- Bitcoin has a bullish construction however didn’t comply with via on the breakout.

- Fears of an area prime attributable to social media buzz performed out up to now 4 days.

Bitcoin [BTC] achieved a breakout from a descending channel it has traded inside since July. Nonetheless, after reaching the native excessive of $66.5k, the value started to reverse its upward momentum.

In a publish on X, crypto market intelligence platform Santiment famous that the gang sentiment was notably bullish. This raised the probabilities of a market prime and panic promoting ought to BTC costs dive decrease.

The close to 5% value drop on Monday vindicated this concept. Is the market able to get well, or was that the native prime?

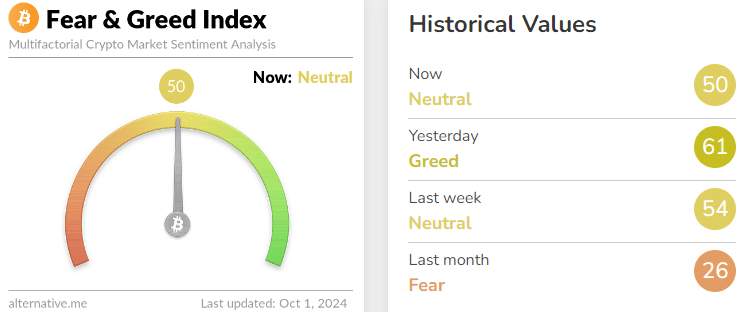

Bitcoin Worry and Greed Index

Supply: Different.me

A take a look at the concern and greed index confirmed that market members needn’t panic. The present sentiment was impartial and has been impartial or fearful in current weeks.

The rating is calculated utilizing totally different information factors resembling volatility, market quantity, social media engagement, and the Bitcoin dominance traits and Google Tendencies scores.

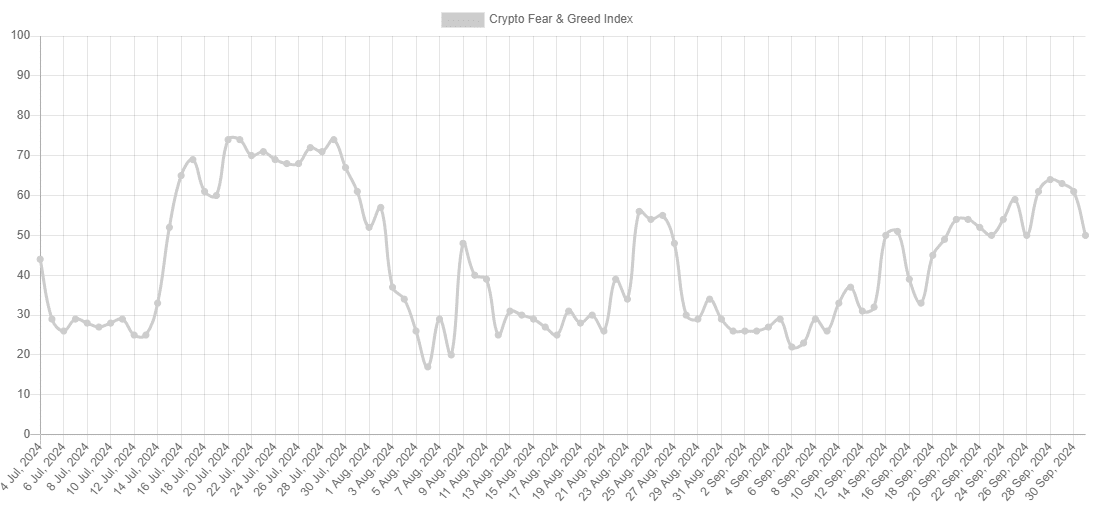

Supply: Different.me

AMBCrypto additionally analyzed the Bitcoin Worry and Greed Index’s scores over the previous three months. The worth pattern of September, particularly the latter half, noticed the index rise increased.

This was nonetheless not sufficient to push the market into “greedy” territory.

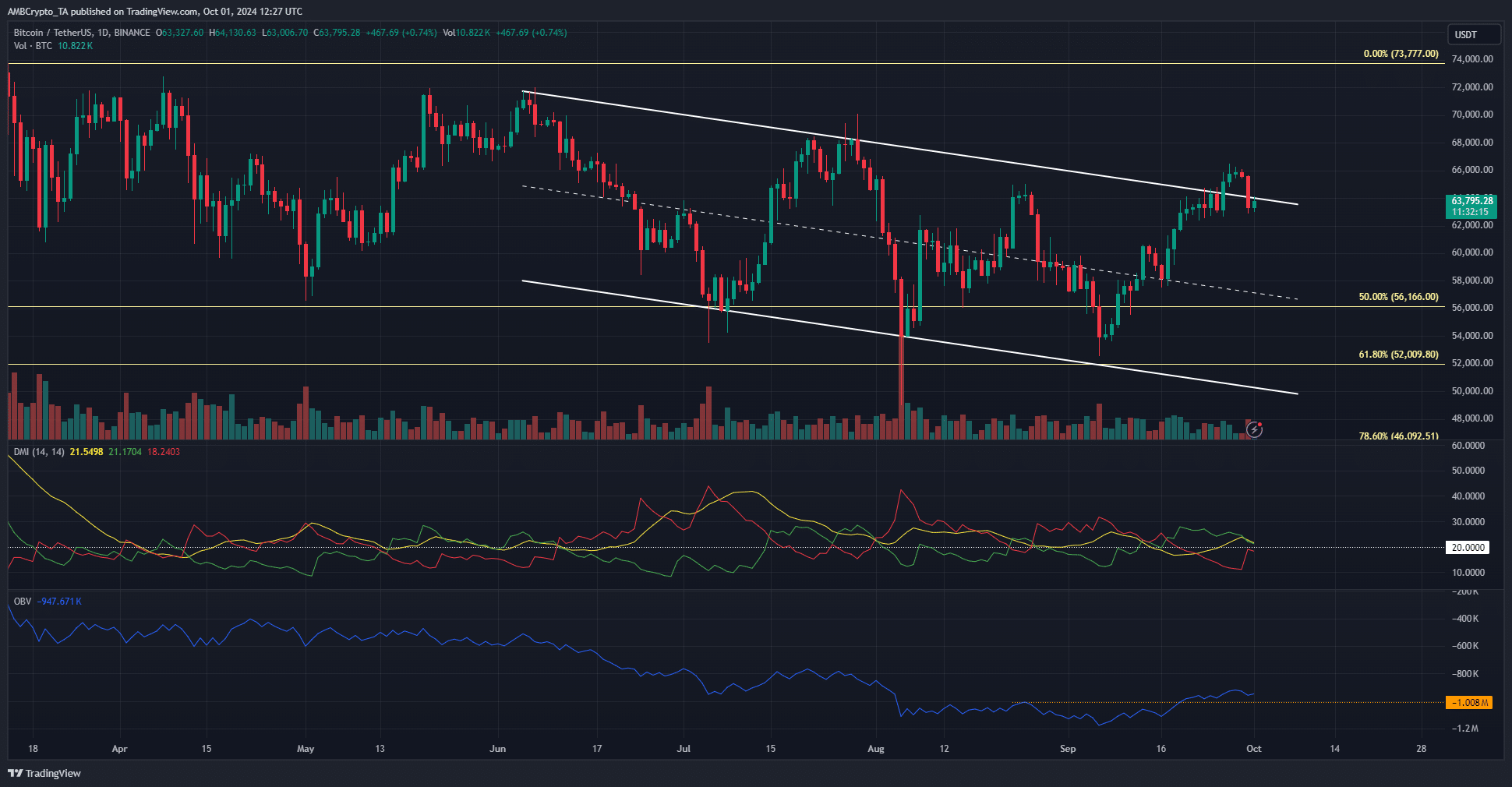

The failed channel breakout

The worth motion since June has been characterised by a sequence of decrease highs and decrease lows. The latest decrease excessive at $65k from the twenty fifth of August was breached, as had been the descending channel’s highs.

This breakout didn’t final lengthy. Inside 4 days, BTC noticed a 4.7% correction to fall again into the vary and beneath the $64k-$66k resistance zone.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

The OBV has cleared the native excessive from August, however not by a considerable margin. A failure to comply with via from the value meant that bulls lacked conviction within the brief time period and had been extra comfy taking earnings.

The DMI had signaled a powerful uptrend through the breakout. The +DI and ADX had been each above 20, and so they nonetheless are, however had been falling decrease. It’s doubtless that the $60k-$61.5k help zone subsequent.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion