- The Nakamoto improve will assist enhance transaction pace.

- Market sentiment, nevertheless, remained bearish on the token.

Bitcoin’s [BTC] layer 2, Stacks [STX], has been getting ready for a significant improve for a number of months.

Nevertheless, whereas the L2 was preparing for this improve, the token’s value motion turned bearish. Will this improve fire up sufficient bullish sentiment to push the token as much as $2?

All about Stacks improve

Named after Satoshi Nakamoto, the nameless developer of Bitcoin, the Nakamoto improve will separate Stacks’ block manufacturing schedule from Bitcoin.

The upcoming Stacks improve will probably be pushed on the twenty ninth of October.

As per the official doc,

“The Nakamoto Release is an upcoming hard fork on the Stacks network designed to bring several benefits, chief among them are increased transaction throughput and 100% Bitcoin finality.”

Manufacturing of Stacks blocks would not be depending on miner elections beneath Nakamoto.

Fairly, miners generate blocks at a predetermined charge, and the set of PoX Stackers relies on miner elections to determine when to modify from one miner to a different.

Will STX cross $2?

Although the blockchain was getting ready for a significant improve, its token, STX, didn’t see a lot profit. CoinMarketCap’s knowledge revealed that STX’s value dropped by greater than 5% within the final 24 hours.

At press time, Stacks was buying and selling at $1.84 with a market capitalization of over $2.75 billion. The unhealthy information was that the token’s buying and selling quantity elevated whereas its value dropped, which legitimized the value drop.

AMBCrypto selected to dig deeper into STX’s present state to search out out whether or not it’s viable to count on the token to the touch $2 within the coming days.

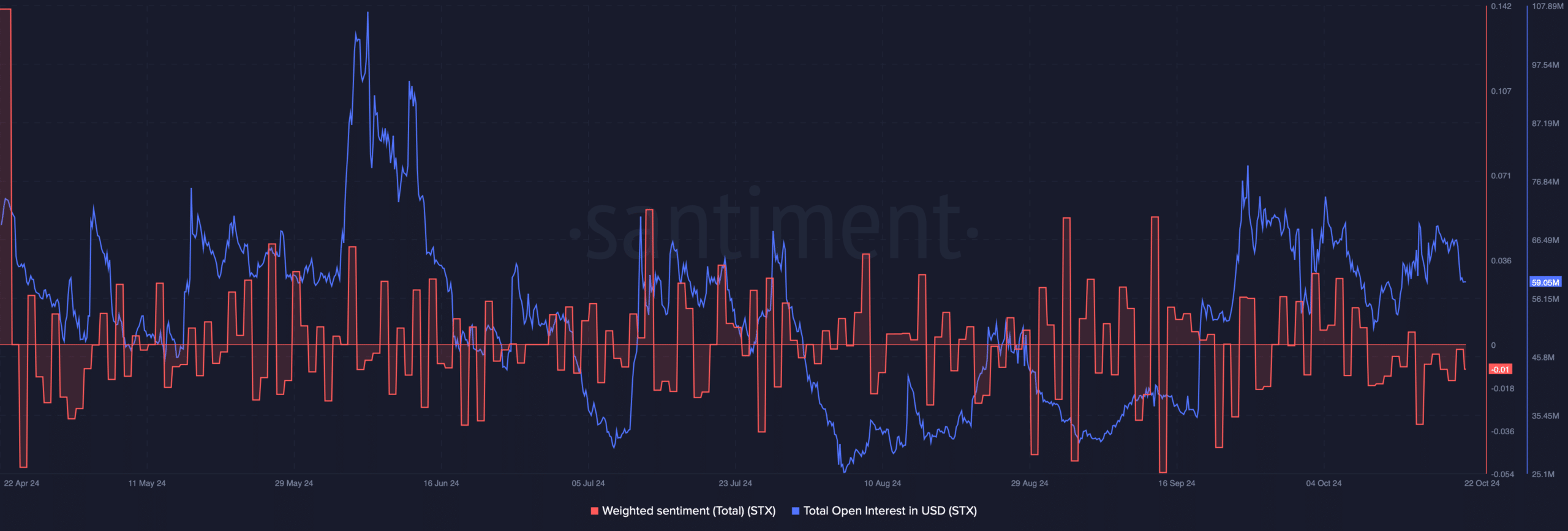

As per our evaluation of Santiment’s knowledge, STX’s Weighted Sentiment dropped considerably final week. This meant that bearish sentiment across the token was rising, hinting at a insecurity amongst buyers.

Additionally, as per Coinglass’ knowledge, STX’s Lengthy/Quick Ratio noticed a dip. Each time the metric drops, it signifies that there are extra quick positions available in the market than lengthy positions, which could be thought of a bearish signal.

Lastly, Stacks’ Open Curiosity noticed a decline. This indicated that the continued bearish value development may change within the coming days.

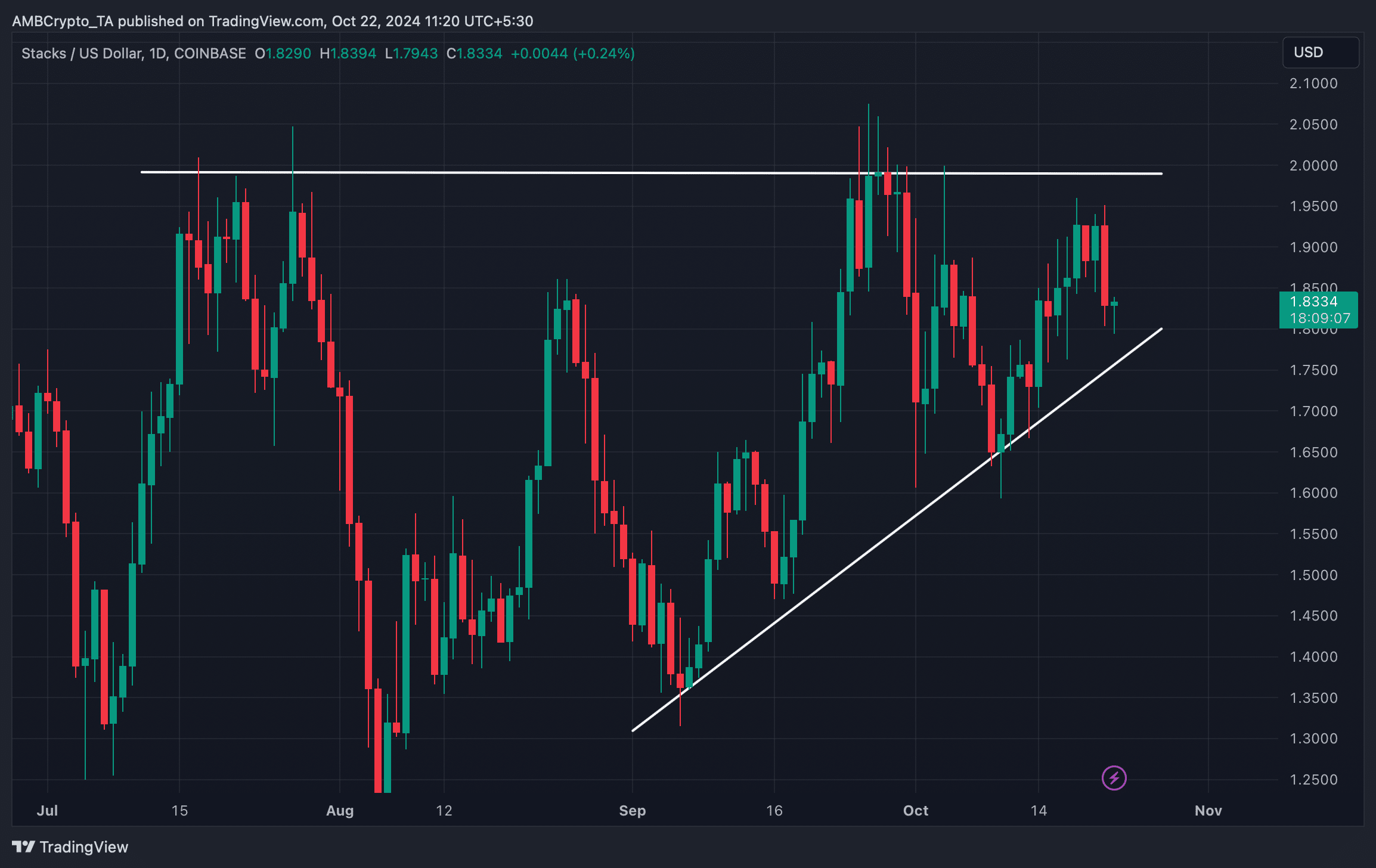

AMBCrypto took a have a look at STX’s each day chart to raised perceive what to anticipate.

Learn Stacks [STX] Value Prediction 2024-25

As per our evaluation, STX’s value was shifting inside a rising triangle sample. The most recent value decline might have been as a result of the token was consolidating contained in the sample.

A breakout above the rising triangle might push the token effectively above $2 within the coming days.