- An unknown pockets transferred BTC price tons of of thousands and thousands to Coinbase

- At press time, BTC gave the impression to be approaching a vital assist, and a re-test may change the prevailing market development

Bitcoin [BTC] traders have been a contented crowd currently after it managed to push previous $72,000 on the charts over the previous couple of days. Nevertheless, it couldn’t maintain its optimistic momentum and shortly, BTC began to drop.

Therefore, it’s price taking a more in-depth have a look at why Bitcoin is down at the moment.

Why did Bitcoin drop under $70k once more?

Bitcoin bulls gained management of the market on 27 October. Since then, BTC has carried out very nicely, with its worth climbing as excessive as $73.4k on 30 October. Following the identical, the cryptocurrency began to consolidate and remained someplace close to $72k.

Nevertheless, issues took a u-turn during the last 24 hours or so. Bitcoin’s market bears returned and pushed the coin’s worth down by greater than 4%. On the time of writing, it was buying and selling at $69,063.85 on the charts.

A attainable purpose behind this newest worth correction may very well be a significant switch. Whale Alerts, an X deal with that shares updates associated to whale exercise, revealed that greater than 8000 BTC, price over $567 million, had been transferred from an unknown pockets to Coinbase.

Such main sell-offs typically set off worth declines. Nevertheless, issues on this state of affairs may be totally different. This wasn’t the case on this event, nonetheless, as there are possibilities the switch was made by a chilly CEX pockets. These usually don’t have an effect on costs a lot.

In actual fact, Lookonchain’s latest tweet prompt {that a} whale truly purchased the dip.

In line with the identical, after Bitcoin’s worth dipped, a whale purchased 550 BTC, price $38.68 million. Subsequently, AMBCrypto checked different datasets to seek out out whether or not shopping for sentiment elevated during the last 24 hours or not.

What subsequent for BTC?

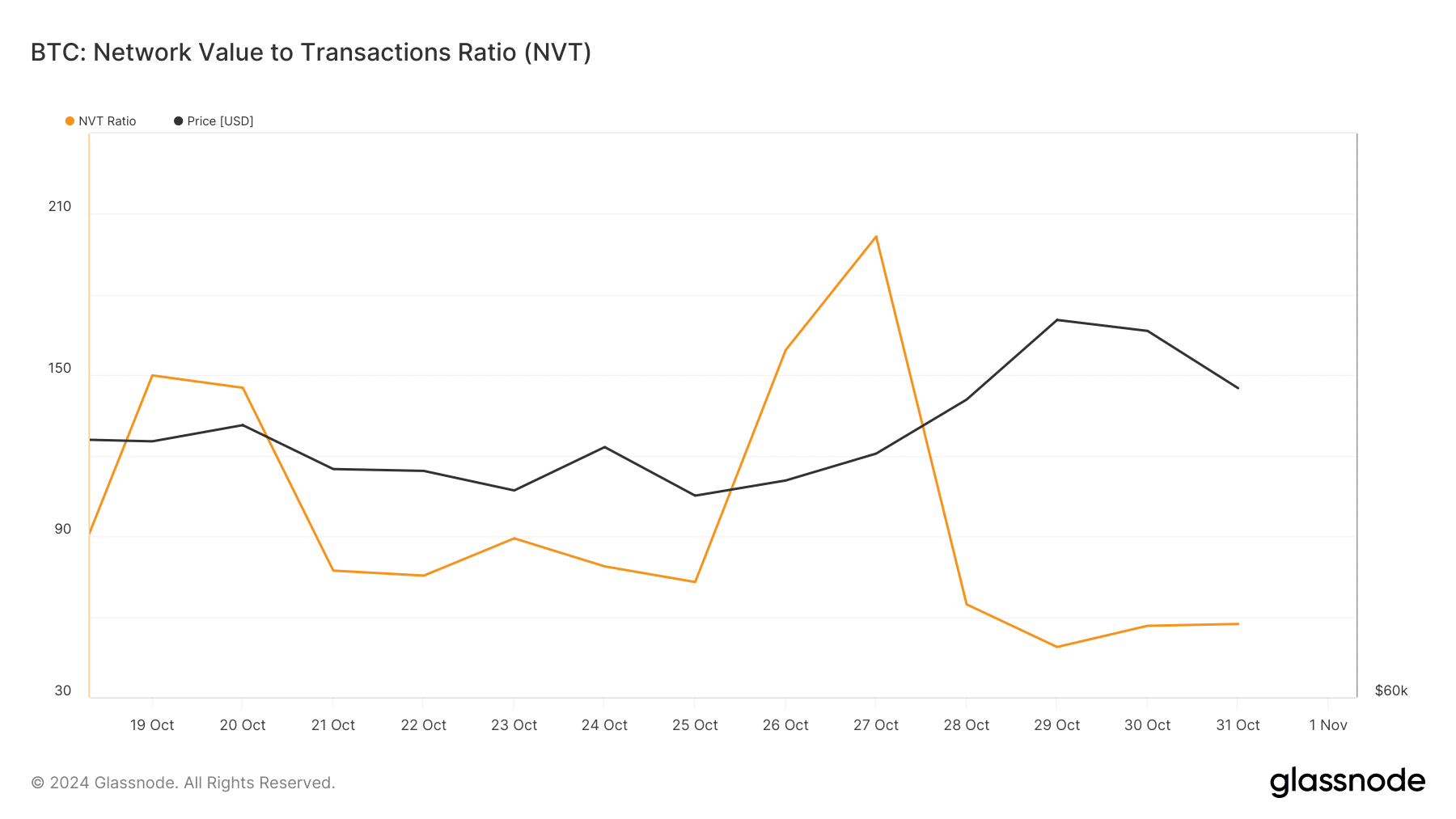

As per our evaluation of Glassnode’s knowledge, Bitcoin’s accumulation development rating had a worth of 0.88. A quantity nearer to 1 signifies that purchasing strain is excessive. Bitcoin’s NVT ratio additionally declined sharply over the previous couple of days.

A drop within the metric implies that an asset is undervalued. This might have additionally motivated traders to extend their accumulation whereas BTC’s worth dropped.

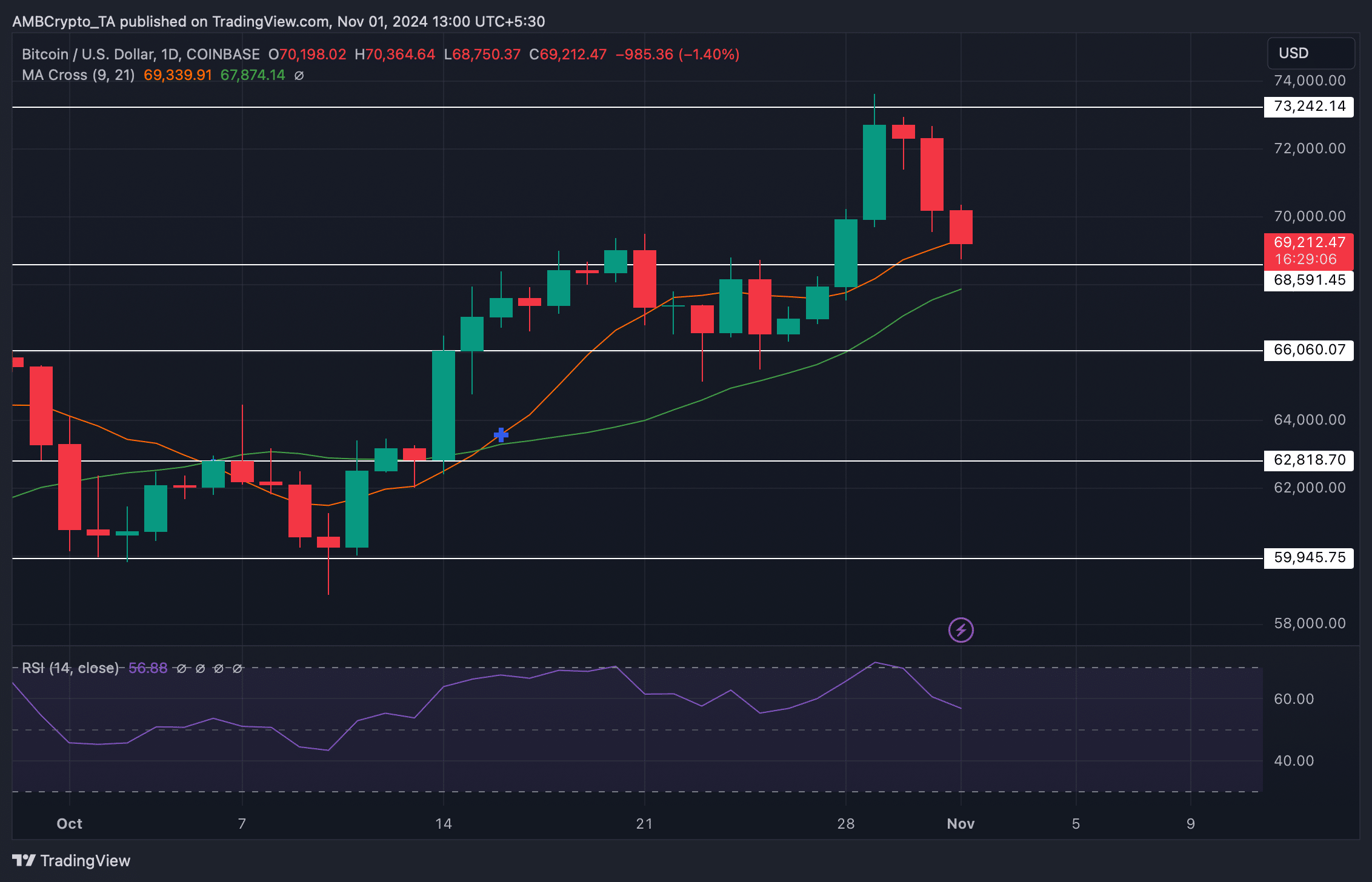

To higher perceive why Bitcoin is down at the moment, AMBCrypto checked its every day chart. We discovered that BTC’s Relative Energy Index (RSI) declined sharply over the previous couple of days.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Nonetheless, the MA cross indicator revealed that the 9-day MA was nicely above the 21-day MA, which regarded bullish. At press time, BTC was approaching its assist at $68.59k. A profitable take a look at may as soon as once more push BTC in the direction of $73k.