- Crypto buyers have reportedly shifted focus to the current Chinese language inventory rally

- Because the fairness uptrend falters, will buyers revert to crypto buying and selling?

Chinese language shares’ rally has tapered after a disappointing stimulus package deal, elevating hopes of a possible shift to Bitcoin [BTC] and crypto buying and selling.

Since late September, Asian shares have rallied amid stable Chinese language authorities stimulus packages and expectations that the insurance policies might proceed in 2024.

Based on Alex Kruger, an economist and market analyst, markets anticipated the Chinese language authorities to announce an additional $1.4 trillion fiscal package deal. Nonetheless, solely a $14 billion package deal was introduced.

This dampened market optimism, triggering most Chinese language shares to retrace current beneficial properties. How does that have an effect on BTC and crypto buying and selling?

China’s affect on crypto buying and selling

Based on a current Bloomberg report, the Chinese language inventory rally might need tipped some crypto buyers to reallocate capital to those booming equities. The report cited Tether’s USDT low cost relative to the U.S greenback (USD) since late September as an important indicator.

One professional famous that this coincided with China’s quantitative easing program and would possibly sign “panic buying” of Chinese language shares.

“If the traders are rushing to exchange back into fiat currency, it can be inferred that they are panic buying Chinese stocks.”

Ergo, buyers might need bought their USDT to purchase Chinese language shares. Now that the Chinese language fairness market rally has briefly stifled, will they shift focus to BTC and crypto buying and selling once more?

Based on Singapore-based crypto buying and selling agency QCP Capital, the waning Chinese language inventory rally might enhance BTC. The agency acknowledged,

“As the Chinese rally wanes, we anticipate capital reallocation back into crypto, reflecting the industry’s growing maturity as an alternative risk-on asset.”

Nonetheless, it added that the upcoming incomes season and September US CPI information scheduled for 10 October could possibly be draw back dangers. They might complicate the crypto market’s outlook.

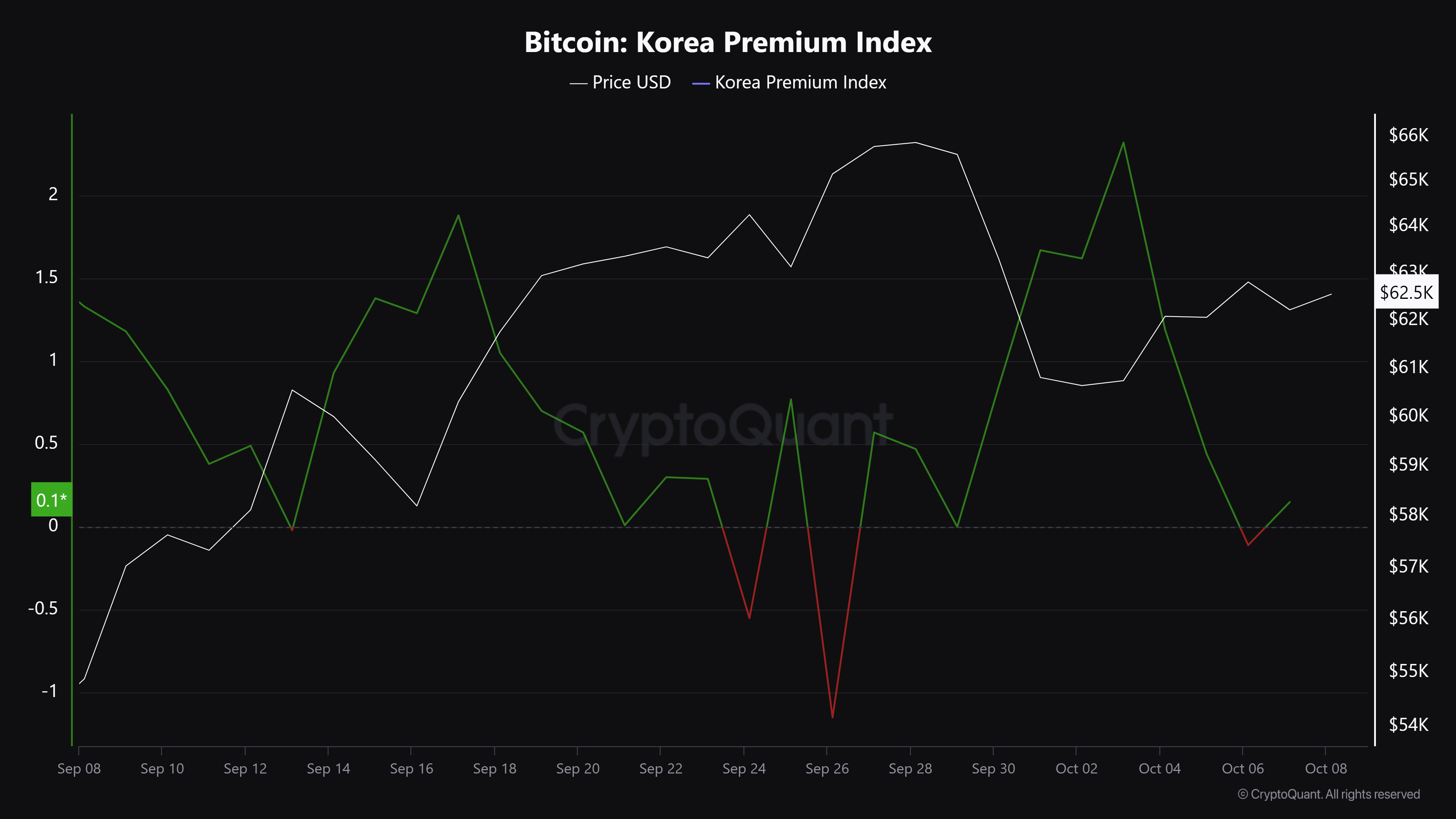

In the meantime, the BTC Korean Premium Index shaped a V-reversal sample at press time. It was above the impartial stage after dropping within the first week of October.

The metric, also called Kimchi Premium, tracks BTC value variations between South Korean and international exchanges. A better premium would counsel a stronger demand for BTC in Korea than abroad.

The aforementioned optimistic studying steered little Korean demand for the asset. On the time of writing, BTC was valued at $62.5k, down about 1% on the weekly charts.