Picture supply: Getty Photographs

The IAG (LSE:IAG) share value has slumped 10% over the previous 5 days, marking an finish to the broad upward trajectory of the final six months. So what’s occurring?

Airways are delicate

Airways are notably delicate shares in terms of geopolitical occasions, wars, and oil value fluctuations. As we’ve seen with current and ongoing conflicts, tensions and wars typically result in airspace closures, route disruptions, and decreased journey demand, straight affecting airline revenues.

Western airways are nonetheless having to keep away from Russian airspace, whereas Iran’s ballistic missile barrage on Israel brought on extra non permanent disruptions. I used to be a type of unhappy folks watching flightradar24 as airways diverted and Iranian property flew out of hurt’s approach on Tuesday (2 October) night.

In the meantime, other than the dreadful human value, wars are likely to have a profound impression on oil costs, in flip, severely impacting airways’ backside traces. Gas accounted for round 25% of IAG’s expenditure final yr.

So what occur right here?

Iran’s ballistic missile assault on Israel is dangerous for a lot of causes — most of them don’t have anything to do with investing. For one, this represented an arguably anticipated however tragic escalation of the continuing battle between Israel and Iran’s proxies.

However that is additionally a priority as a result of Iran stays a notable oil producer — representing round 3% of world output — and exporter with over 1.7 million barrels a day leaving the nation — a lot of it heading to Chinese language refiners that don’t recognise US sanctions.

We are able to speculate as to how Israel would possibly retaliate. Nevertheless, US President Joe Biden stated publicly on 3 October that Israeli strikes on Iranian oil amenities had been being thought-about.

The result’s oil spiked. On the time of writing, Brent Crude — a benchmark for oil — is up 8.9% over the week at $78 a barrel. Some analysts have even begun forecasting $100 a barrel by the top of the yr.

Gas hedging

It goes with out saying that as oil turns into dearer, so does jet gasoline. And that may impression the underside line of airways like IAG.

Nevertheless, European airways observe hedging. This includes fixing a gasoline value for a set interval, which may help corporations enhance value administration.

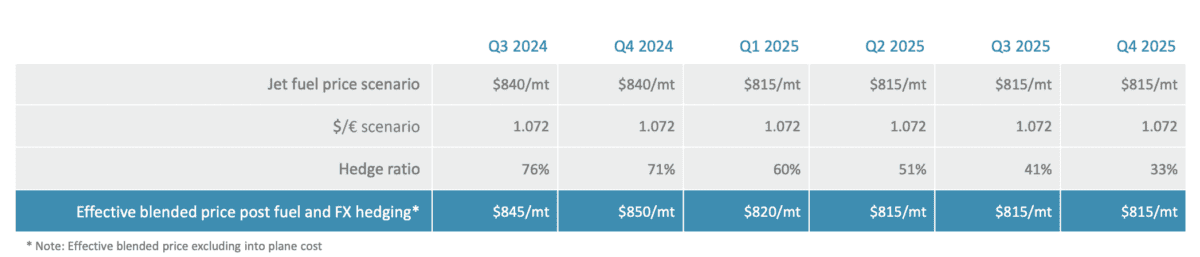

IAG, the proprietor of British Airways and Iberia, has a powerful hedging place, with simply 24% of Q3 gasoline — the present quarter — bought at reside or near-live costs.

As we are able to see from the above, IAG’s hedged round 74% of gasoline prices by to the top of the yr. This could put it in a powerful place to handle prices even when oil spikes.

Nevertheless, wanting additional into 2025, the corporate’s extra uncovered to market costs. Which means that whereas IAG has secured a degree of value stability for its gasoline prices within the rapid future, it faces better uncertainty and potential threat from oil value fluctuations as we transfer into 2025.

My take

Traders are at all times searching for good entry factors as shares fall. And it’s attainable the market’s overreacted to the escalation chance, one thing all of us fervently hope doesn’t occur.

There’s rather a lot to unpack right here, together with OPEC’s spare capability, slowing oil demand, Iran’s means to dam key oil provide routes, and IAG’s valuation.

This could possibly be a chance for buyers, however there are dangers connected.