- BTC has declined over the previous week by 1.67%.

- Bitcoin’s variety of particular person traders should stay above 54 million for it to rally.

Over the previous week, Bitcoin [BTC] has skilled a big market correction. The correction was accompanied by a pointy decline in buying and selling actions. Notably, buying and selling quantity has declined by 62%, implying much less demand and fewer members.

This decline in members has left analysts speaking concerning the significance of particular person traders for a BTC rally. One in all them is the CryptoQuant analyst Burak Kesmeci, who has instructed that BTC should exceed 54 million particular person traders to rally.

Why 54 million particular person traders are essential

In his evaluation, Kesmeci posited that the indispensable situation for Bitcoin’s bull rally is a surge within the variety of particular person traders.

In line with him, BTC must exceed 54 million particular person traders for the crypto to see a worth rise. The variety of particular person traders elevated for 12 months after dropping to 43 million in January 2023.

Over this era, it has elevated to hit 52.4 million, making a 22%. After the approval of ETFs, the quantity declined to 51.6 million in February 2024.

Nevertheless, this quantity noticed a sustained enhance throughout the March 2024 rally and peaked at 54.14 million in June. Since then, the variety of particular person traders has declined.

Traditionally, a rise within the variety of particular person traders intently correlates with BTC costs. For example, BTC surged by 300% when the variety of particular person traders elevated in January 2023.

Consequently, after the variety of particular person traders peaked in June 2024, the Bitcoin worth declined.

Bitcoin’s variety of members continues to say no

The evaluation supplied by Kesmeci means that it’s important for the variety of traders to extend for a BTC rally. This means that new entrants into the BTC blockchain are important for worth appreciation. The query is, are new traders getting into the market?

In line with AMBCrypto’s evaluation, Bitcoin is experiencing a decline within the variety of members.

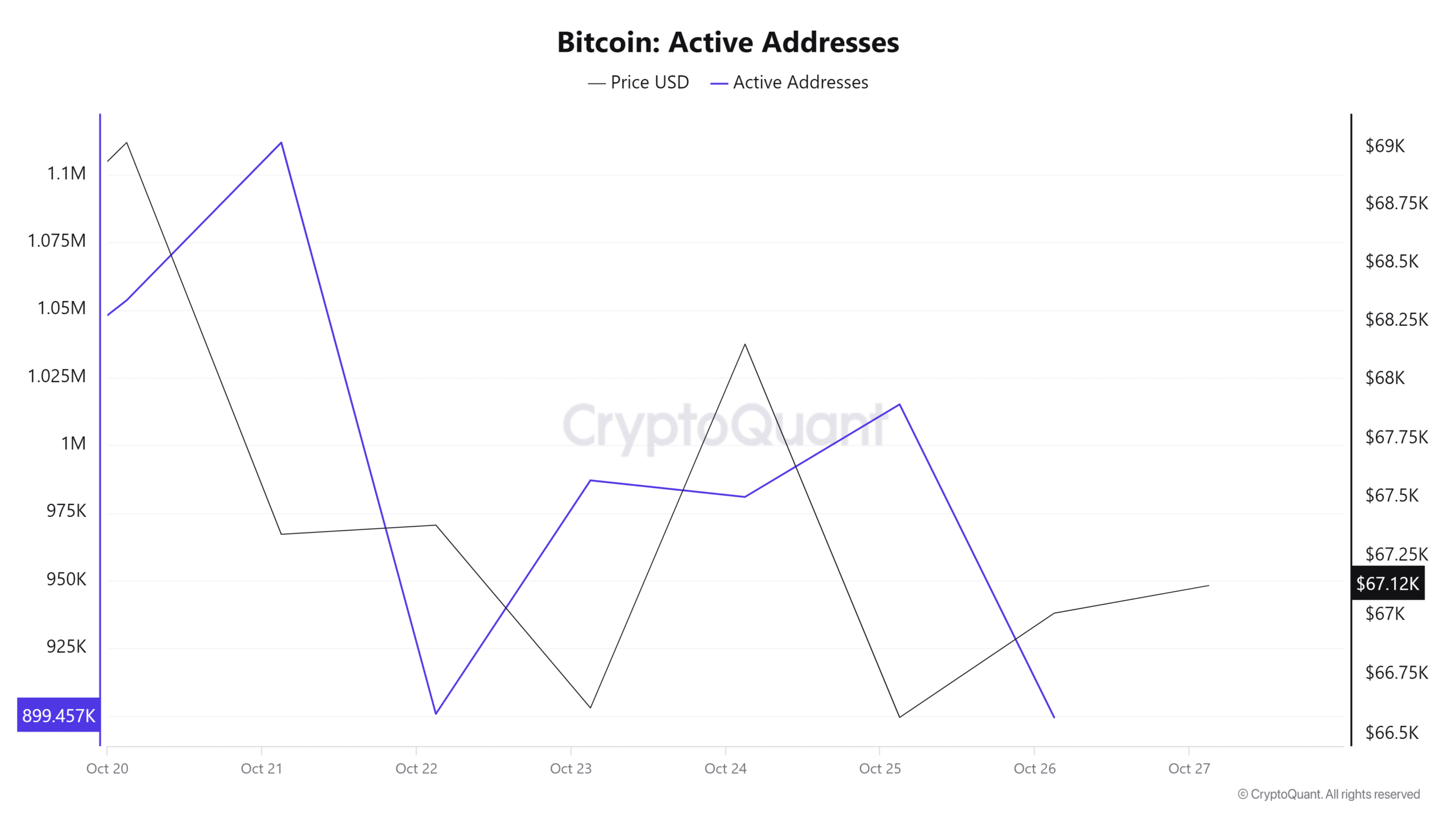

For instance, Bitcoin’s day by day energetic addresses proceed to say no. Over the previous week, energetic addresses have dropped from 1.1 million to 899k. This means that fewer traders are getting into the market, signaling a decline within the variety of particular person traders.

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

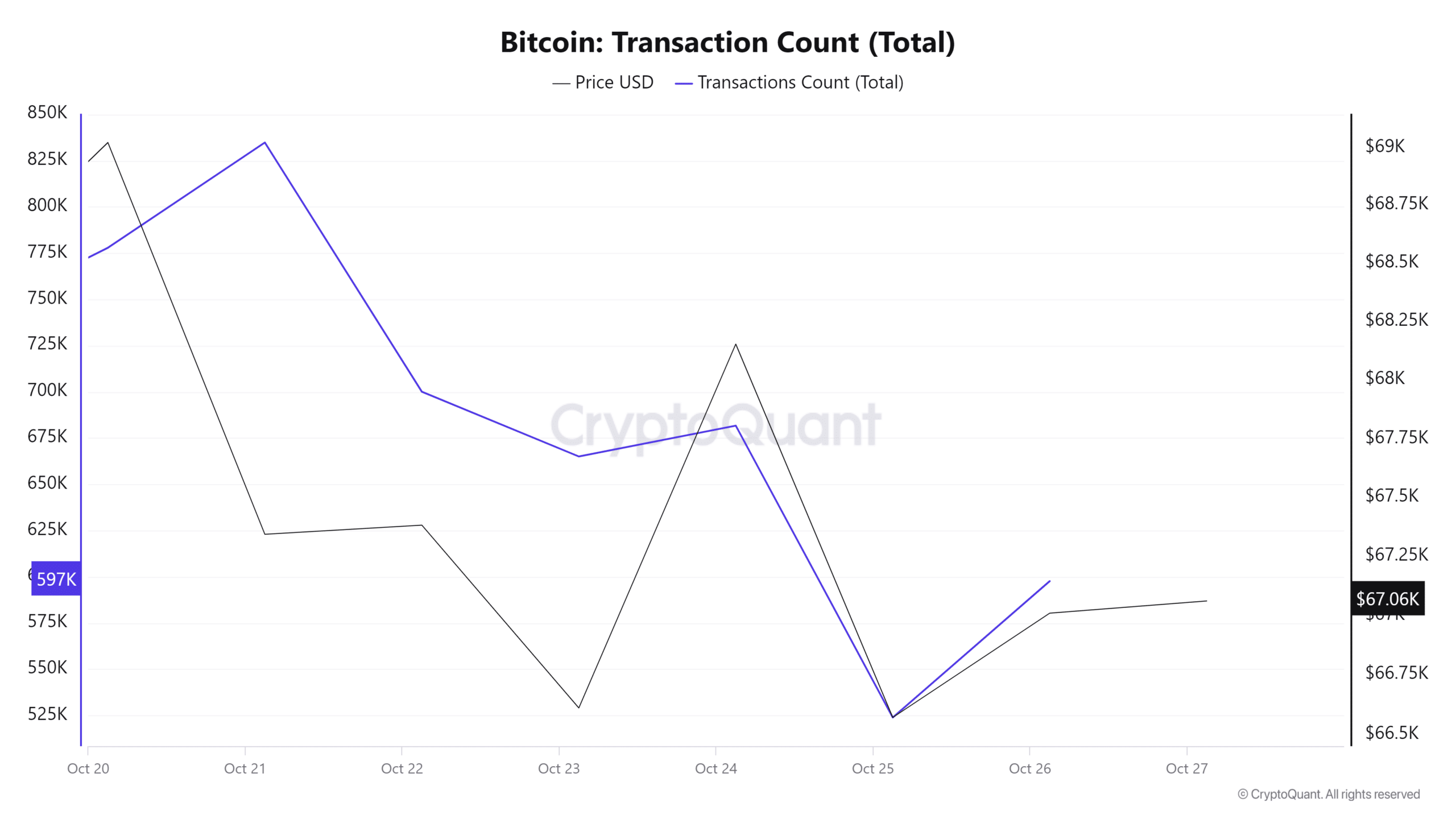

Moreover, Bitcoin’s transaction depend has declined from 834k to 598k over the previous week. This indicated decrease demand for BTC as fewer traders are utilizing the blockchain.

As noticed above, BTC is experiencing a decline within the variety of members. This normally leads to a market correction, as witnessed over the previous week with Bitcoin buying and selling at $67,074 at press time. Thus, if the present development persists, BTC may decline additional to $65,757.