- Amid the continued value correction, whales and establishments have moved Bitcoin price a whole bunch of thousands and thousands

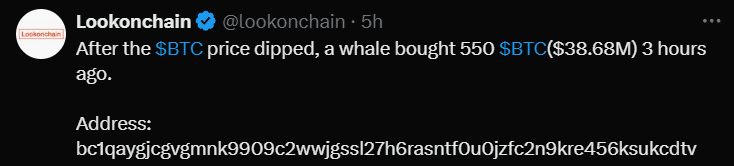

- A crypto whale purchased the dip, including 550 BTC price $38.68 million

After a notable rally, Bitcoin (BTC), the world’s largest cryptocurrency by market cap, registered a significant value correction on the charts. Between 26 – 29 October, the cryptocurrency attracted important consideration owing to its 11% value rally. Nonetheless, this wasn’t to final.

Will Bitcoin’s value correction proceed?

Proper now, traders and merchants ought to perceive {that a} value correction after a notable rally is a optimistic signal for the long run. Particularly since it may assist a possible value surge in the long run.

Therefore, such a value correction could have been anticipated by some too. Within the backdrop of the aforementioned correction, some whales and establishments have additionally moved belongings price a whole bunch of thousands and thousands.

Whales’ and establishments’ current motion

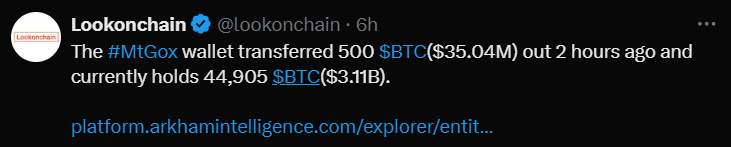

Based on the blockchain-based transaction tracker Lookonchain, throughout the morning hours of the Asian buying and selling session, Mt. Gox’s pockets, which holds practically 45,000 BTC price $3.11 billion, transferred 500 BTC price roughly $35.04 million.

Moreover, one other whale purchased the dip, including 550 BTC price $38.68 million as the worth declined to its essential assist degree.

Bitcoin technical evaluation and key degree

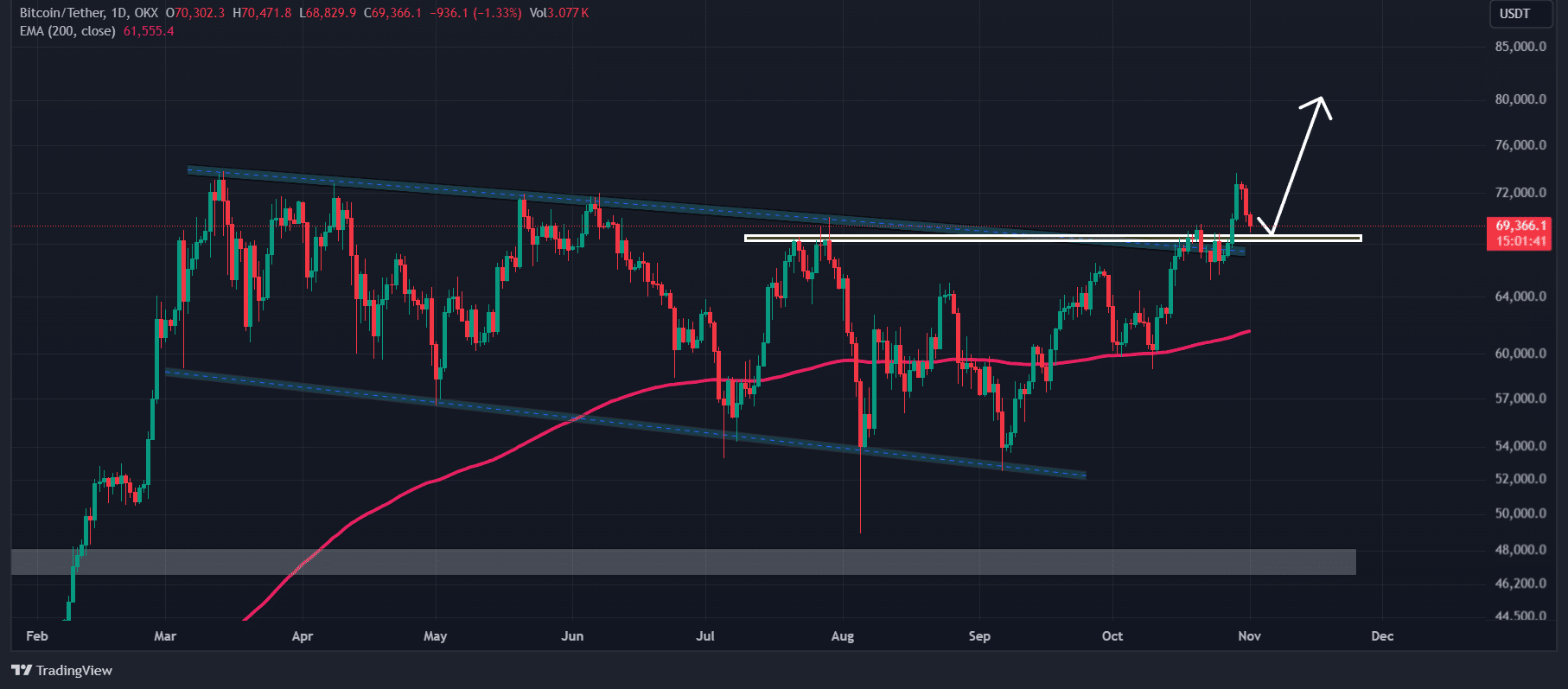

Based on AMBCrypto’s technical evaluation, BTC, at press time, gave the impression to be retesting its breakout degree of $69,235 of the decline channel value motion sample.

Based mostly on its current value motion and historic momentum, if BTC holds this degree, there’s a robust risk it might rally considerably within the coming days. In any other case, this breakout will likely be thought of a fakeout.

On the time of writing, BTC was buying and selling above the 200 Exponential Shifting Common (EMA) on the every day timeframe, indicating an asset development that’s on an uptrend. In the meantime, its Relative Power Index (RSI) steered a possible upside rally, because it remained within the impartial space (neither oversold nor over-bought).

Bullish on-chain metrics

Bitcoin’s optimistic outlook was additional supported by its on-chain metrics. Based on the on-chain analytics agency Coinglass, BTC’s Lengthy/Quick ratio had a press time worth of 1.09, indicating robust bullish sentiment amongst merchants.

Moreover, Open Curiosity surged by 17% – An indication of rising curiosity within the asset amongst merchants.