- MicroStrategy plans to purchase $42B BTC within the subsequent 3 years.

- An analyst projected that MSTR will change into extra like a US spot BTC ETF.

Michael Saylor’s agency, MicroStrategy, introduced plans to amass $42 billion of Bitcoin [BTC] within the subsequent three years, simply earlier than the 2028 halving cycle.

“Today, we are announcing a strategic goal of raising $42 billion of capital over the next 3 years, comprised of $21 billion of equity and $21 billion of fixed income securities, which we refer to as our “21/21 Plan.”

This has bolstered Saylor’s uber-bullish stance on BTC, as he expects the asset to succeed in $3 million-$49 million within the subsequent 20 years. He has additionally supported Trump’s pro-crypto stance, with the most recent push for eradicating the capital beneficial properties tax on BTC.

Is MSTR altering to BTC ETF?

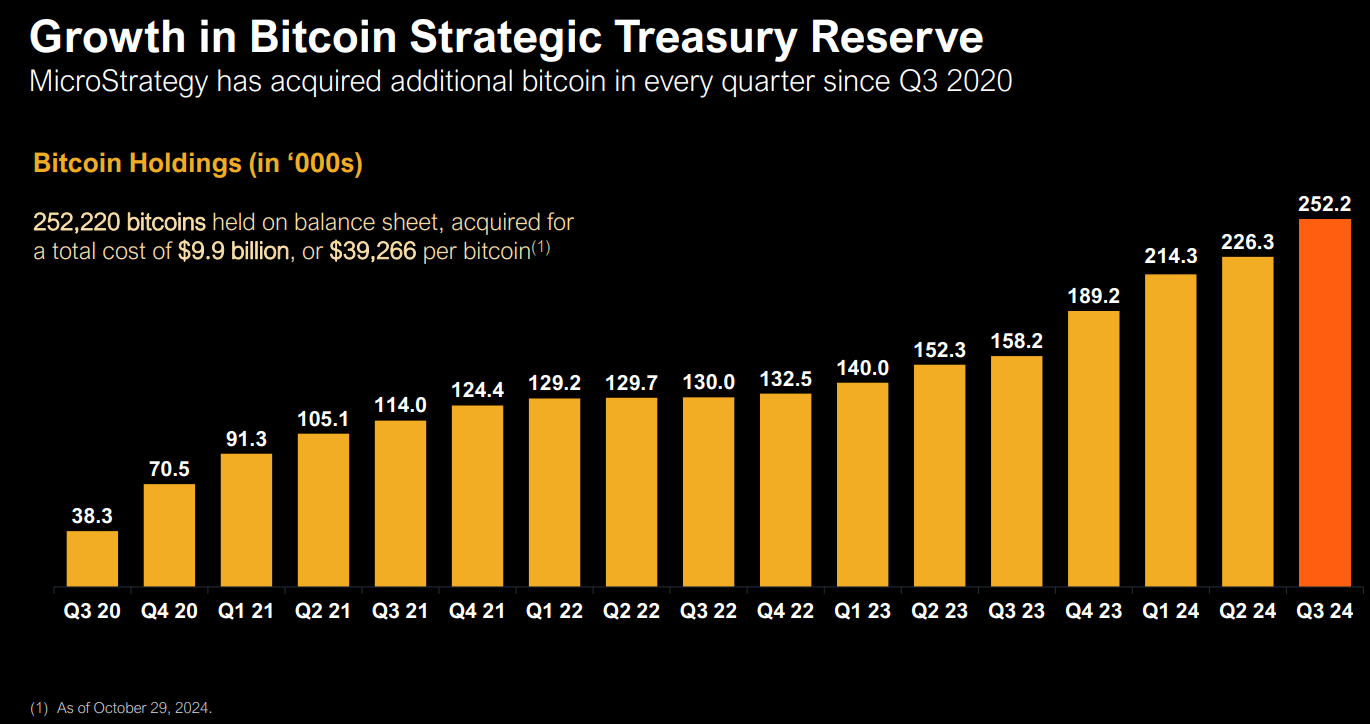

As of October 2024, MicroStrategy held 252, 220 BTC, acquired for $9.9 billion. The agency’s BTC stash was now value over $18.15 billion at present costs, translating to $8 billion in unrealized beneficial properties.

Nevertheless, a part of the agency’s $42 BTC acquisition plan can be accomplished by way of a $21 billion ATM (at-the-market) inventory issuance program, which some analysts consider would flip its inventory’s MSTR right into a BTC ETF.

One of many analysts, Quinn Thompson, founding father of macro-focused crypto hedge fund Lekker Capital, mentioned,

“By ripping the bandaid off and announcing a massive ATM shelf like this, they are turning $MSTR into a de-facto ETF.”

This might enable the agency to subject shares within the secondary market at any time to fund its BTC acquisition, nearly just like how US spot BTC ETFs function. Based on Thomspon, this might increase MSTR much more.

The fairness program, alongside the intention to subject convertible notes (debt) to purchase BTC, sums up the agency’s long-term imaginative and prescient of changing into a ‘Bitcoin bank,’ as revealed in mid-October.

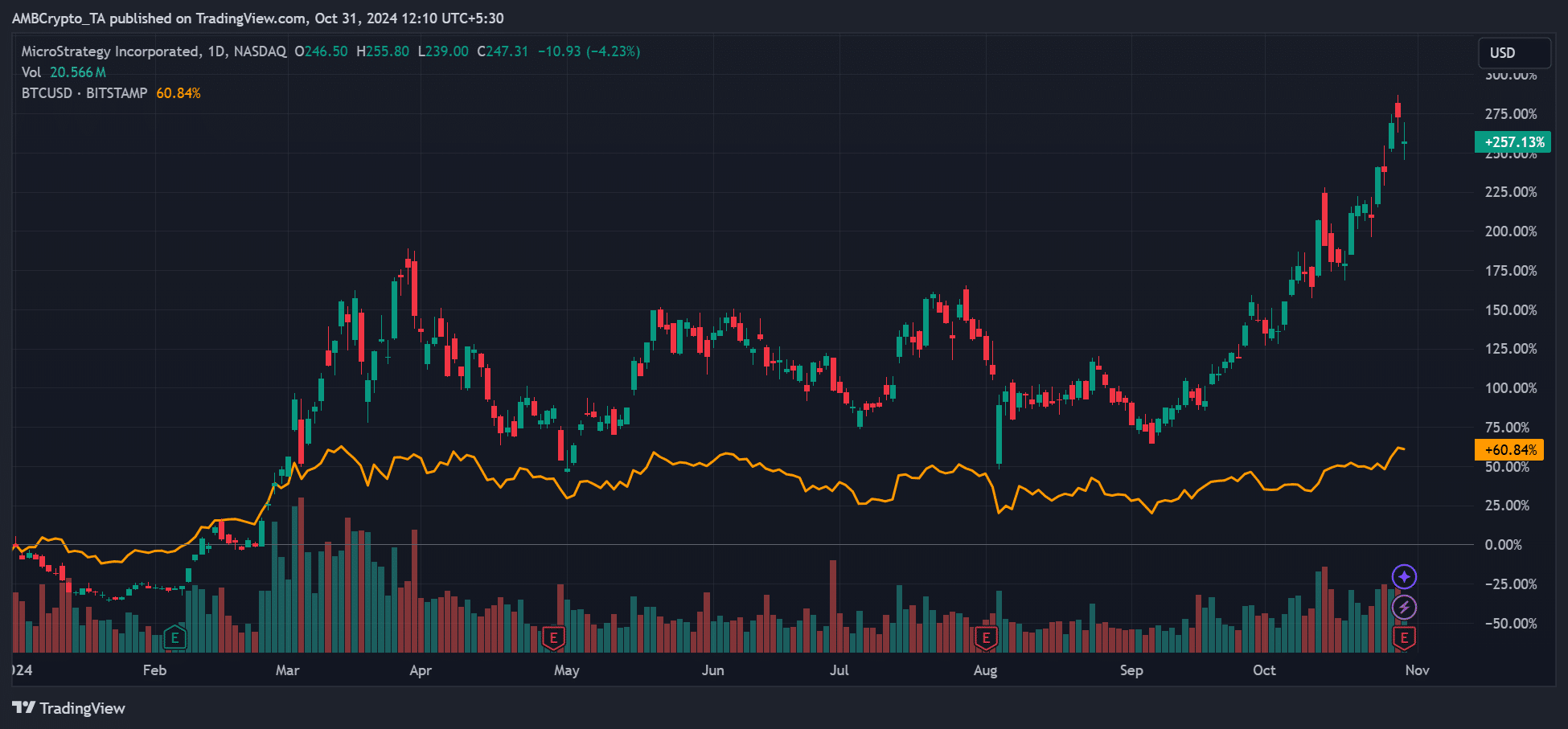

That mentioned, MSTR holders gave the impression to be the true beneficiaries of the most recent replace. MSTR has been the best-performing S&P inventory since adopting the BTC technique in 2020. This has seen MSTR outperform and will even downplay the agency’s newest Q3 lack of $19.4 million.

On year-to-date (YTD) foundation, MSTR was up +250%, greater than 4x BTC’s 60% beneficial properties. In Q3, MSTR rallied about 20%, whereas BTC closed the quarter with lower than 1% beneficial properties.

Briefly, from an investor returns perspective, it was higher to carry MSTR than BTC.

Apparently, the inventory was anticipated to put up an additional 7% rally after the most recent earnings report, famous Bitwise’s head of alpha methods, Jeff Park. Citing the MSTR choices knowledge, Park said,

“As we enter $MSTR earnings, an explosive set up: Nov 1 Vol is ~115%, implying a 7.2% move.”

At press time, MSTR was valued at $247, and it stays to be decided whether or not it would print a recent yearly excessive as Park projected amid BTC’s tight consolidation above $72K.