- Altcoin season may kick off in November, revealing sturdy funding alternatives.

- Nonetheless, altcoins as an asset class proceed to say no.

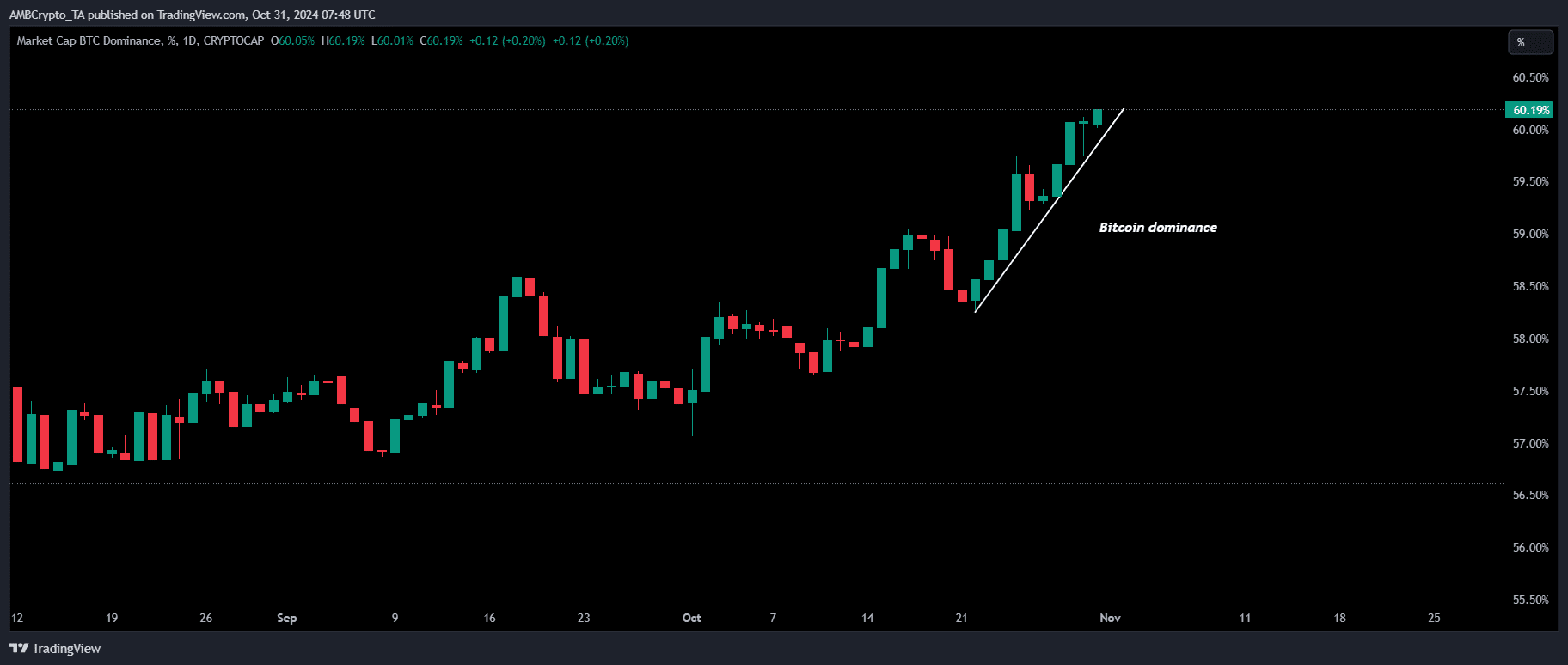

With election outcomes on the horizon and anticipated shifts in financial coverage, Bitcoin [BTC] is charting a unstable course, drawing merchants towards its relative stability. This traditional buying and selling transfer – looking for refuge in Bitcoin throughout market uncertainty – has pushed BTC near its all-time excessive of $73K, boosting its market dominance to over 60%.

As Bitcoin holds the highlight, may this excessive dominance set the stage for a wave of profit-taking into altcoins, sparking a possible altcoin season?

Submit-election cycle may kickstart an altcoin season

In earlier cycles, such because the run-up to Bitcoin’s all-time excessive of round $73K in March, altcoins noticed important rallies as retail traders diversified their portfolios, pushed by optimism and FOMO. Nonetheless, the present surroundings seems totally different.

A latest AMBCrypto report signifies that spikes in brief liquidations have considerably influenced Bitcoin’s latest worth will increase.

Whereas this implies a short-term bullish outlook, it could additionally result in hesitation amongst traders involved in regards to the volatility from the spinoff market.

This response displays a primary psychological response to uncertainty. If this pattern holds, traders may redirect their capital into different high-cap tokens, probably setting the stage for an altcoin season.

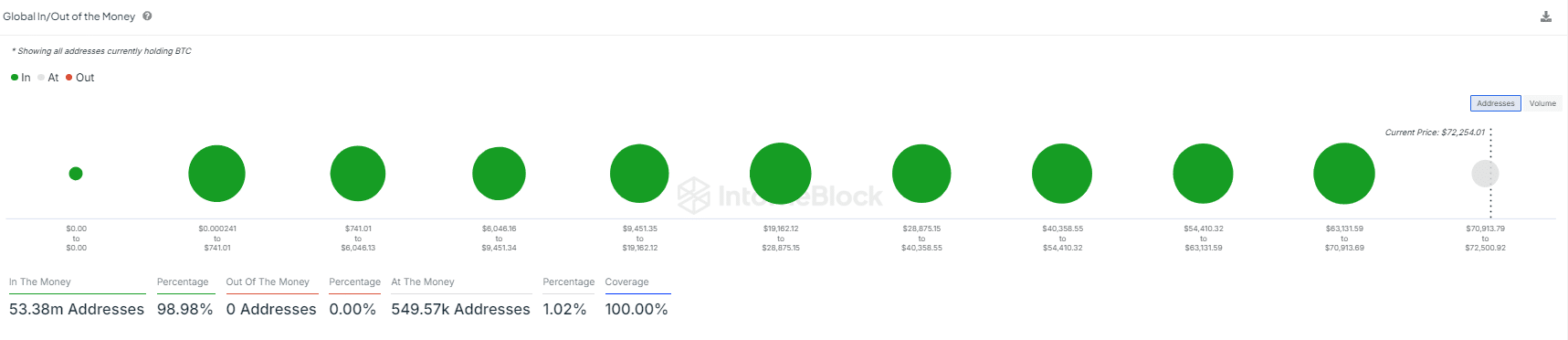

With 100% of Bitcoin cohorts at the moment in internet revenue, there’s a robust chance that altcoins may expertise a surge by mid-November.

This timeframe could align with the conclusion of the election cycle, main traders to recalibrate their methods in response to new market tendencies.

Put merely, as profit-taking happens and market sentiment shifts, altcoins may benefit from elevated capital circulation, probably igniting an altcoin season.

However there’s a catch

The present optimism, with Ethereum posting a notable weekly surge after underperforming towards main rivals within the earlier cycle, its resurgence indicators a return to earlier market tendencies.

Nonetheless, altcoins as a complete are nonetheless struggling. Whereas a number of tokens could expertise breakouts, the broader pattern stays clear – altcoins, as an asset class, proceed to fade.

As the overall market cap has risen from $2T to $2.4T, practically all new cash has flowed into Bitcoin, pulling liquidity away from altcoins, which is clear within the rising Bitcoin dominance.

This means that Bitcoin and the remainder of the market are more and more changing into separate worlds. At the moment, solely 14 altcoins have managed to draw liquidity previously 90 days.

Moreover, they’ve been in a brutal downtrend towards Bitcoin since early 2022. After practically 4 years of underperformance, altcoins have reached ranges not seen since February 2021.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

General, it’s clear that the liquidity dynamics in crypto have shifted considerably. Whereas a number of altcoins is perhaps poised for good points through the post-election cycle as Bitcoin holders search to redistribute income, the narrative surrounding an altcoin season stays elusive.

This pattern suggests that prime Bitcoin dominance could now not function a dependable precursor for an altcoin season.