possibly retrace if crypto shorts regain management

Over the previous three days, as BTC surged previous $60K, crypto shorts have retreated, permitting a major inflow of lengthy positions.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Nonetheless, a slight downward pattern may set off large liquidations if the bulls fail to keep up help. If merchants exit and bulls retreat, a resurgence of crypto shorts may push Bitcoin again under $60K.

Traditionally, $64K has acted as each resistance and help, and the potential of a breakout hinges on investor technique. Failing to capitalize on the $147M crypto shorts squeeze may see BTC retrace to $55K.