- Greater than $238 million was liquidated from the crypto market in 24 hours after costs plunged.

- Subsequent week’s US elections and upcoming FOMC assembly may trigger a surge in market volatility.

The cryptocurrency market is headed for one of the vital essential weeks this yr. Hypothesis on the week’s occasions has triggered value declines. At press time, all the highest 50 cryptos by market capitalization, aside from Celestia [TIA] had been buying and selling within the pink.

Over the weekend, Bitcoin [BTC] dropped from $71,000 to commerce at $68,380 at press time. Ethereum [ETH] additionally traded at $2,440, after a 2% dip.

The declining costs resulted in large liquidations within the derivatives market. Knowledge from Coinglass confirmed that within the final 24 hours, greater than $238 million was liquidated from the market.

The liquidations affected greater than 104,000 merchants, with the biggest liquidation order of $9.9 million occurring on the OKX change.

Apart from the standard weekend volatility, the US election polls on Polymarket may need stirred the current value strikes. The election is now lower than two days away, and former US President Donald Trump has dropped by 6% within the polls inside three days.

A Trump win is predicted to have a web constructive affect on the crypto market because of his pro-crypto marketing campaign coverage.

Upcoming FOMC assembly

The Federal Open Market Committee (FOMC) will maintain its subsequent assembly on seventh November. Through the earlier assembly, the committee slashed rates of interest by 50 foundation factors, which set the stage for a restoration in danger property comparable to crypto.

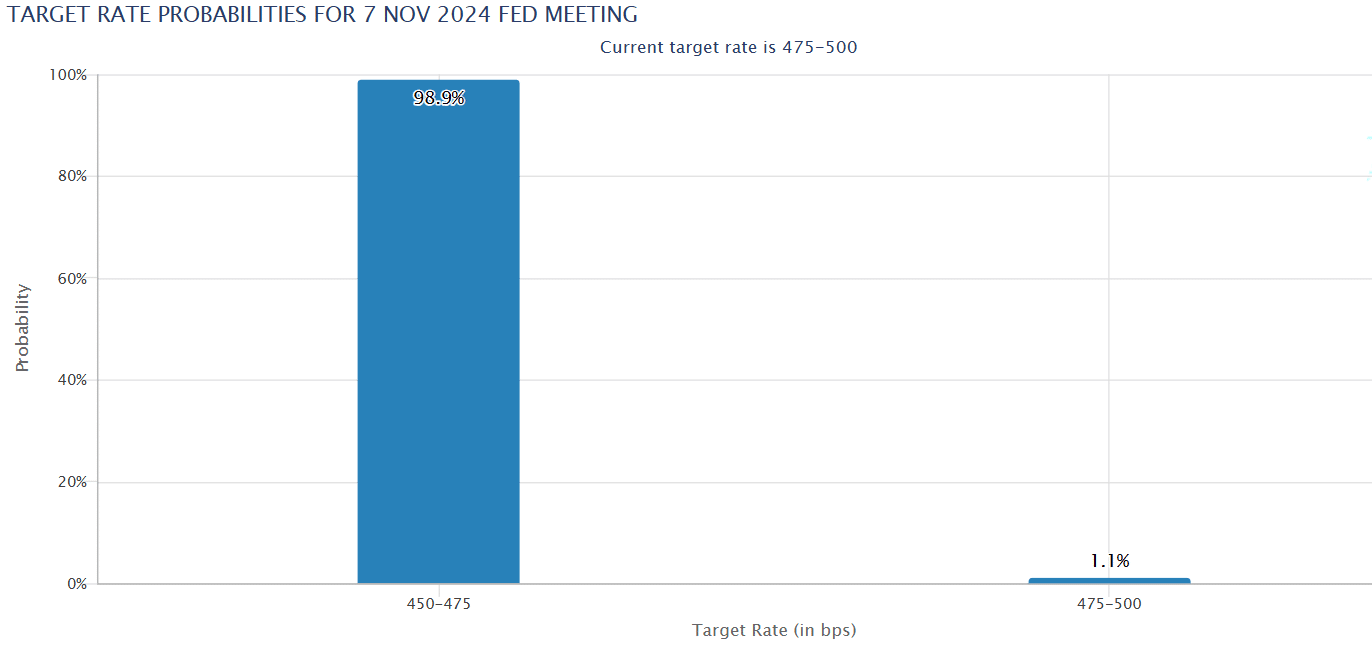

Knowledge from the CME FedWatch Device reveals that 98% of traders are anticipating one other price lower, of 25 foundation factors, in the course of the November assembly.

If the Federal Reserve trims charges per the market expectations, crypto costs are poised for an uptrend. It is because a unfastened financial coverage will increase traders’ danger urge for food, which boosts demand for property comparable to crypto.

As AMBCrypto reported, the US September inflation price got here in at 2.1%, inching nearer to the Federal Reserve’s goal of two%. This helps the argument for additional price cuts.

After the September assembly, Bitcoin gained by round 8% inside per week. The same upward transfer may propel BTC to document highs provided that at its present value, it’s 7% shy of its all-time excessive.

Crypto market sentiment continues to be bullish

Regardless of the current drop in costs and rising volatility, the crypto market sentiment stays constructive as seen within the Worry and Greed Index, which had a price of 74 at press time.

At its present worth, this index reveals that the market is in a state of greed. This sentiment tends to spur shopping for exercise, which in flip results in value features.

This reveals that crypto merchants are nonetheless trying in the direction of extra features after the current pullback. Some catalysts of this constructive sentiment embody the FOMC assembly and expectations that This autumn has traditionally boded properly for crypto costs.