- The Bitcoin Rainbow Chart and different key metrics signaled ‘BUY’ at press time.

- Market pundits anticipate bullish This fall and 2025 — Must you maintain on or soar in?

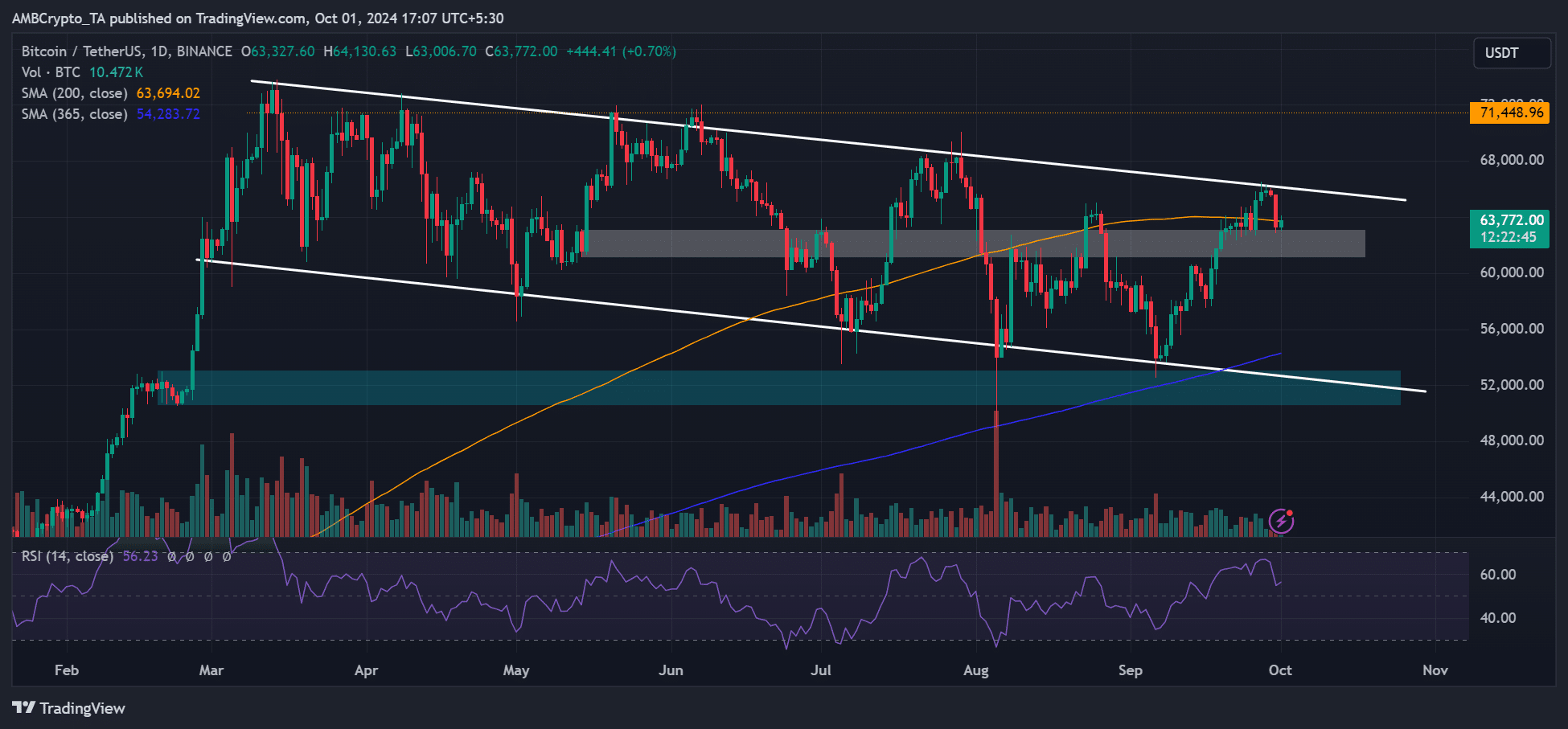

Bitcoin [BTC] has been consolidating inside $60K—$70K for the previous seven months. Regardless of the boring value motion, the present BTC worth was nonetheless a fantastic purchase alternative forward of a traditionally bullish This fall.

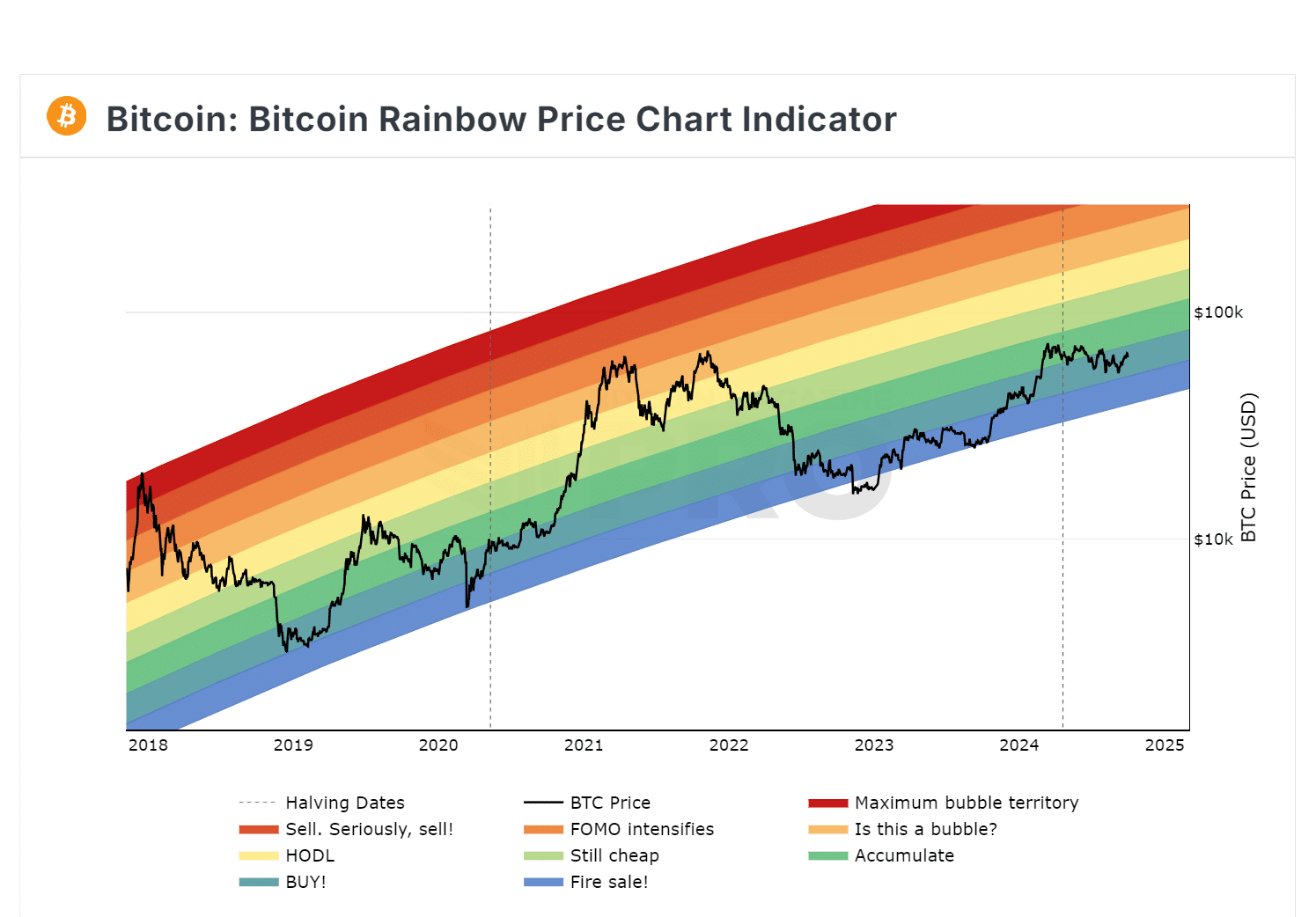

In accordance with the Bitcoin Rainbow Chart, BTC’s present worth was nonetheless inside the ‘buy’ zone.

In truth, since its March and subsequent retracement, the asset has been firmly inside the ‘accumulate’ and ‘buy’ zones.

For context, the Rainbow Chart gauges BTC valuation based mostly on historic costs however is introduced visually by rainbow colours.

Decrease coloration bands sign undervalued BTC, whereas larger bands denote overheated market and potential corrections.

Is BTC nonetheless discounted?

Different key valuation metrics additionally signaled that BTC was comparatively ‘cheap’ at press time worth.

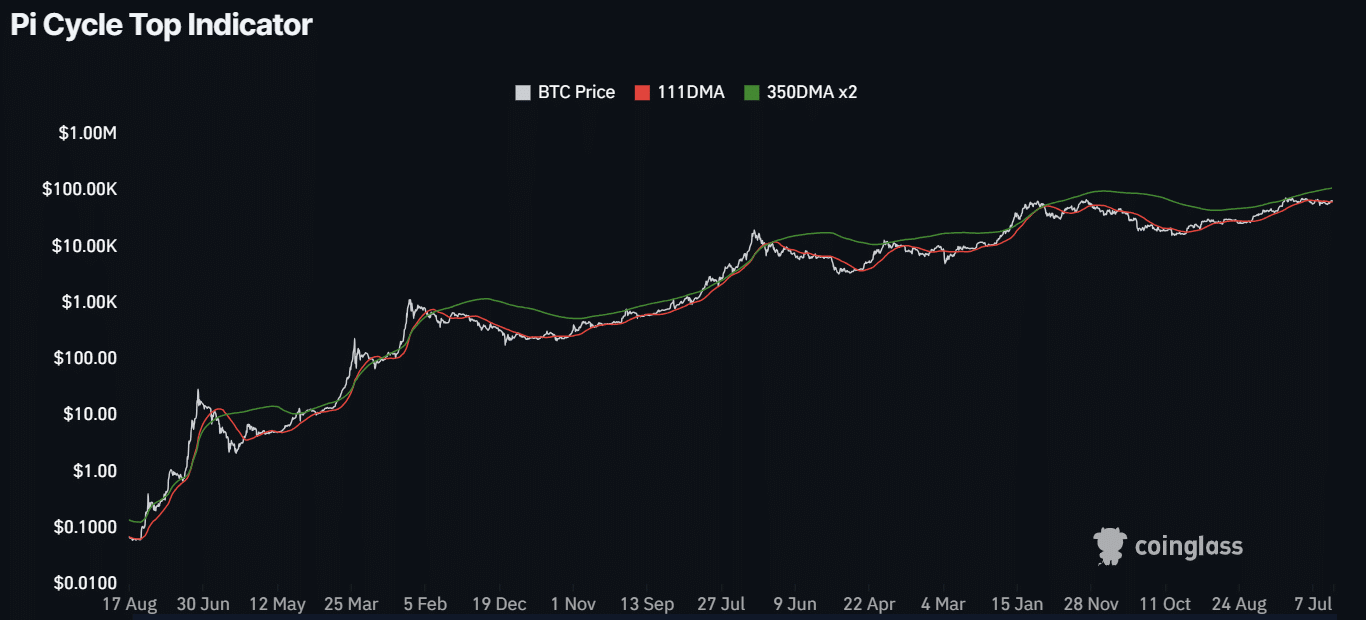

In accordance with the Pi Cycle High indicator, BTC was removed from hitting this cycle’s high, as denoted by the vast hole between the 111-day MA (Shifting Common) and 350-day MA a number of (350 DMAx2).

For the unfamiliar, the Pi Cycle High metric has successfully captured BTC cycle tops with a 3-day accuracy. Traditionally, cycle tops have been hit after 111 DMA hiked and crossed 350DMAx2.

The vast hole at press time meant BTC’s bull run may lengthen.

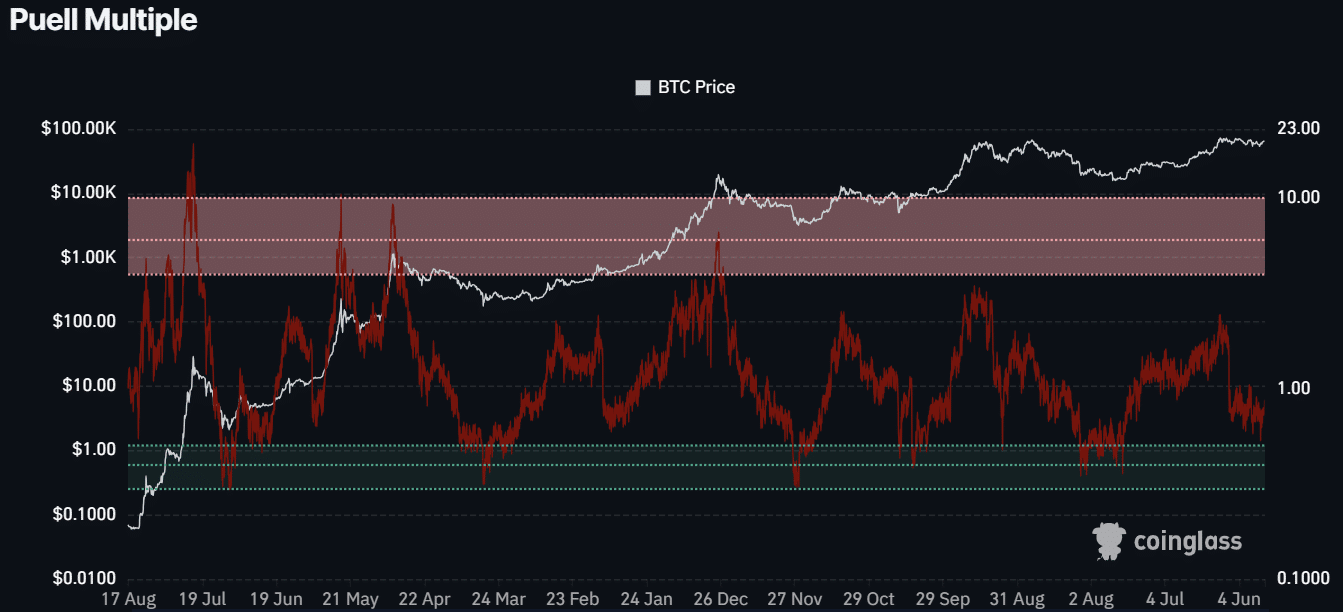

Briefly, BTC was comparatively undervalued at press time. An analogous outlook was illustrated by the Puell A number of, which evaluates whether or not BTC is overpriced utilizing BTC miners’ profitability.

The inexperienced zone is synonymous with undervalued BTC, whereas the overhead zone indicators an overheated market.

Based mostly on the press time studying, 0.73, BTC was grossly underpriced, suggesting a fantastic shopping for alternative for traders.

In addition to the above valuation metrics, key trade figures and corporations have made excessive BTC value targets for end-2024 and 2025. Customary Chartered Financial institution predicted the asset may hit $250K by 2025.

On his half, CK Zheng, founding father of crypto-focused hedge fund ZX Squared Capital, BTC, would hit an ATH in This fall 2024, no matter who wins the US elections.

The manager cited excessive US nationwide money owed and financial deficits as explanation why BTC would develop into extra profitable amid the Fed charge lower cycle.

If the predictions come true, This fall 2024 and 2025 would supply big BTC returns, doubtlessly breaking above the 7-month lengthy value vary. If that’s the case, the present BTC worth might be deemed grossly discounted.