The next is a visitor put up from Shane Neagle, Editor In Chief from The Tokenist.

The regular Bitcoin trickle into the mainstream consciousness since 2009 mainnet launch had many cascading results. First, it served as a revelatory automobile by exemplifying the character of cash; why it must be exterior of central banking, and why fastened provide is necessary for the valuation of cash.

Second, Bitcoin sparked a complete crypto business, additional making the case for decentralized monetary providers that remove gatekeepers in favor of good contracts enforced by blockchain networks. As this $2.2 trillion sector develops, banks are additional poised to lose their position as trusted intermediaries.

Third, information heart infrastructure is changing into extra necessary than ever. Whether or not home-based or as giant mining operations, crypto infrastructure wants dependable high-performance computing assets, storage capability and reminiscence alongside quick networking to maximally scale back blockchain latency.

Actually, information facilities are so important that a complete data discipline emerged to stability energy necessities, cooling options, server density and crypto internet hosting location. When these components come collectively, crypto must forge an indelible mark on the info heart design itself. Let’s discover how.

The Vital Position of Knowledge Facilities in Crypto Infrastructure

Within the early days of the web, broadband connection was uncommon. This necessitated native assets inside companies and establishments for use for information storage and administration. By the top of 2000s, broadband infrastructure had change into sufficiently ubiquitous to start out supporting cloud computing.

In different phrases, information facilities had been being delocalized into distant, scalable, on-demand server clusters. The flexibility to remove on-premise infrastructure and host information and apps remotely drastically lower upfront capital expenditure. After all, this finally benefited Amazon Net Providers (AWS), Microsoft Azure and Google Cloud as the info heart triumvirate that powers the majority of at the moment’s digital panorama.

Nonetheless, securing blockchain networks exerts a completely new load layer. As a result of these digital ledgers facilitate real-time transaction processing, between a number of nodes to confirm them, further CPU, GPU energy and RAM is required to attenuate congestion and latency.

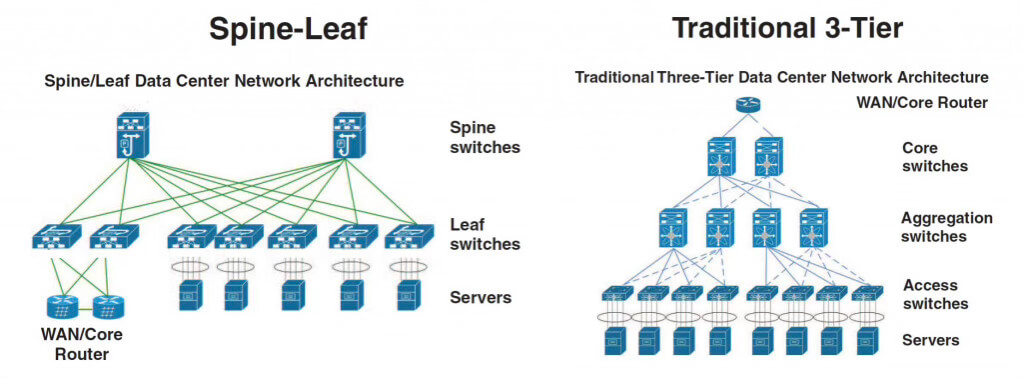

And if there’s a sudden spike in blockchain community site visitors, this too requires useful resource redundancy. That is why each AI and blockchain-oriented information facilities have been transitioning from conventional client-to-server structure (north to south) to spine-and leaf structure (east to west).

The spine-leaf method makes for a non-hierarchical design that permits information to move horizontally between servers. That is important for blockchain networks, as every node straight communicates with different nodes with out having to undergo a congestible central level.

Due to this fact, a spine-leaf structure alleviates bottleneck and single level failure potential. As a result of this mirrors the spirit of crypto decentralization and peer-to-peer (P2P) communication, spine-leaf information facilities have change into the brand new customary for blockchain reliability and safety.

Power Consumption and Effectivity Challenges

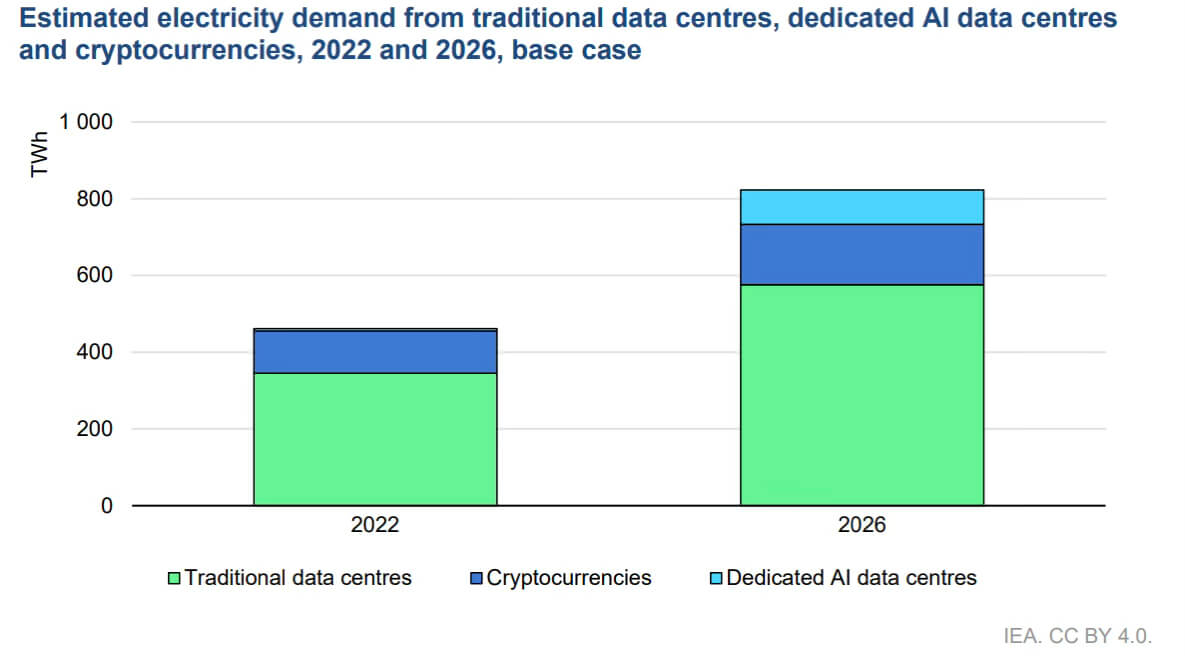

As blockchain networks want larger compute energy to validate transactions and execute good contracts, so is there larger want for vitality consumption. By 2022, blockchain networks have already carved a big proportion of information heart electrical energy demand.

In accordance with the Worldwide Power Company (IEA), the info sector servicing the crypto business globally consumed 460 TWh in 2022, which is forecasted to greater than double by 2026.

For comparability, France consumed 447 TWh yearly in 2021. These traits clearly level to a dependable supply of energy, which is why Microsoft noticed match to make a 20-year cope with Constellation Power to restart Unit 1 nuclear reactor in 2028.

In Europe, the European Fee even designated Small Modular Reactors (SMRs) as “green” to stability decarbonisation efforts with elevated electrical energy demand. However uncooked energy capability is barely the start of scaling.

To make crypto-oriented information facilities extra environment friendly, they’re transferring nearer to energy crops. That is greatest exemplified by Bitcoin. The first cryptocurrency makes use of a proof-of-work algorithm to safe the community, successfully anchoring Bitcoin within the bodily world of vitality and {hardware} belongings.

That is what finally offers Bitcoin its worth as decentralized cash and international switch of wealth. In essence, Bitcoin represents digital vitality. However as a result of energy is misplaced over lengthy distance electrical transmission, on account of copper/aluminum resistance, it might be wasteful to erect crypto information facilities simply anyplace.

Quite, they need to be as near energy crops as potential to attenuate transmission loss. Living proof, the New York state energy plant bypasses state degree community by straight plugging in 1000’s of servers. Likewise, Ward Roddam, mayor of Rockdale, Texas, lately made the case that Bitcoin mining can revitalize communities by investing to siphon extra vitality and stabilize the electrical grid with versatile load demand.

“Riot Platforms is constructing a state-of-the-art facility in Corsicana, which will probably be one in every of Navarro County’s largest employers. The mine may carry $1.4 billion in taxable purchases and over $115 million in wages over the following decade.“

One other crypto mining firm, TeraWulf, has been constructing its Nautilus Cryptomine adjoining to the Susquehanna nuclear energy plant, now within the arms of Talen Power. This would be the first zero-carbon, nuclear-powered Bitcoin mining facility.

With a 200 MW capability, this might be the equal to ~160,000 US households’ vitality consumption yearly.

Adapting Knowledge Middle Design for Blockchain Know-how

Along with spatial proximity to cut back transmission loss, information facilities servicing blockchain networks want specific mechanical, electrical and plumbing (MEP) necessities. As each PC proprietor is aware of, the supply of such necessities at giant scale comes from warmth administration.

Steady fixing of cryptography puzzles requires nice computing energy which generates warmth. For a few years, air cooling has been the go-to answer to lengthen {hardware} longevity and dissipate warmth. Sadly, cooling additionally attracts vital vitality on prime of computing itself.

That is why there’s a new pattern to rely extra on direct-to-chip liquid cooling (immersion cooling) which cuts down on energy utilization.

₿𝗥𝗘𝗔𝗞𝗜𝗡𝗚: 33,000 new immersion-cooled #bitcoin mining computer systems join on-line at the moment. This 100 megawatt facility is now the most important electrical energy person in Sadersville, Georgia. pic.twitter.com/5TzqF9f3IT

— Documenting ₿itcoin 📄 (@DocumentingBTC) February 13, 2024

Besides, some of these information facilities want superior HVAC management methods and capability to deal with thermal masses. Equally so, high-power-density clusters, at 20 – 40 kW per rack, require bigger energy transformers, backup methods and high-capacity energy distribution items (PDUs).

For instance, Crypto Minotaur PDU can deal with as much as 92.4kW price of energy density. Lastly, to make sure steady blockchain workloads, such information facilities usually depend on backup redundancy through pure gasoline or diesel energy turbines coupled with automated switch switches (ATS).

Tier Changes and Value Administration

These conversant in the internal workings of Bitcoin code know that its safety is derived from the idea of Byzantine Fault Tolerance (BFT). In brief, even when a number of community nodes fail, the consensus on the present state of the ledger continues to be achieved.

In information heart design, which means that blockchain miners must account for redundancy tiers in line with the Uptime Institute:

- Tier I: Fundamental Capability, no IT redundant gear, downtime as much as 1729 minutes

- Tier II: Redundant Capability – gear failure much less more likely to result in community downtime (1361 minutes)

- Tier III: Concurrently Maintainable – due to duplicate IT gear, upkeep and enlargement doesn’t result in downtime (95 minutes)

- Tier IV: Fault Tolerance – parallel cooling and energy methods for minimal downtime potential (26 minutes)

After all, as every tier will increase redundancy, so does it will increase the price. Massive firms with deep pockets can afford such scaling after which entice smaller companies into their cloud computing ecosystems.

Living proof, Microsoft Azure’s information heart infrastructure is licensed as ISO/IEC 27001:2013 and NIST SP 800-53 for community safety and reliability, which is the prerequisite to realize Tier IV degree of fault tolerance.

Nonetheless, such redundancy just isn’t strictly vital for Bitcoin wants, as different nodes across the globe can take up the slack. Bitcoin’s 10-minute block affirmation interval was deliberately picked by Satoshi Nakamoto to inject inherent redundancy within the community.

Nonetheless, this may occasionally not apply to blockchain networks like Solana (SOL) or Avalanche (AVAX) with near-instant settlements that goal to supplant Visa-like cash switch methods. For actions like day buying and selling, they might require most uptime supplied by Tier IV information facilities.

To that finish, Solana Basis fashioned the Solana Server Program. Its versatile month-to-month contracts depend on information heart suppliers like Edgevana. Ethereum and Avalanche usually use AWS, Google Cloud and Tencent Cloud for the majority of their server wants.

Viability of Crypto Mining Operations

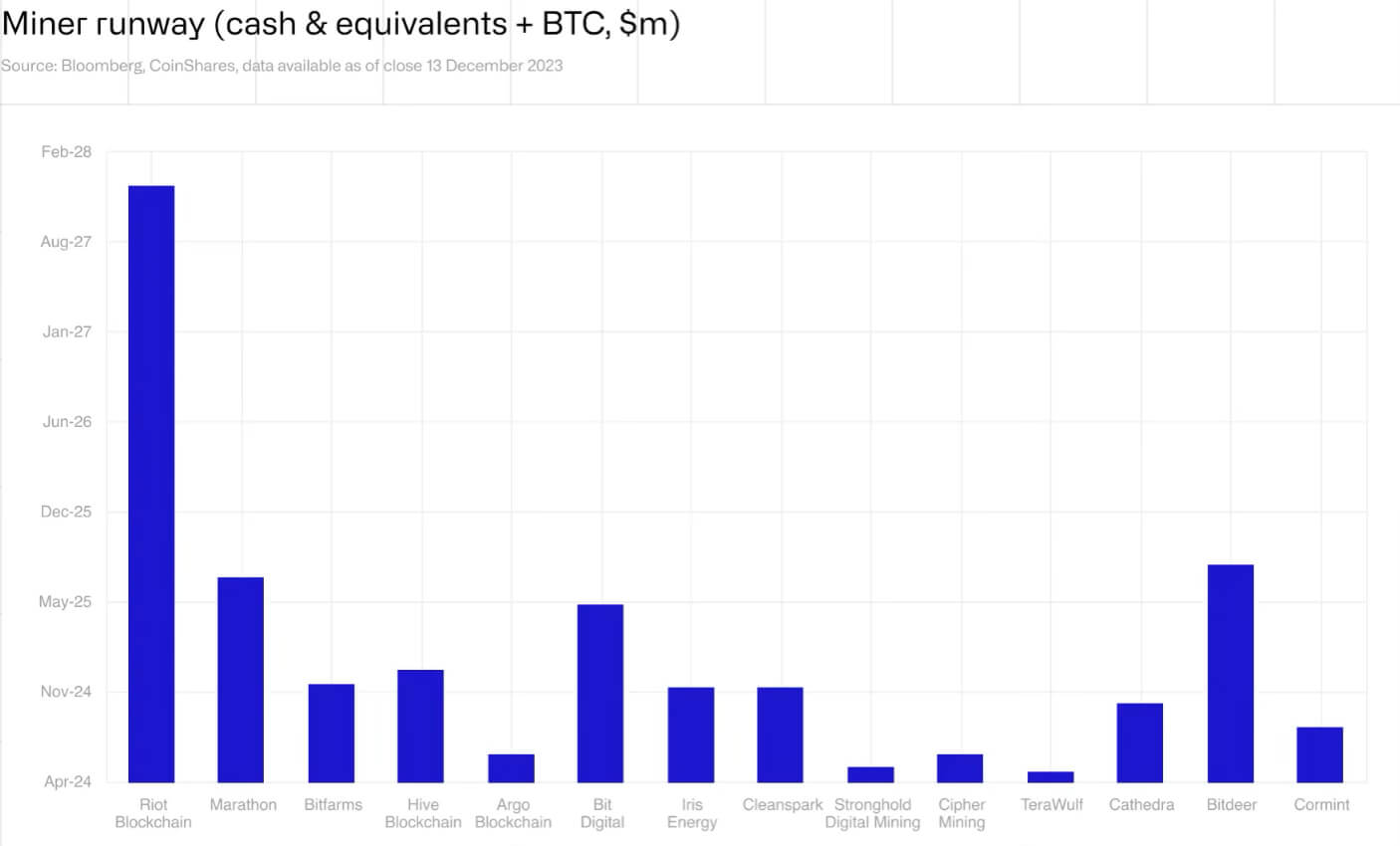

After the 4th Bitcoin halving in April, miners’ rewards had been lower in half, from 6.25 to three.125 BTC. On the identical time, Bitcoin community issue elevated from 86.3886 T to current 88.4044 T. It’s additional estimated that the following Bitcoin issue adjustment will improve by 3.81% on October ninth.

This interprets to fewer funds for a similar quantity of computational exertion and vitality consumption. But, this might exert a damaging impression, to the purpose of chapter, provided that Bitcoin value had been to fall beneath $40k, in line with CoinShares’ report.

Taking into consideration the spectrum of preliminary capital expenditures, this interprets to totally different value runways for various mining firms.

Analyze the return on funding for crypto mining operations, notably in gentle of current reductions in Bitcoin mining rewards. Contemplate the potential for added income streams, similar to changing amenities for warmth reuse.

However with main promoting pressures out of the best way, specifically from the German authorities and Mt. Gox funds, it’s extra probably that BTC value will go up relatively than drop. Traditionally, BTC value achieves a brand new all-time excessive inside ~18 months following the halving occasion.

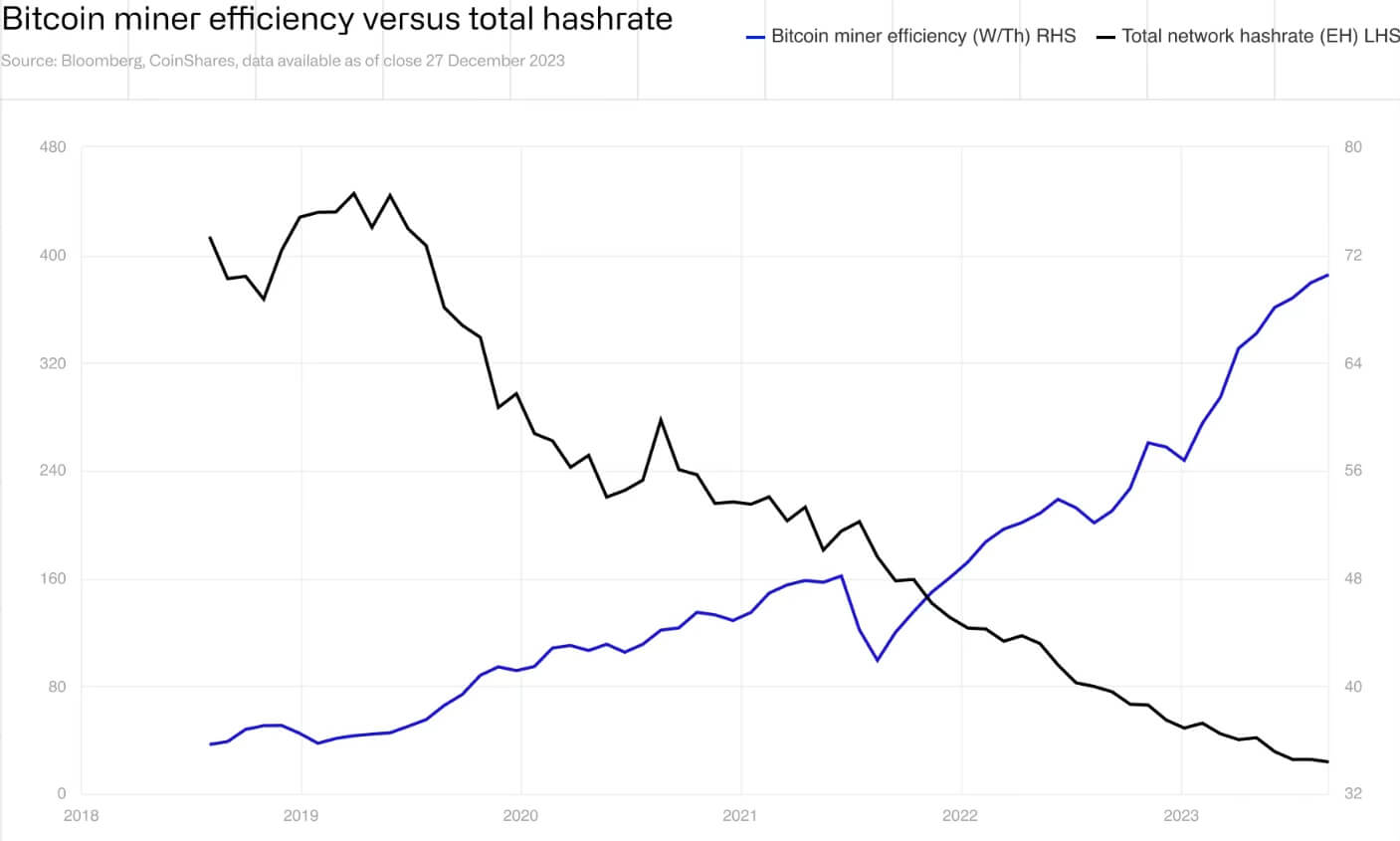

Moreso, the USG’s uncontrollable spending is more likely to additional cement Bitcoin’s case for sound cash because the greenback’s worth continues to steadily erode. Lastly, Bitcoin mining effectivity continues to enhance, as famous by aforementioned cooling immersion and upgrades to newer ASIC machines similar to Antminer S21.

Integrating Sustainable Practices into Crypto Mining

For an electrical grid to stay steady (and usable) it has to stability intervals of excessive and low demand. The Bitcoin community is ideally suited to this process as Bitcoin miners can regulate utilization on the fly.

After Texas legislatures handed Home Invoice 591, Bitcoin information facilities have an additional position to play in vitality sustainability. The invoice permits oil and gasoline operators to promote vented/flared gasoline to on-site cell information facilities. This gasoline would in any other case be wasted as a byproduct of extraction.

Such redirection is estimated to cut back their carbon footprint by as much as 63%. On prime of this, Bitcoin information facilities utilizing immersion cooling can use that vitality to warmth water. Utilizing this method Canadian crypto miner startup MintGreen has been deploying Digital Boilers in Vancouver.

500 kVA for in-house Digital Boiler testing ♨️🌱 pic.twitter.com/KMhlgbFbej

— MintGreen (@MintGreenHQ) March 19, 2024

Extra information heart warmth may be used to warmth greenhouses, as showcased within the Netherlands by BloemBitcoin.

🌷 💨 pic.twitter.com/uEemmptSGg

— BitcoinBloem (@BloemBitcoin) March 4, 2023

If Bitcoin value positive aspects new excessive floor in 2025 and past, it isn’t tough to see larger mainstream acceptance of such progressive options.

Conclusion

Crypto mining first introduced into focus giant scale high-performance computing (HPC). For the longest time, this was met with hostility, usually painted as wasteful. After BlackRock’s profitable integration of Bitcoin through its IBIT ETF, such considerations have largely disappeared. Sure, this was the identical BlackRock that pushed the Environmental, Social, and Governance (ESG) framework within the finance sector.

Crypto mining is now set to be overshadowed by generative AI infrastructure, benefiting from years of classes discovered in giant scale information heart deployment. Furthermore, even crypto mining firms like Core Scientific and Iris Power are adopting a hybrid method by internet hosting each GPU servers for AI and ASIC machines for Bitcoin mining.

In the long run, crypto information facilities have confirmed to be something however wasteful.