- The altcoin market has developed considerably, with huge wallets making strategic strikes to gas their development.

- With all eyes now on this increasing area, the query is: which altcoins must you goal?

Between late November and early December, Bitcoin’s [BTC] dominance plunged from 61% to 54%, coinciding with its record-breaking $99K shut.

This sharp shift signaled a neighborhood high, as spooked traders both flocked to various property or exited the market solely. Within the chaos, many altcoins seized the chance to shine.

Ripple [XRP], Ethereum [ETH], Cardano [ADA] and Binance Coin [BNB] have been among the many huge names that capitalized on the second.

Nevertheless, the true shock got here from Tron [TRX], which recorded the longest inexperienced candlestick in its historical past, surging an unimaginable 96% in a single day.

Now, with BTC again within the highlight, hitting new all-time highs, the market is as unstable as ever.

The unpredictability of BTC’s value motion – usually going in opposition to mainstream expectations – leaves no clear indication of the place it’ll head subsequent.

So, when the subsequent native high arrives, which altcoins ought to traders be watching? May now be the proper time to dive in and seize the ‘dip’ earlier than the market strikes once more?

The brand new 12 months will demand better diversification from you

The crypto market is on the transfer once more. Previously 24 hours, Bitcoin has seen a surge in capital, driving its value larger, pushing all holders into revenue, and wiping out $118 million briefly positions.

With its market share now at 57%, it’s clear that Bitcoin is slowly reclaiming its dominance. However volatility is way from over, presenting a great alternative for altcoins to capitalize.

Why does this matter? Because the market matures, danger administration turns into important. The secret’s to lock in earnings and keep away from overexposure, which suggests shifting focus to altcoins.

Within the 12 months forward, diversification will likely be your finest ally. Your danger urge for food will likely be examined greater than ever, making it important to remain forward with a balanced strategy.

That is precisely the technique whales have used on the Tron community. As Bitcoin surged through the years and danger elevated, altcoins like Tron began attracting consideration.

So, what started as a small pockets holding a couple of TRX cash has now ballooned into large holdings, forming what we all know as whales.

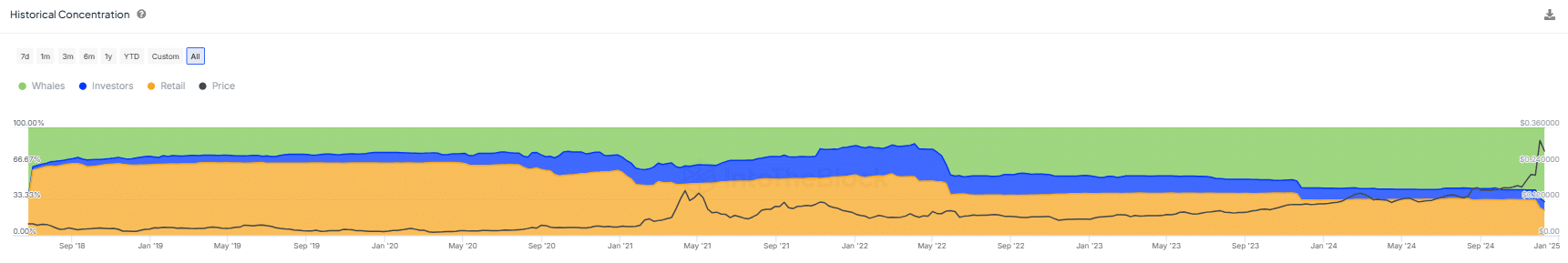

These whales now management practically 70% of the entire provide, as proven within the inexperienced chart, with their holdings rising 12 months after 12 months.

Extra importantly, this technique isn’t distinctive to Tron – it’s a development seen throughout most high altcoins, with only some exceptions.

So, as Bitcoin continues to hit new highs, this development is about to develop, with altcoins changing into each extra “affordable” and more and more seen as a “safe haven” for strategic traders.

So, which altcoins must you maintain your eye on?

Timing is every little thing in crypto, and proper now, many altcoins are quietly accumulating, constructing momentum in opposition to Bitcoin.

If historical past has taught us something, as soon as BTC hits a neighborhood high, altcoins are primed to interrupt out – making “buying the dip” now a method that might repay huge in the long run.

That mentioned, be ready for a bumpy journey. This market may be unstable, with corrections much like these we’ve seen prior to now. Take LINK, for instance – it skilled over 15 corrections in lower than a 12 months throughout 2020-2021.

Proper now, it’s sitting at $29, which is identical value it was two years in the past. However even with that, 84% of LINK holders are nonetheless within the inexperienced, and virtually half of its provide is held by simply 18 whale wallets.

Now, right here’s the place it will get attention-grabbing. Whales may carry some stability to altcoins, however these large holdings additionally imply they’ll trigger some severe value swings.

With a lot of the availability managed by a couple of wallets, these whales can transfer the market nonetheless they need.

So, what’s the very best technique going ahead? It’s time to shift focus towards low and mid-cap tokens with much less whale affect.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

Why? As a result of the brand new 12 months goes to carry much more volatility.

As Bitcoin makes its strikes, danger goes to go up, and with whales dominating the highest altcoins, diversifying into smaller, less-concentrated tokens may very well be one of the simplest ways to guard your portfolio whereas additionally capitalizing on positive factors from high alts.