- Bitcoin dominance has dropped, inflicting altcoins to evolve into ‘safe havens’ throughout high-risk durations.

- Nevertheless, full independence remains to be a great distance off, as altcoins stay susceptible to Bitcoin’s swings.

The previous 20 days have been a rollercoaster for the crypto market, full of wild swings and intense feelings.

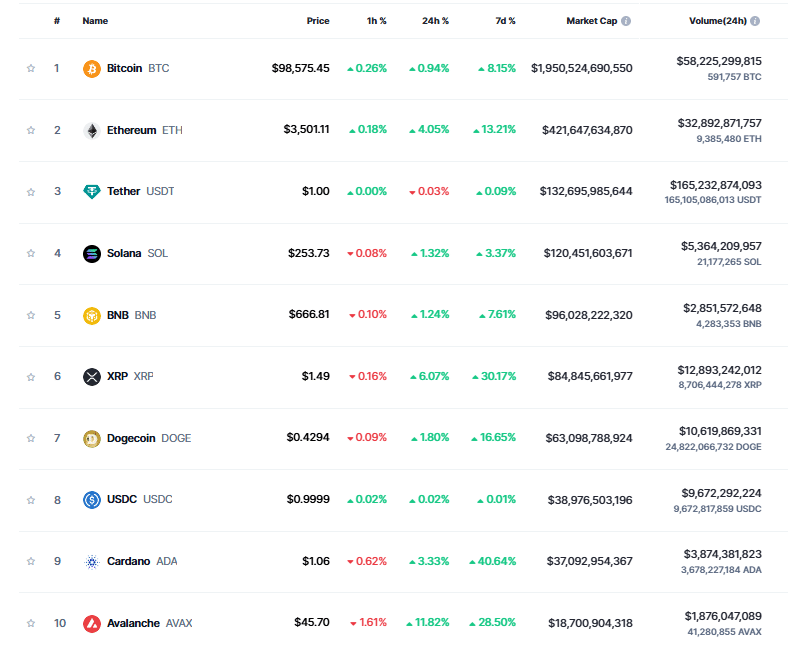

All of it kicked off with Bitcoin [BTC] blasting to a brand new all-time excessive of $99,317, propelling its market dominance to a commanding 61%.

However simply as rapidly as the thrill constructed, the market started to chill off, leaving everybody questioning: what’s subsequent?

Bears have actually made it clear that reaching $100K gained’t be a stroll within the park – persistence shall be examined.

In consequence, one other day has handed with the goal nonetheless out of attain, with Bitcoin now buying and selling at $98,300, and its dominance slipping under 59%.

Amidst the uncertainty, altcoins have emerged as the largest winners, with some reaching triple-digit good points in lower than per week.

The excessive stakes tied to Bitcoin appear to have shifted investor focus towards extra inexpensive belongings.

Nonetheless, the destiny of altcoins stays tethered to Bitcoin’s efficiency. Whereas consolidation has allowed many to smash by key psychological resistance ranges, a Bitcoin pullback might swiftly reverse these good points.

Altcoins should give attention to ‘unique’ strengths

It’s true that an underlying shift is gaining momentum out there. Traditionally, altcoins intently adopted Bitcoin’s actions.

Nevertheless, in current cycles, altcoins have been diverging, establishing themselves as a definite asset class.

As an illustration, on the one-day timeframe, Ethereum has reclaimed the $3,500 resistance degree, a goal final seen in July.

Actually, ETH is only one amongst many altcoins reaching key value milestones on this cycle, together with breaking the elusive $1 mark.

This shift aligns with a gradual decline in Bitcoin dominance over the previous 4 days. Opposite to in style perception, a drop in Bitcoin dominance doesn’t robotically point out a bearish part.

As an alternative, it displays the rising traction of altcoins as they seize a bigger share of the market.

As mentioned, that is usually pushed by traders reallocating income from Bitcoin’s rise into altcoins to diversify and search larger returns.

Nevertheless, reaching true independence from Bitcoin’s market swings requires specializing in the distinctive strengths of particular person altcoins to differentiate them from broader market volatility.

Solana [SOL], for example, has emerged as a standout, famend for its excessive throughput and lightning-fast transaction speeds, positioning it as a promising contender.

That stated, a full-scale decoupling of altcoins from Bitcoin stays in its infancy. At present, solely a handful of altcoins exhibit important independence.

Subsequently, till extra altcoins reveal related resilience, their correlation to Bitcoin’s efficiency stays largely unchallenged. Subsequently,

If Bitcoin dominance falters, it might drag the market down

With Bitcoin stalling under $100K after 20 days of market pleasure, analysts recommend a wholesome retracement is due, as indicators of overheating develop extra obvious.

As per AMBCrypto, a pullback to the $96K–$98K vary would seemingly keep market confidence, given BTC’s week-long fluctuations inside this band.

Nevertheless, a dip under this vary might spell hassle, significantly for altcoins.

In March, after Bitcoin reached its earlier ATH of $73K, a 5% decline over the following two days triggered panic, inflicting Bitcoin to drop to $69K, and its dominance to fall to round 50%.

This led to a market-wide crash, with altcoins struggling much more severely. Nevertheless, a lot has modified since then, with choose altcoins now rising as ‘safe havens’ during times of excessive threat.

Whereas a response as extreme as final time might not unfold, a correction stays inevitable, as altcoin actions stay intently tied to Bitcoin’s.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Subsequently, if Bitcoin’s dominance falters and it retraces under $95K, altcoins will seemingly observe go well with.

Regardless of rising confidence in sure altcoins, their standing as protected gamers gained’t protect them from losses, as traders pullback, fearing broader market slippage.