- Bitcoin has surged by 34.39% over the previous month.

- An analysts sees potential market correction citing 4 causes.

Since hitting a neighborhood low of $66,798 earlier within the month, Bitcoin [BTC] has surged to hit an ATH of $93,483.

Whereas the market appears optimistic for BTC to even attain $100k, some analysts are pessimistic. One in all these analysts is Ali Martinez who has recommended 4 the reason why BTC may see a steep correction.

The reason why Bitcoin may see a correction

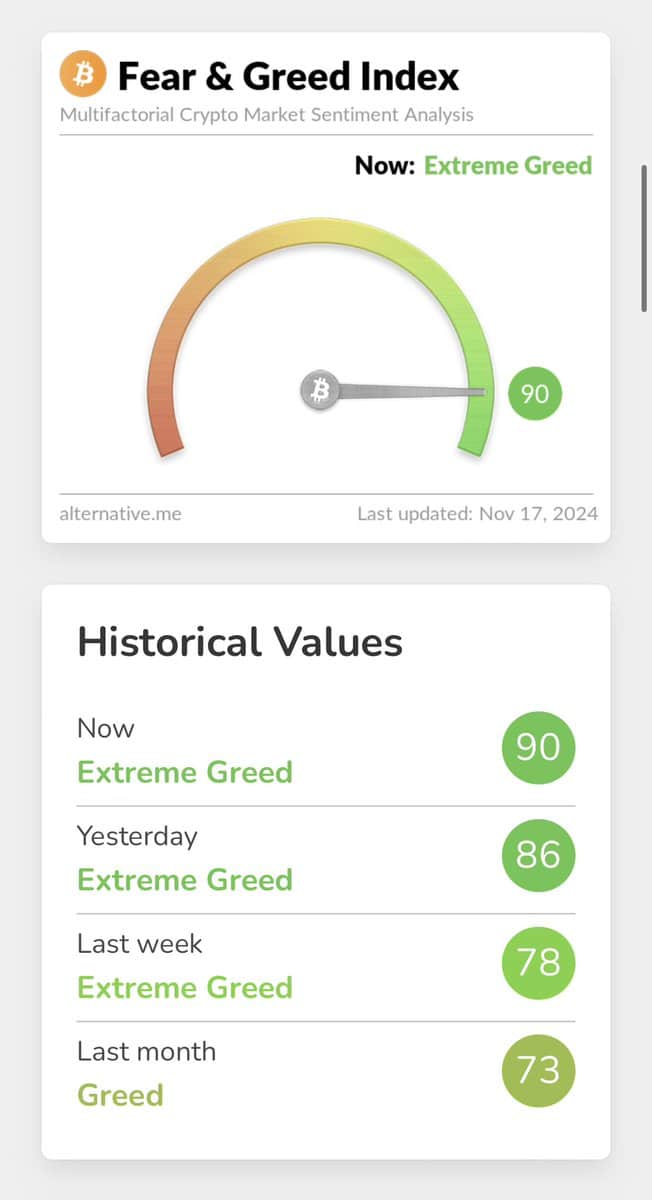

In his evaluation, Martinez recognized 4 main the reason why Bitcoin is about for a pointy decline. Firstly, Bitcoin’s crypto lovers are extraordinarily grasping with the greed index at 90%.

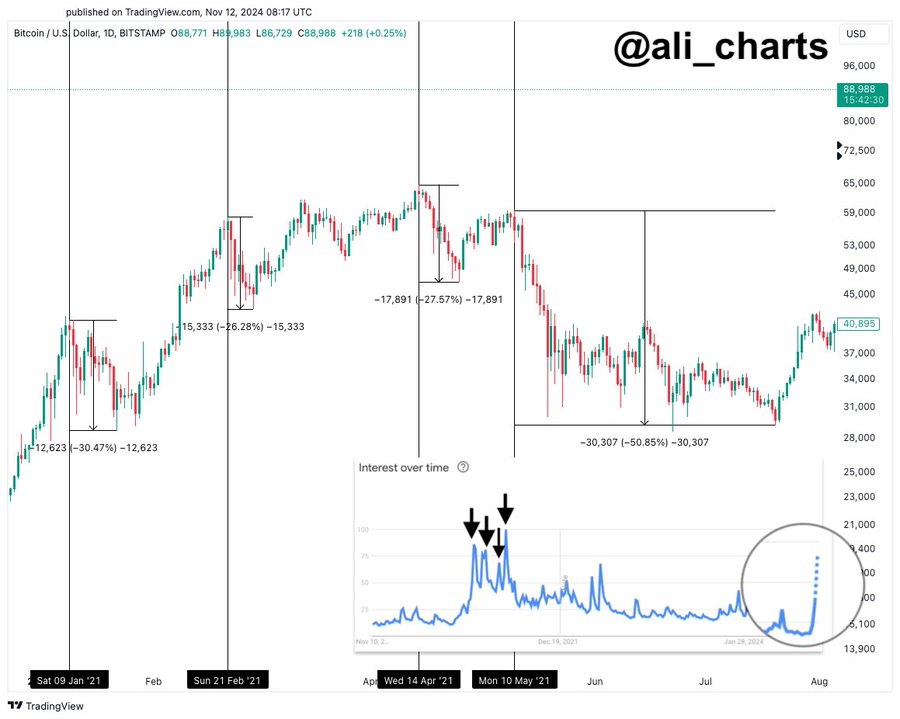

This greed was witnessed amongst retail buyers as proven by the spike in Google search curiosity for BTC.

In response to him, though retail curiosity in Bitcoin alerts additional capital influx, spikes in search developments often align with worth decline. For instance, in 2021, the highest surges in search curiosity for Bitcoin resulted in a correction of 30%, 26%, 27%, and 50%.

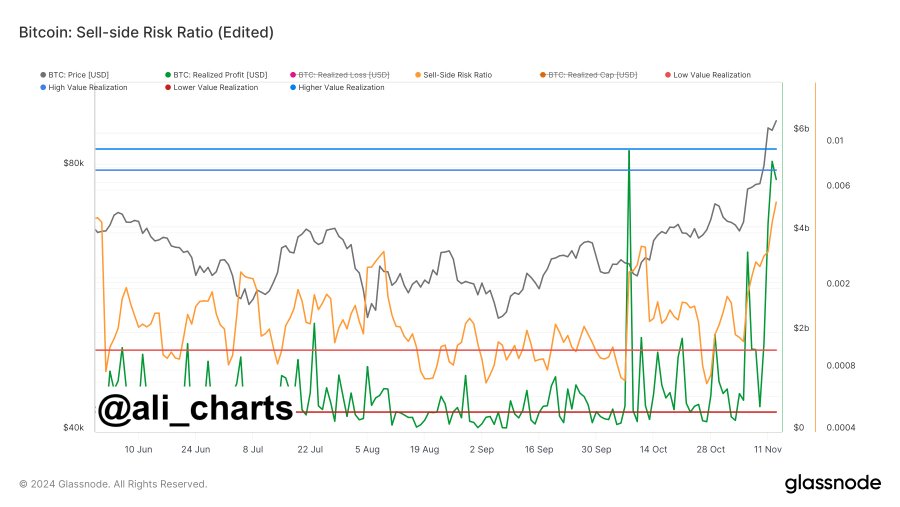

The second purpose is that savvy BTC buyers have realized $5.42 billion in income. This has led to a spike within the sell-side danger ratio suggesting that buyers are promoting to maximise income.

Thirdly, based mostly on a technical perspective, the TD sequential has introduced a promote sign on every day charts. This reveals that the uptrend is exhausted and a development reversal will comply with particularly with many buyers taking income.

The ultimate purpose is that the RSI alerts that Bitcoin is presently sitting within the overbought territory at 75.91. When RSI reaches overbought, it means that an asset might be overvalued and the patrons are dropping the momentum.

As such, the analyst identified that within the occasion of a worth correction, BTC will discover help partitions round $85800, $83250, and in addition $75520- to a low of $72,880.

What BTC charts say

Whereas, the evaluation, offered above supplies a cautionary story for buyers, it’s important to have a look at different market indicators and see what they are saying.

As noticed above by Martinez, our evaluation factors in the direction of a possible pullback as BTC is perhaps presently overvalued.

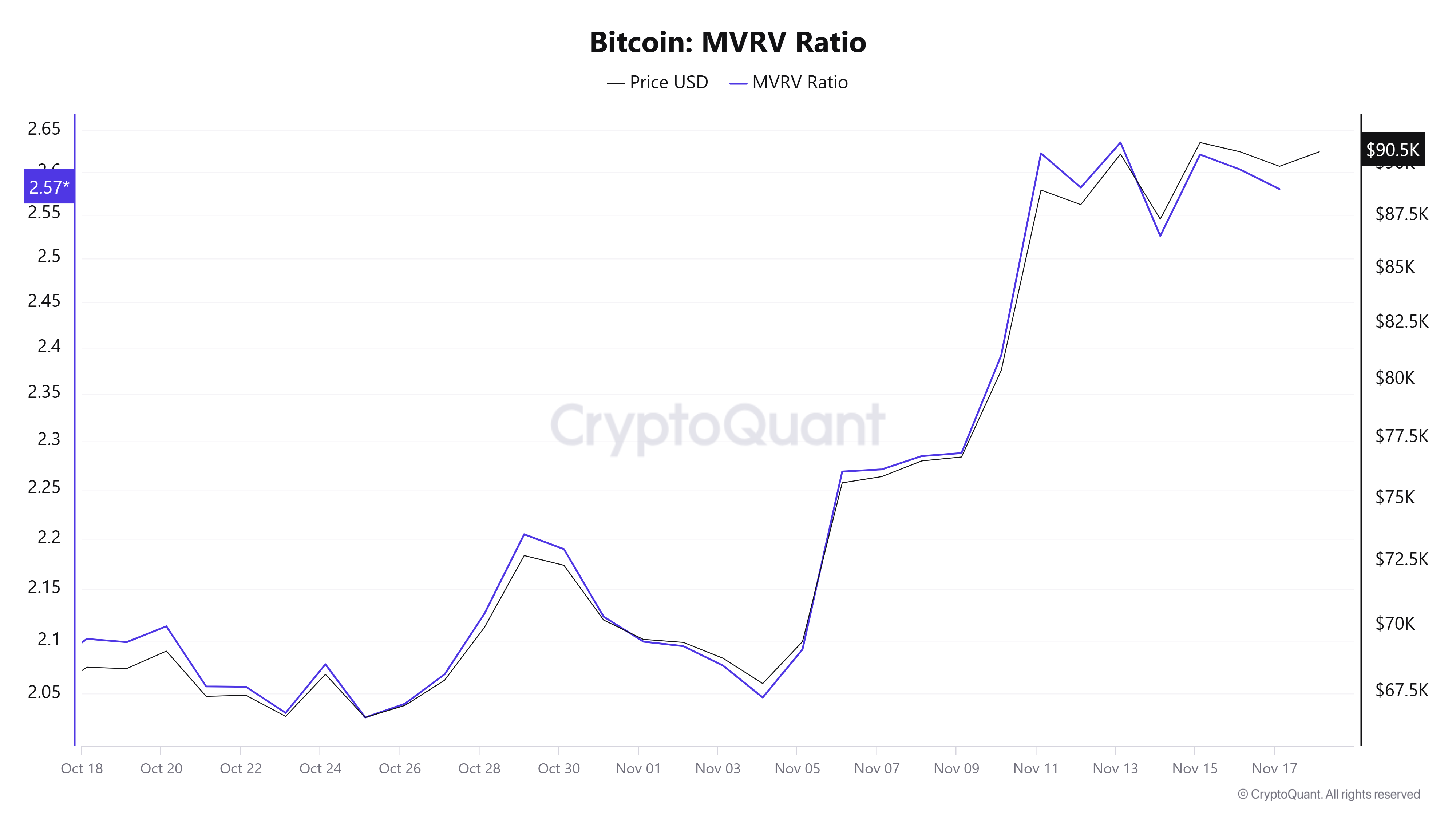

For instance, Bitcoin’s MVRV ratio has skilled a sustained uptrend to hit a excessive of two.5. When the MVRV ratio turns into too excessive, it suggests overbought circumstances.

Traditionally, excessive MVRV values have been adopted by worth pullback as early buyers promote to safe income.

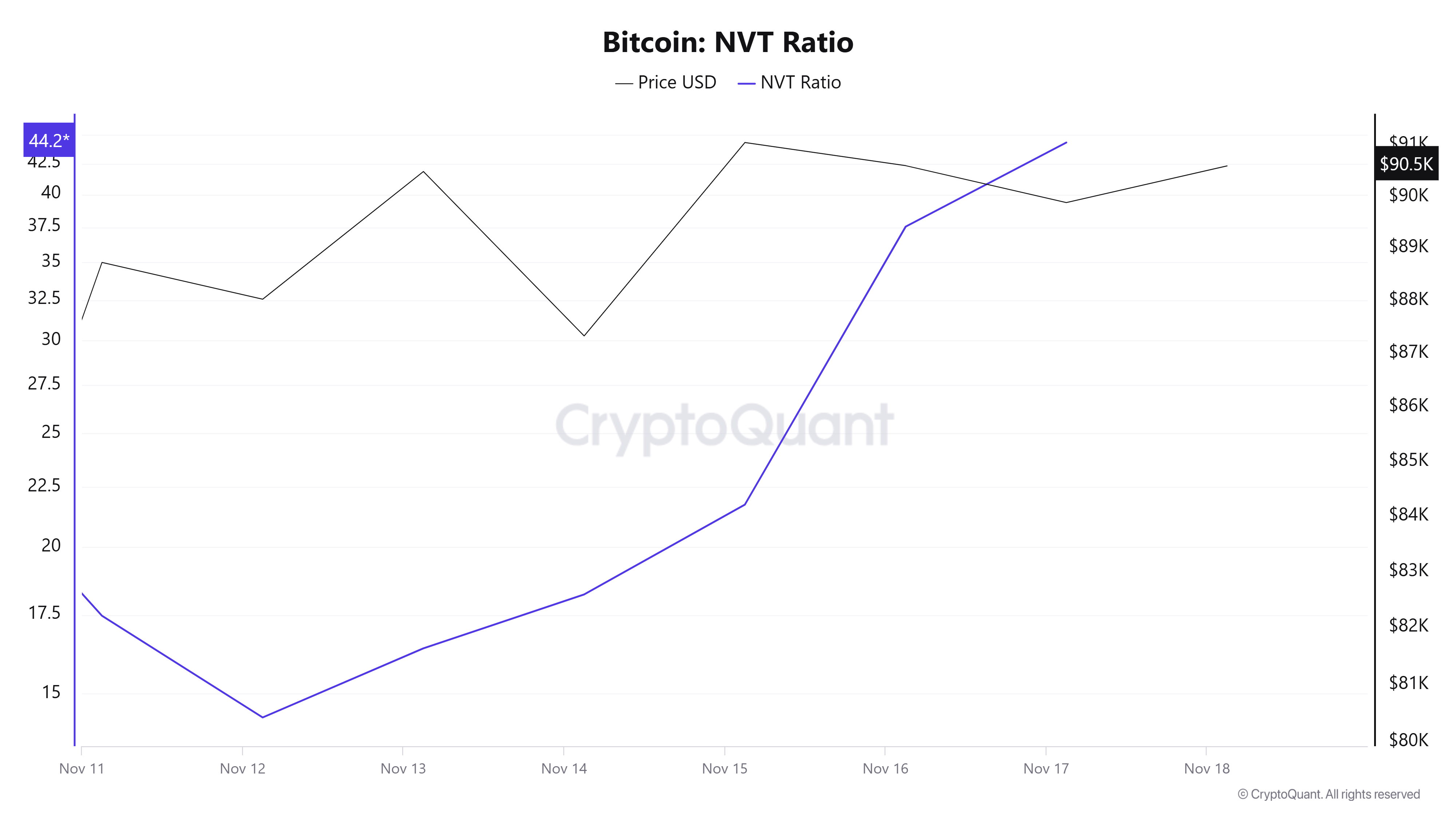

Moreover, Bitcoin’s NVT ratio has surged from a low of 14 to 44 suggesting that whereas the market cap is rising, the transaction exercise shouldn’t be preserving tempo.

Learn Bitcoin (BTC) Value Prediction 2023-24

This means a speculative worth rise with out corresponding development within the community’s worth. Thus implying BTC is probably overvalued as costs outpace its on-chain exercise.

Merely put, BTC costs may decline to satisfy its precise market demand. If it declines, it should discover the subsequent help round $87140. Nonetheless, if $9100 help holds, BTC may proceed with the uptrend in the direction of $100k.