- Bitcoin searching down any lengthy entries however it nonetheless will not be too late.

- Demand for crypto in US rising as MSTR makes a file BTC buy.

Bitcoin [BTC] lengthy positions entered throughout present uptrend are swiftly being “hunted” down, resulting in abrupt exits whereas the costs continues to rally.

This repeated sample indicated a unstable buying and selling atmosphere the place lengthy positions are rapidly focused for liquidation notably after Bitcoin hit the $90K degree.

The continuing cycle of lengthy entries adopted by swift downturns instructed that merchants trying to capitalize on the uptrend are dealing with vital dangers.

This buying and selling conduct prompts the query: with such aggressive focusing on of lengthy positions, is it presently too late, or nonetheless possible, to think about going lengthy on Bitcoin with out dealing with quick setbacks?

Bitcoin SOPR for STH

Analyses of the Quick-Time period Holders’ SOPR (STH SOPR) instructed a balanced market sentiment.

Presently positioned halfway between the extremes of greed and concern, the SOPR indicated there was nonetheless potential for additional value will increase with out the quick danger of a significant correction.

The evaluation, supported by the 30DMA, confirmed that whereas STHs had been certainly taking earnings, their actions weren’t indicative of market euphoria.

Traditionally, as soon as the SOPR ventures into ‘extreme greed’, it usually presages a pullback because the market turns into overheated.

Conversely, the ‘extreme fear’ zones have historically been the place vital market lows type, providing prime shopping for alternatives.

The present reasonable studying instructed a interval of regular progress and cautious optimism amongst merchants. A swift transfer in the direction of the greed finish might sign the necessity for strategic profit-taking to preempt a downturn.

The interval provided a chance for strategic investments, with a balanced method being essential to navigating the continued volatility and capitalizing on the uptrend.

Rising demand and MSTR’s file buy

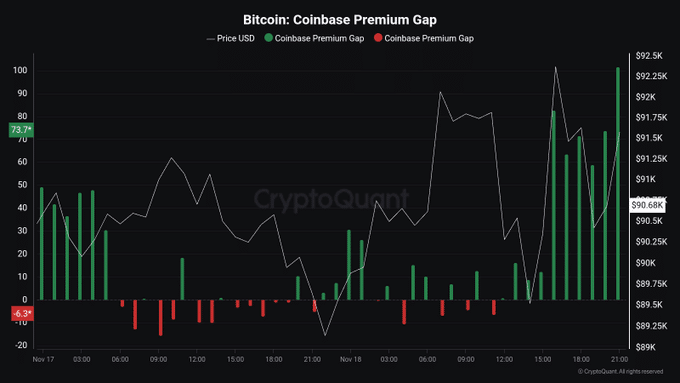

Publish-elections within the US continued to spark uptick in Bitcoin demand, as indicated by the surging Coinbase Premium Index. This gauge mirrored a heightened shopping for fervor amongst US merchants, sustaining the present bull run.

The information from the previous days confirmed vital premiums, with the index hitting peaks concurrently with Bitcoin’s value pushing in the direction of $92,000.

This development indicated optimism and the potential for additional upside, suggesting that coming into lengthy positions now might nonetheless be opportune.

Moreover, establishments continued to purchase with Michael Saylor asserting that they might elevate $42 Billion to purchase Bitcoin “much before” the three yr plan for MicroStrategy.

Learn Bitcoin (BTC) Worth Prediction 2024-25

MSTR has already purchased 66% of subsequent yr’s $10 Billion goal in simply 10 days.

The rise in demand and MSTR’s continued shopping for which have introduced one other proposal to purchase BTC reveals that it’s nonetheless not late to purchase BTC for the long-term run.