- Spot market demand leads Bitcoin’s upward momentum.

- BTC has declined by 2.46% over the previous 24 hours.

Over the previous month, Bitcoin [BTC] has skilled a sustained uptrend, hitting a brand new ATH of $108268.

This uptrend has left key stakeholders deliberating over elements behind it. Inasmuch, CryptoQuant analysts have cited rising spot market demand as the most important issue pushing BTC’s costs up.

Bitcoin’s spot market demand soars

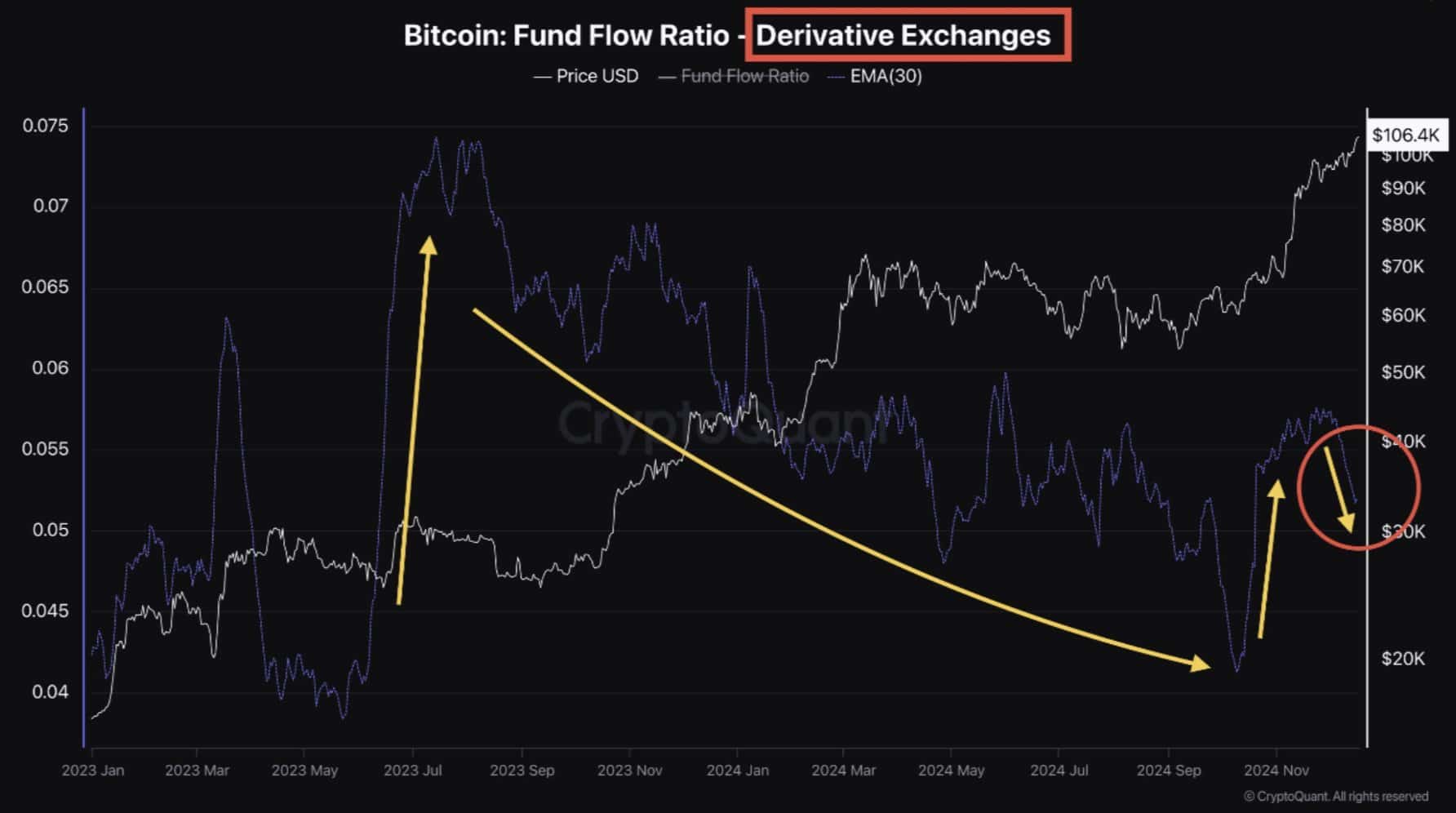

In his evaluation, Avocado on-chain posited that Bitcoin’s bull cycle is both pushed by the Futures market or the spot market.

As such, the 2023 bull run was pushed by the Futures market adopted by a spike in spot market exercise, thus driving costs up.

Nonetheless, the spot and Futures market noticed a protracted decline from March 2024 to September. In October 2024, Bitcoin noticed an increase in buying and selling volumes for each markets, which has since pushed costs as much as new ATH.

Whereas Futures market demand has declined over the previous month, spot market demand continues to extend.

This surge in spot market demand means that speculative extra within the Futures market is cooling, whereas shopping for strain within the spot market is gaining momentum.

Subsequently, Futures markets will proceed to expertise a cycle of liquidations and overheating, thus leading to BTC’s value progress. As such, this value motion will encourage additional capital inflows into the spot market.

Typically, a surge in spot market demand pushes an asset’s value up by the next shopping for strain.

Influence on BTC

Normally, an increase in shopping for strain results in increased costs. Nonetheless, Bitcoin has skilled a market correction over the previous day.

In truth, as of this writing, Bitcoin was buying and selling at $103825, a 2.46% decline in every day charts. Regardless of the dip, the market is regularly experiencing increased demand, particularly within the spot market.

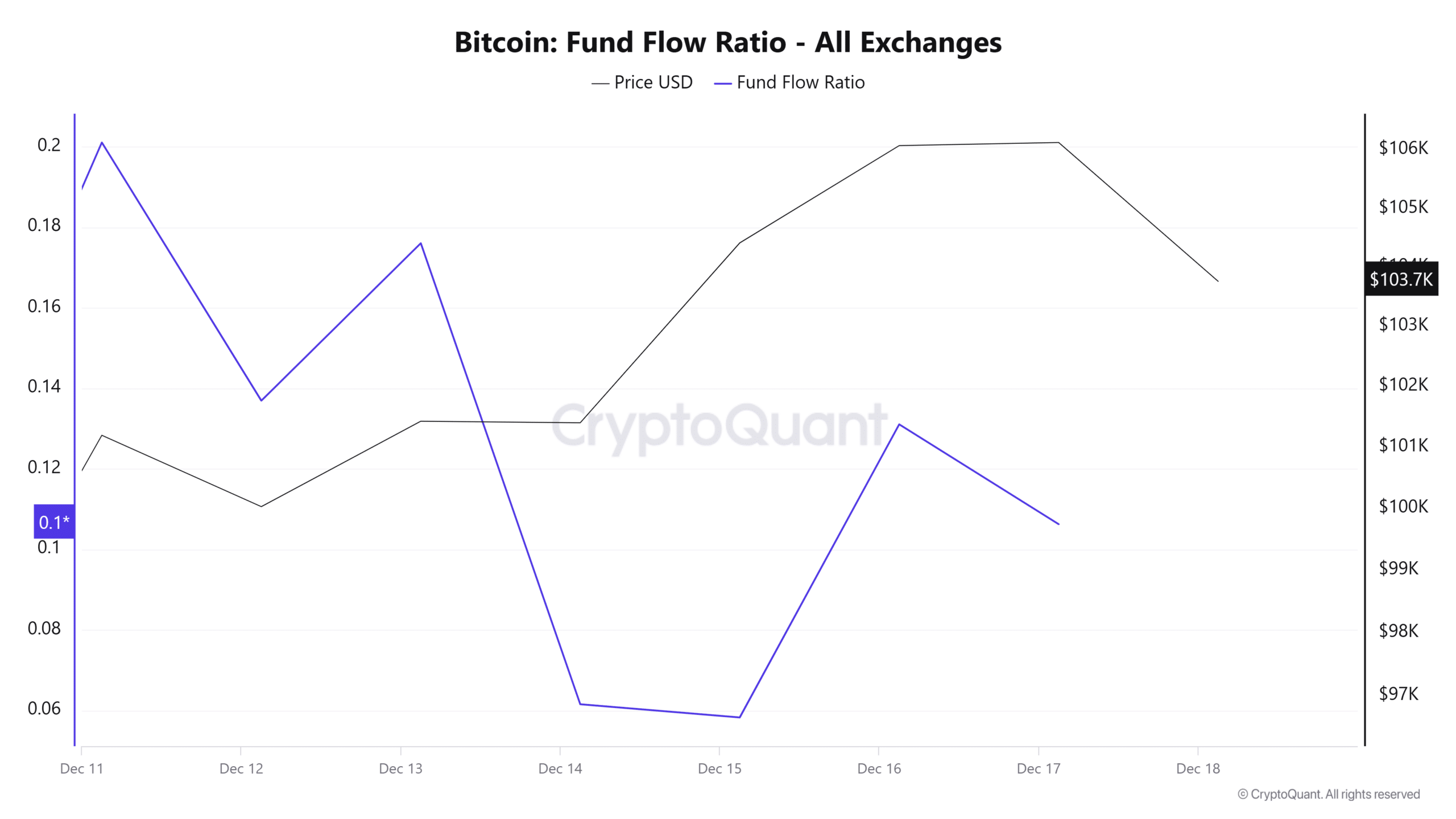

This surge in spot market demand is clear by the decline in fund movement ratio. Notably, customers are withdrawing funds from exchanges and holding them in personal wallets.

This can be a bullish sign exhibiting decreased trade exercise, which correlates with long-term market confidence.

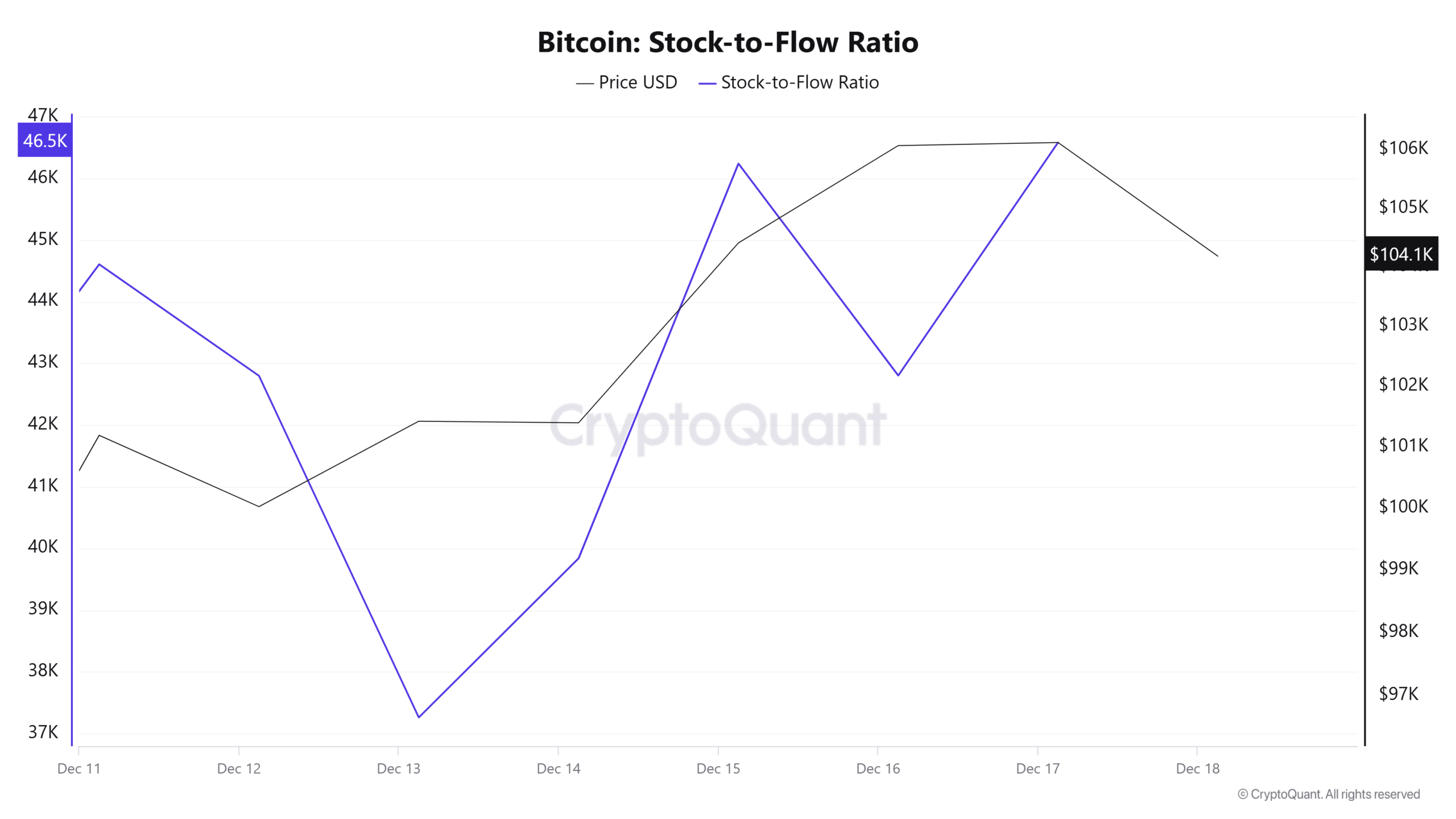

Moreover, Bitcoin’s stock-to-flow ratio has spiked to 46.5k after declining to 37k. A surge in SFR suggests a spike in BTC shortage.

This exhibits that the provision of the property is decreasing whereas the demand will increase. When demand rises amidst rising shortage, it causes a provide squeeze, thus driving costs up.

Learn Bitcoin Value Prediction 2024–2025

Merely put, a surge in Bitcoin’s spot market demand positions the crypto for extra beneficial properties on its value charts by the next shopping for strain. Subsequently, if this demand continues, costs will proceed rising.

In that case, we might see BTC reclaim $106,000 and push in the direction of a brand new excessive. Subsequently, if the correction witnessed over the previous day persists, the king coin will decline to $102630 earlier than one other uptrend.