Coinspeaker

Ethereum Climbs 40% in November, Staking Hits ATH, What’s Subsequent?

Ethereum

ETH

$3 488

24h volatility:

5.1%

Market cap:

$420.01 B

Vol. 24h:

$34.99 B

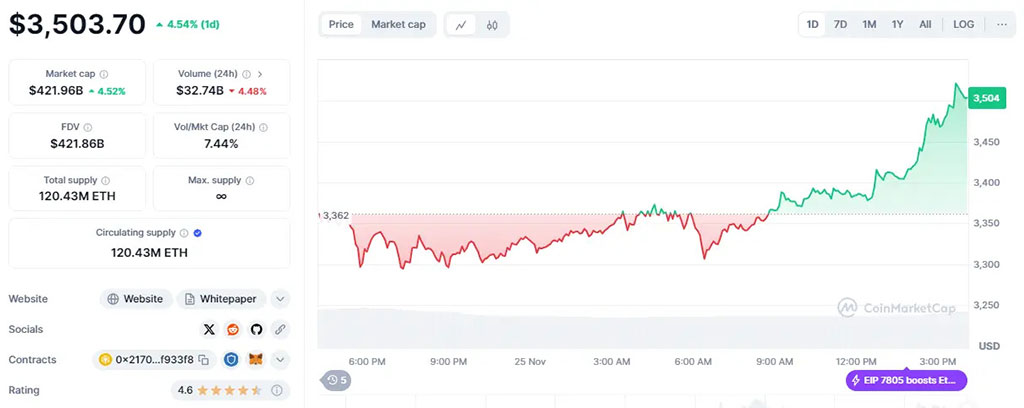

has attracted substantial consideration in crypto markets in November to date. The main altcoin skilled a 40% worth surge, crossing the $3,500 mark for the primary time since July. Regardless of Bitcoin (BTC) reaching a number of all-time highs throughout the identical interval, Ethereum demonstrated notable resilience and rising enchantment amongst traders.

Up to now week alone, Ethereum gained 12.60%, with its worth rising sharply from $3,031 to a peak of $3,515. Concurrently, the market witnessed a record-breaking enhance in Ethereum staking exercise. Crypto analyst Maartunn revealed that weekly web flows for ETH staking reached unprecedented ranges, signaling a big market shift. Beforehand, staking withdrawals persistently exceeded deposits, underscoring the significance of this new development.

📊 Ethereum Staking Sees Sturdy Weekly Internet Inflows After Months of Outflows

Over the previous week, Ethereum staking recorded a web influx of +10k ETH, with 115k ETH deposited and 105k ETH withdrawn. This marks a notable shift, as deposits have outpaced withdrawals after months of… pic.twitter.com/4SEX60vQUx

— Maartunn (@JA_Maartun) November 24, 2024

Ethereum Staking Information 10K ETH Internet Influx

In response to IntoTheBlock, Ethereum staking has skilled a notable turnaround, with a weekly web influx of 10,000 ETH after extended outflows. Current knowledge reveals that 115,000 ETH was deposited towards 105,000 ETH withdrawn. This shift signifies decreased provide, which can curtail inflation and bolster costs. The stability of diminishing provide alongside rising demand usually ignites worth rallies, strengthening Ethereum’s place available in the market.

Increased costs and improved staking infrastructure have performed a key function on this resurgence. Enhanced programs for staking incentivize traders to lock up their ETH, successfully shrinking the circulating provide. A rising stock-to-flow ratio underscores this shortage, a crucial driver of asset worth that usually elevates costs when demand stays strong.

Moreover, main holders are increasing their ETH positions, as evidenced by elevated month-to-month staking inflows. This exercise highlights rising confidence amongst massive traders, amplifying shopping for stress and tightening provide. Their accumulation of ETH injects upward momentum, reinforcing the development of rising costs.

The interaction between heightened staking exercise and rising worth has amplified Ethereum’s market efficiency. ETH, at present buying and selling barely above $3,500, displays a 4.50% acquire within the final 24 hours. Sustained shopping for dominance might propel costs past the $3,560 resistance stage, paving the way in which for additional development.

Analyst Predicts Ethereum to Hit $5,300 – $15,300

Crypto analyst Alan Santana from TradingView anticipates a optimistic long-term trajectory for Ethereum. He likened ether’s traits to a pervasive, weightless component, emphasizing its intrinsic worth and broad presence. Analyzing Ethereum’s efficiency on the weekly chart, Santana pointed to constant development, signaling a good outlook for the crypto sector.

“Let’s argue, $11,300 or $15,300? […] I have a better explanation, of course. I considered another option. Choose from $7,300, $11,300, or $15,300 […] You know what? $5,300 will be easy, representing a 60% increase and a new All-Time High from the current price,” mentioned Santana.

Ethereum Climbs 40% in November, Staking Hits ATH, What’s Subsequent?