- Market analysts instructed that Bitcoin could outpace altcoins because the BTC/ALT ratio reached historic ranges.

- Bitcoin additionally reached a brand new all-time excessive as change reserves continued to say no.

Over the previous month, Bitcoin [BTC] has been the focus of market exercise, attracting each retail and institutional buyers. This curiosity has pushed a 34.16% value surge inside a month.

Up to now 24 hours, BTC has gained a further 1.06%, hitting a report value of $94,002.87, at press time.

AMBCrypto’s evaluation identified that rising market traits and knowledge point out Bitcoin might be on the verge of one other important upswing.

Analyst predicts potential upside for BTC

Fashionable crypto analyst Benjamin Cowen highlighted a vital second for BTC, suggesting that Bitcoin could also be on the verge of one other important rally.

Based on Cowen, the ALT/BTC pair reached a valuation much like its stage on the twenty fourth of November 2020, simply earlier than a significant shift in liquidity from altcoins to BTC.

Historic knowledge reveals that in 2020, this liquidity divergence propelled Bitcoin to new highs over 5 weeks, whereas altcoins largely stagnated.

Cowen notes the parallels, stating,

“The ALT/BTC pairs are at the same valuation today as they were in November 2020, right before the final drop of ALT/BTC pairs began.”

If the sample repeats, BTC might see a meteoric rise, establishing new highs as altcoins take a again seat in the course of the anticipated shift.

Stablecoin minting might sign inflows to BTC

Current knowledge confirmed a major rise in stablecoin minting, with a complete market capitalization of USDT now reaching $128.90 billion, which is commonly a bullish sign for the broader crypto market.

In a notable improvement, Tether [USDT] lately minted one billion USDT on the Ethereum blockchain.

Such large-scale minting usually displays rising demand and is usually used to accumulate different cryptocurrencies by market contributors.

Given the latest ALT/BTC sample, it’s probably that a good portion of this newly minted USDT will circulate into Bitcoin if historical past repeats itself.

Falling change reserves level to market shift

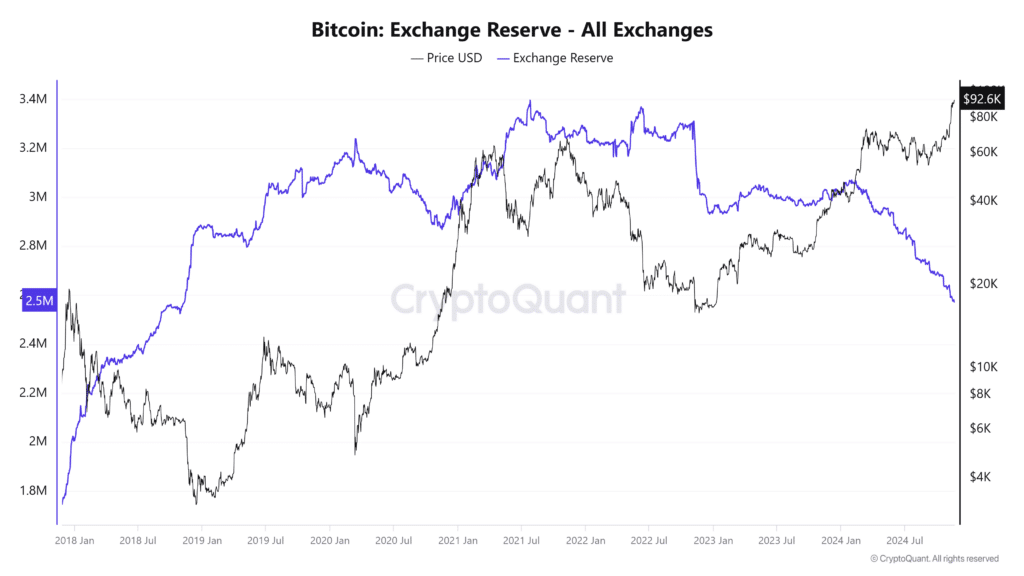

Information from CryptoQuant revealed a notable decline in Bitcoin change reserves, with each day and weekly figures exhibiting decreases of 0.34% and 0.77%, respectively.

As of this writing, the overall Bitcoin reserve on exchanges has dropped to 2,572,477.995 BTC, marking its lowest stage since 2019.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

A constant decline in accessible BTC on exchanges is commonly thought-about a bullish indicator, because it suggests market contributors are opting to carry their Bitcoin in personal wallets quite than promoting.

This shift displays rising confidence in Bitcoin’s long-term worth.