- Bitcoin profitability warrants an evaluation of the likelihood of promote strain.

- BTC’s latest knowledge demonstrates a resurgence of confidence in its potential to push again above $70,000.

Bitcoin [BTC] bulls have dominated for nearly three weeks now, pushing its value above $64,000. This comes on the backdrop of renewed optimism, however must you contemplate taking earnings at this degree?

Whereas Bitcoin bulls have carried out commendably, the worth is now in a zone that beforehand yielded promote strain.

There was evident of some resistance increase above the $64,000 value degree within the final three days. On high of that, an amazing majority of Bitcoin holders, 84% above $63,000, are now in revenue.

This implies that BTC may very well be delicate to important draw back in case of one other bearish occasion. Alternatively, a collection of occasions have yielded expectations and hopes that Bitcoin could soar as excessive as $80,000 this time.

Many at the moment are questioning which alternative could be simpler; to proceed HODLing BTC or to take earnings?

Are long run holders nonetheless optimistic?

A latest CryptoQuant evaluation means that many long run Bitcoin holders are opting to not transfer their cash. This implies that they aren’t taking earnings but, and this might protect BTC from promote strain.

It could additionally permit it to increase its latest upside within the coming days or even weeks if there may be demand to drive up the worth.

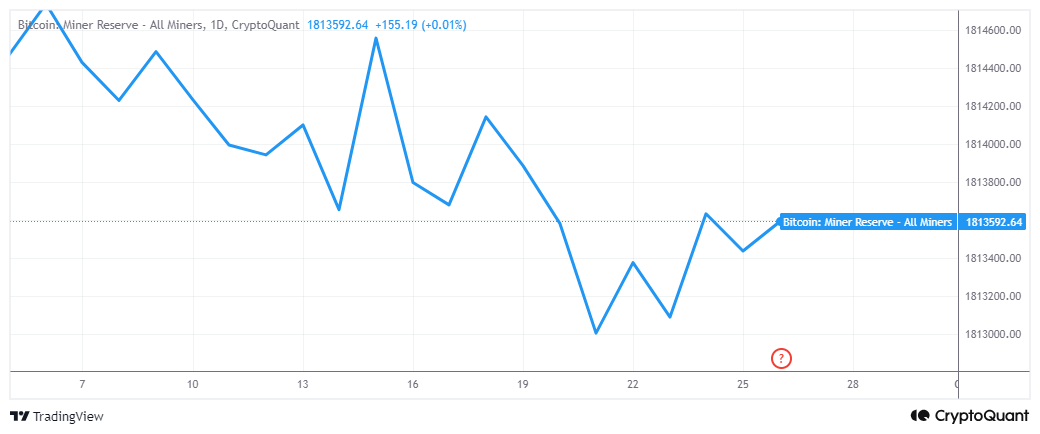

The CryptoQuant evaluation additionally means that miner capitulation could be a motive for long run Bitcoin holders to promote. Nonetheless, on-chain knowledge revealed that miner reserves have been on an total uptrend within the final 5 days.

The miner reserves uptick means that miners are additionally opting HODL their cash in anticipation of upper costs.

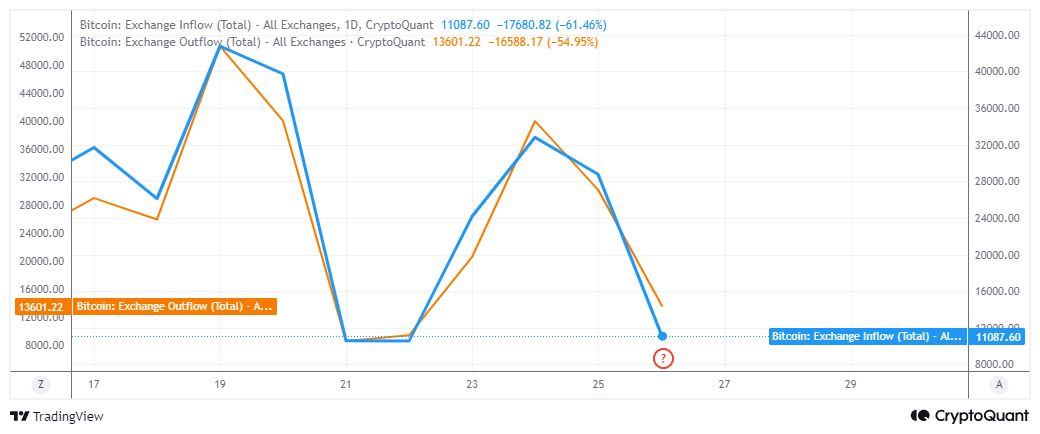

However what concerning the prospects of promote strain within the quick time period? Properly, regardless of the present value degree yielding some resistance, change stream knowledge revealed that demand nonetheless outweighed promote strain.

Bitcoin change outflows had been greater within the final 24 hours at 13,601 BTC in comparison with 11,087 BTC flowing out of exchanges.

Nonetheless, it’s price noting that change flows have been slowing down within the final 3 days. Additionally, they’d slowed right down to ranges the place they beforehand pivoted, suggesting that there may very well be a shift within the coming days.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

In conclusion, Bitcoin value motion beforehand demonstrated sturdy promote strain above $60,000. That doesn’t seem to the case with its newest push above the identical degree.

This implies rising ranges of confidence, boosted by latest prospects of liquidity flowing into the market.