Picture supply: Getty Pictures

Ask the typical investor to say which FTSE 100 civil and defence engineer they thought was the very best share to purchase and most would land on Rolls-Royce or BAE Programs.

So let’s hear it for Melrose Industries (LSE: MRO), the forgotten inventory of the aerospace and defence sector. I really feel it might supply a greater alternative than each Rolls and BAE, each of which I personal however look fully-priced proper now.

Shares have a tendency to slide folks’s minds once they don’t go anyplace for some time. The Melrose share value has been simple to disregard. It’s down 25.11% over 5 years, and 0.98% over the past 12 months.

But this could make them engaging to contrarian buyers, who know the early levels of the restoration are most rewarding.

Can this FTSE 100 inventory maintain climbing?

That’s the case with Melrose, whose shares have all of the sudden jumped 16.45% within the final month. What’s occurring?

The bounce got here after it printed figures on the 19 joint ventures it holds with engine producers on 28 October. Beneath these Threat and Income Sharing Partnerships (RRSPs), Melrose shares within the ongoing revenues of the engines it provides elements for.

The contracts can run for 50 years, and supply a gradual stream of money from upkeep and elements replacements. Melrose anticipates £22bn of RRSP money flows over the subsequent 25 years. My back-of-a-fag-packet maths suggests that is price £880m a 12 months. This might be price buyers who purchase shares with a long-term view (as all of us at The Idiot do) investigating.

Melrose received an additional carry on 5 October when Citi named it a “high-conviction” Purchase, predicting free money circulate would vary from £450m-£550m in 2027/28, beating consensus of £320m-£420m.

Civil aerospace is a bumpy sector, as we noticed within the pandemic. The Melrose share value crashed from 570p to 175p throughout lockdown. It’s struggled since, posting pre-tax losses within the 4 years to 2023.

Underlying revenues climbed 13% to £3.35bn in 2023 and rose one other 6.7% within the first half of this 12 months to £1.7bn. Underlying working revenue hit £247m, as rising aftermarket exercise boosted its Engines division. It’s whittled down web debt to £976m. Provide chain points are proving a drag although.

Melrose Industries ain’t half a combined bag

The Melrose dividend took a beating within the pandemic however is steadily recovering. The trailing yield is a lowly 0.99%. Let’s see what the chart says.

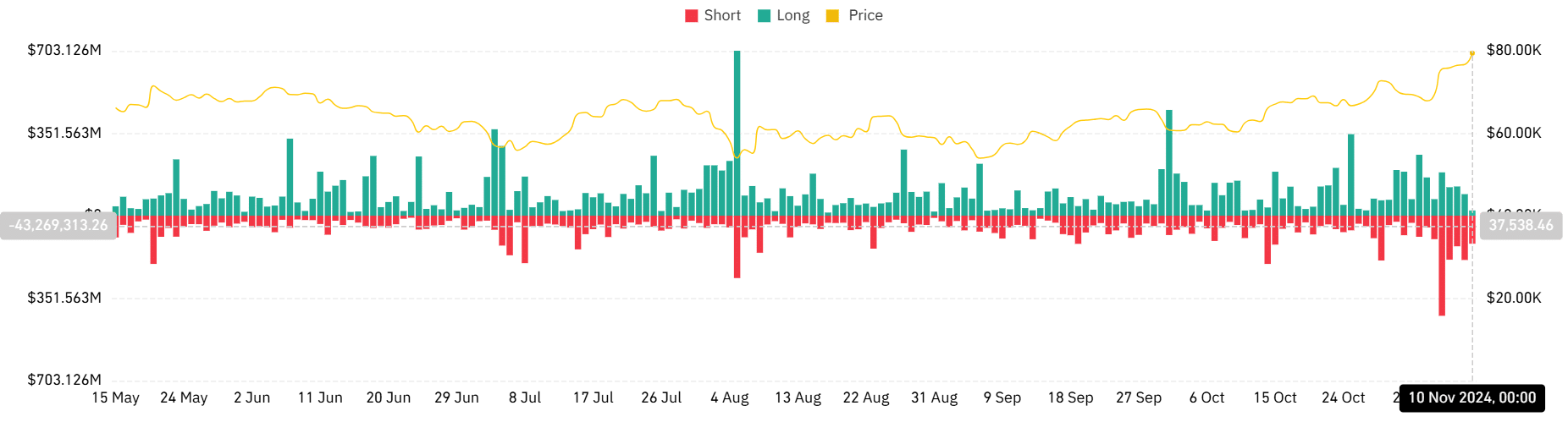

Chart by TradingView

Melrose has one factor in its favour. It seems low-cost with a price-to-book (P/B) ratio of 1.7 on 30 September. That’s method under the typical P/B of seven.6 for the aerospace and defence sector. I think about it’s in all probability a bit pricier because the latest share value hop.

Nevertheless, a price-to-sales ratio of 1.8 is barely a tad behind the sector common of 1.9. Its price-to-earnings ratio of 26.45 doesn’t seize me both.

The ten analysts providing one-year share value targets setting a median determine of 593.6p. That’s up 17.25% at the moment. Promising.

But I’m at all times cautious of shopping for a inventory after it’s all of the sudden jumped, in case I make an instantaneous loss as others take income. The long-term outlook is optimistic, however Melrose nonetheless has work to do within the quick run. I’m tempted, however there are different FTSE 100 shares I’d reasonably purchase at the moment.