- BTC ran as much as $70K flipped community fundaments optimistic.

- Is it a bullish sign regardless of the short-term correction and certain consolidation?

Bitcoin [BTC] community fundamentals turned optimistic for the primary time in October, on what an analyst deemed a optimistic sign for the asset within the medium time period.

In line with CryptoQuant, the optimistic community metrics have been a well-known pattern throughout bullish durations and recommended a possible optimistic final result for the asset regardless of a possible correction or consolidation.

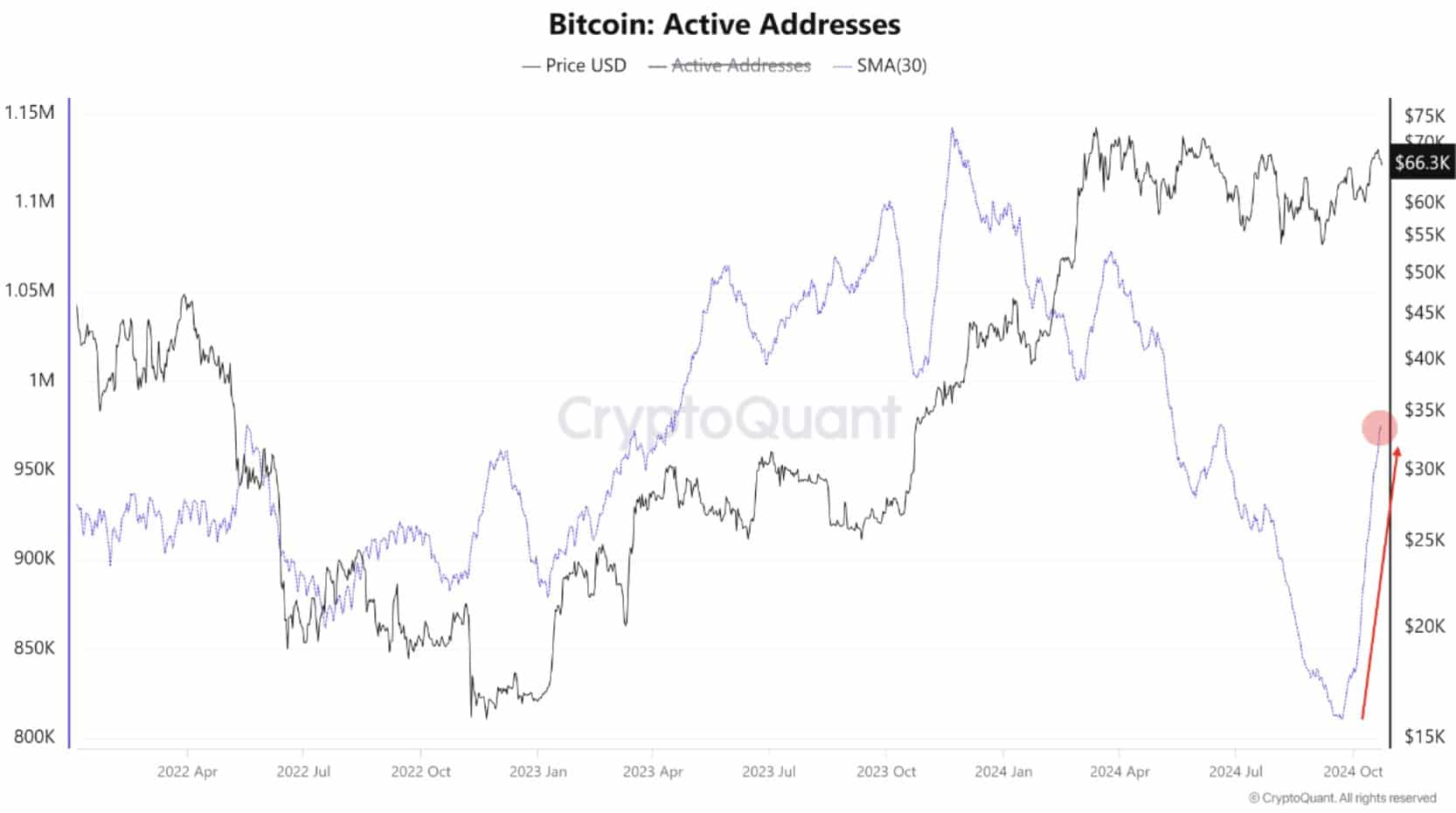

Following a latest run in the direction of $70K, the 30-day common variety of energetic BTC addresses surged in the direction of the 1 million mark. It hit ranges final seen in June, indicating large curiosity within the asset amid final week’s pump.

A BTC hike subsequent?

An identical optimistic pattern was recorded throughout the mining phase and community charges. Notably, the mining problem hit an all-time excessive, indicating intense competitors for rewards amongst BTC miners, a optimistic catalyst for BTC’s intrinsic worth.

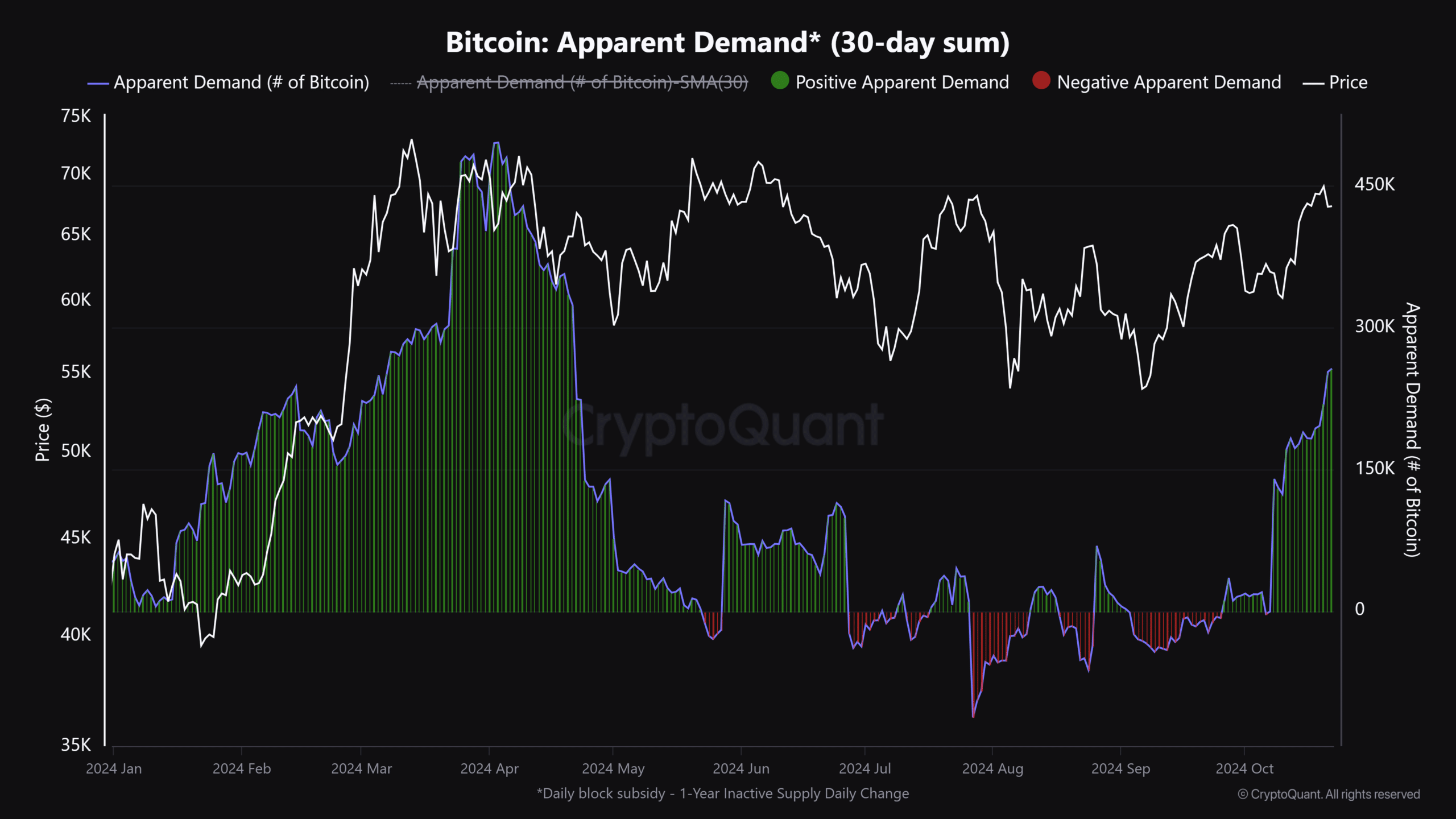

Moreover, BTC’s obvious demand, or distinction between manufacturing and stock schedule, surged to a 6-month excessive of 256K BTC as of press time. Usually, the spike in demand is at all times preceded by a BTC value hike.

Regardless of the above optimistic catalysts, analysts had combined BTC value projections because the US elections edged nearer.

Blockworks’ analyst Felix Jauvin cautioned that BTC might be range-bound till the election was over.

“No person needs to be a marginal purchaser of threat right here this near the election. In all probability only a complete lotta chop till it’s over….:

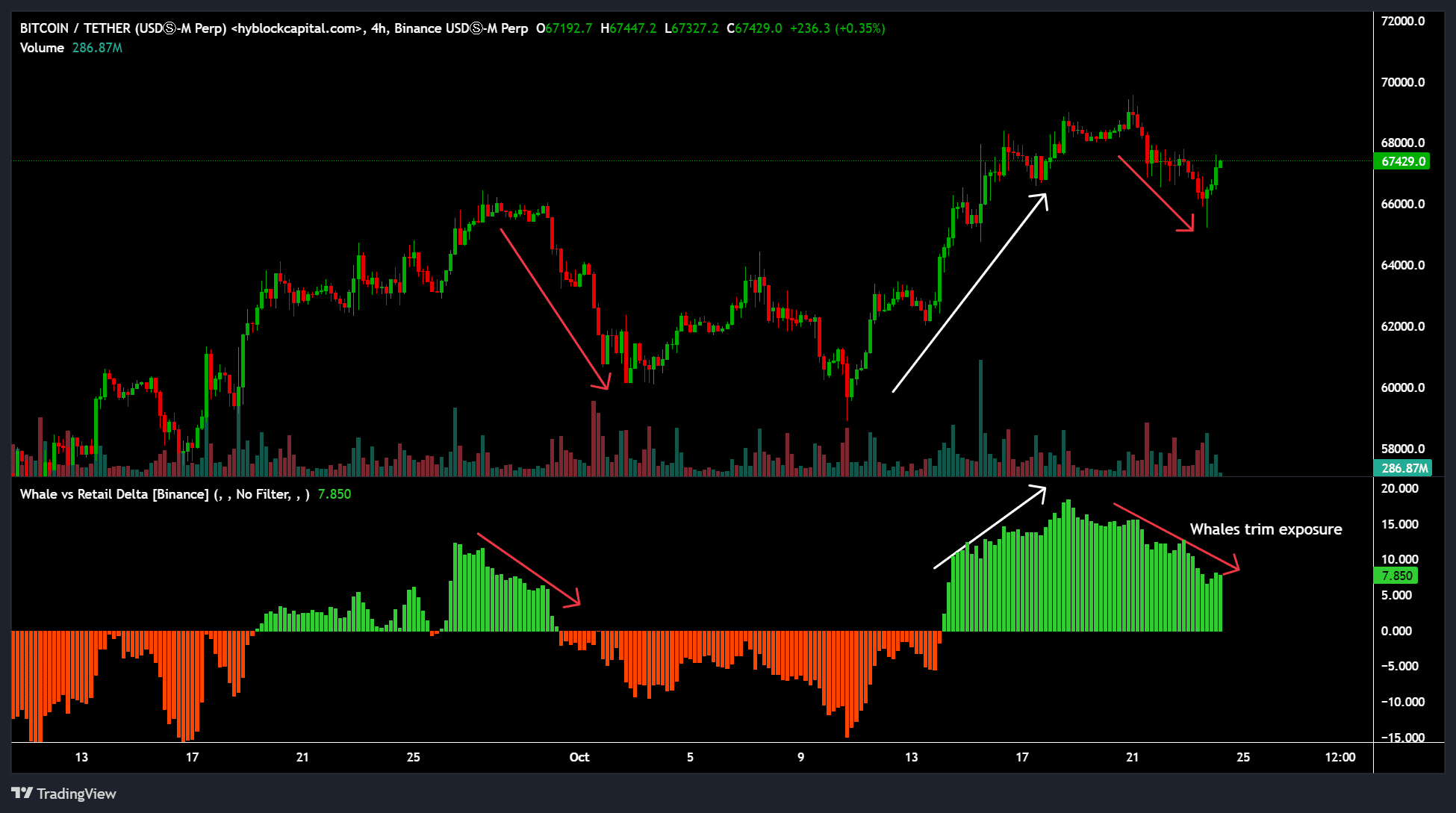

One other pundit, Justin Bennett, echoed his cautious sentiment, citing whales’ lack of curiosity in grabbing the latest mid-week dip.

Since seventeenth October, Whale vs. Retail Delta, which tracks whales’ positioning relative to retail merchants, has declined, suggesting that whales trimmed publicity on BTC.

Curiously, choices merchants remained bullish, as seen by their elevated shopping for of name choices (bets that the BTC value will rise) by election day.

On the 22 October day by day replace, buying and selling agency QCP Capital famous,

“Short-term implied volatility is peaking at election day expiry, with a 10-vol spread over the prior expiry and skews favouring calls over puts, despite BTC being about 8% below its all-time highs”